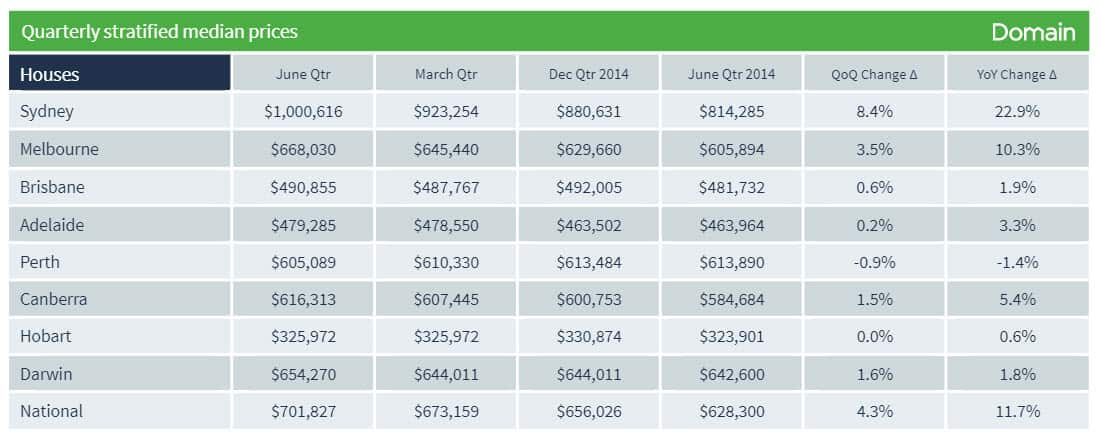

Australian house prices have surged by 11.7 per cent over the last 12 months according to Domain Group, but Sydney has surpassed that, growing by 22.9 per cent.

For the first time, the median Sydney house price is above $1million.

Remember, median and average are different.

To find the median price, all houses are laid out from cheapest to most expensive. The value of the middle home, is the median. It gives economists a clearer indication of value because averages can often be swayed by the top or low values.

At $1,000,616, the median Sydney house price is greater than London, but less than New York and Paris.

Perth was the only capital to record a decline over the last 12 months.

Domain Chief Economist Andrew Wilson says not all cities are performing the same.

"The Sydney market certainly is at hyperdrive. All the rest are probably in first gear."

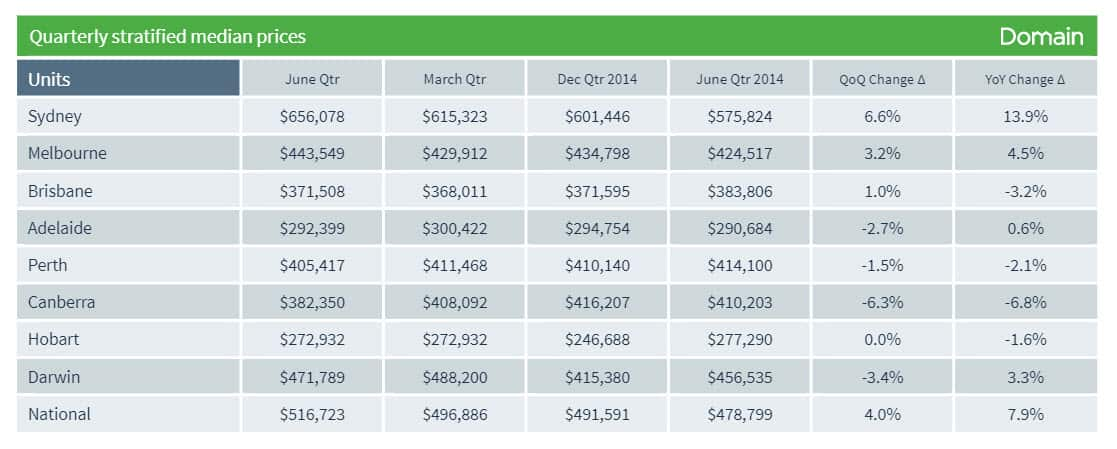

Price movements for apartments weren't as stellar as houses, and in many cities fell over the last 12 months.

While the national median was $516,723 - a rise of 7.9 per cent - Sydney is the most expensive at $656,078, up 13.9 per cent, but there were declines in Brisbane, Canberra and Hobart.

Still, Andrew Wilson says monetary policy is driving price growth.

"There is no secret that the key driver to improved housing market activity is those low interest rates. We've got the lowest interest rates since the mid-1960s at the moment."

Low interest rates have sparked investor activity, which has helped to drive prices higher.

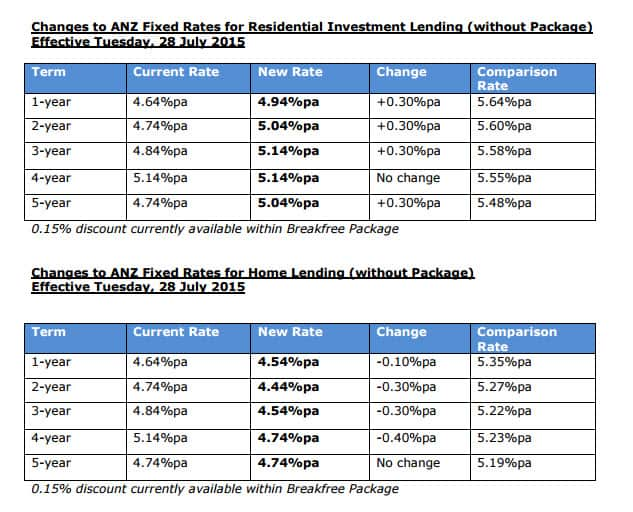

But the banking regulator, APRA, has told Australia's big banks to limit investor loans to 10 per cent to try to curb over investment.

Late today, ANZ said it would lift the existing residential investment property loan rate from August the 10th.

There will be no change to owner-occupied loans, and fixed rates for new owner-occupied loans will fall slightly.

It comes at a time some economists predict official interest rates may be cut once again.

Earlier today, New Zealand's central bank slashed its cash rate to three per cent because lower commodity prices have hurt revenues.

It's the same reason why the Bank of Canada reduced its cash rate to 0.5 per cent last week.

CommSec's Tom Piotrowski says the RBA will be keeping a close eye on resource prices, because like New Zealand and Canada, Australia is a commodity-based economy.

"What we have seen in recent times is a pretty substantial marking down in commodity prices and, as a result, the revenue into those economies has been slashed quite significantly. That is one of the factors central banks weigh up when they're thinking about interest rate expectations."