Sydney investor Tara Ende had her heart set on an apartment currently being built in the inner Sydney suburb of Surry Hills, but now all she has are the plans.

"It sounded really positive and we also weren't in a particular rush to buy something right then, so I knew buying off the plan I had time to save some more money and get the financing together," she said.

Two years ago Tara paid a 10 per cent deposit on a two bedroom apartment in the building, off the plan, called East Central.

Two months ago the contract was cancelled despite repeated assurances that settlement was approaching.

"The letter from the solicitors said they didn't have the occupation certificate and therefore under one of the clauses of the contract they were rescinding the contract. My solicitor called their solicitor, we were told it was a commercial decision and that was it."

SBS World News has also spoken to another investor in the building, Susan Seale from the Central Coast.

"We've been told from January this year to have our money ready."

She too had her contract for two apartments rescinded in July, for the same reason as Tara and has been refunded her deposit plus interest.

In a statement, developer Samadi told SBS World News, a small number of contracts of sale were rescinded, adding "we exercised our rights under the contracts of sale and under the law" and that "There has to date been no proof (or even an allegation) that this company did not take all reasonable steps to complete the development prior to sunset date."

The sunset clause involves a date by which a contract may be rescinded or cancelled without penalty by either the developer or purchaser if some conditions aren't met.

It's meant to protect both parties.

Over the construction period property values in the city and the suburb have soared.

SQM Research says the median unit price in Surry Hills surged 22 per cent since Tara signed her contract in June 2013.

But Tara may have stood to gain more.

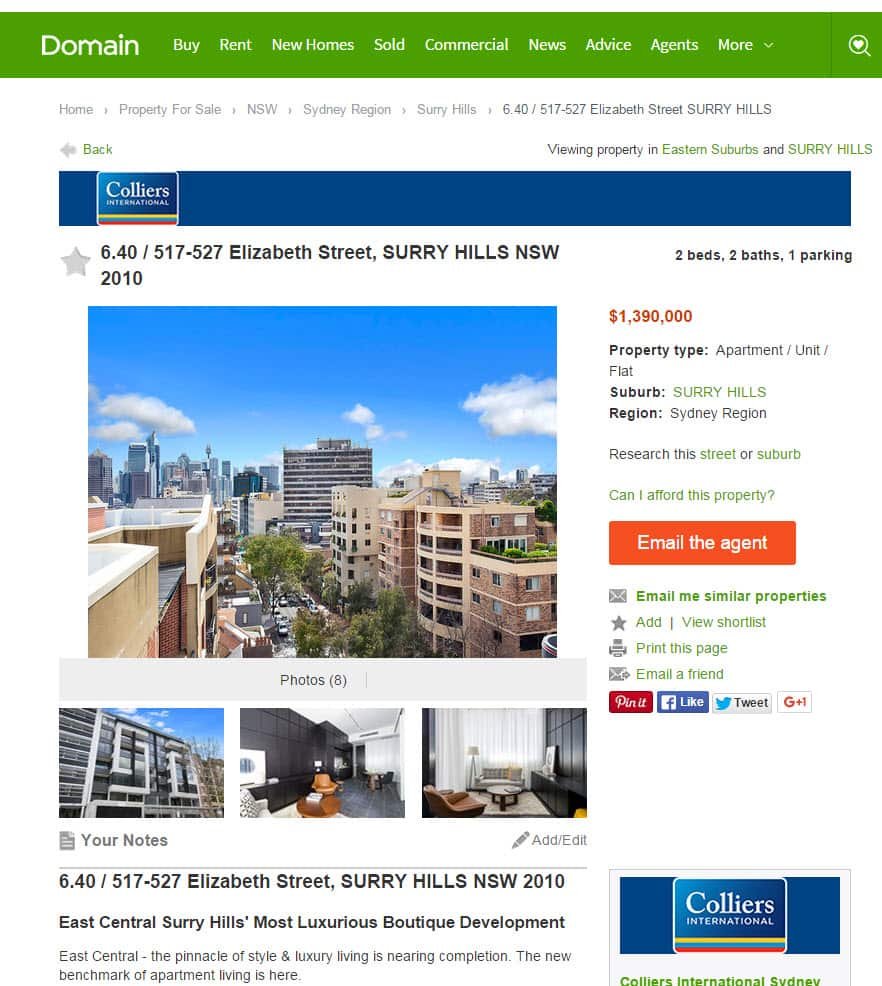

She agreed to pay $890,000 and says a similar apartment in the building, which is still under construction, is listed for sale on Domain for nearly $1.4 million.

Tara went public after it was revealed the development company owned by Auburn deputy Mayor Salim Mehajer, who made headlines recently with a lavish wedding, legally reduced the size of apartments under contract at one of its sites.

Property expert Margaret Lomas warns than an off the plan purchase isn't for every investor.

"An investor really needs to be buying a property that is already there, that they know they can get tenanted straight away, that they know can get them an income now off the plan ties them in, it doesn't give them a lot of wriggle room to buy other properties and you never really know what you're going to get at the end," she said.

Margaret says off the plan purchases may benefit owner-occupiers more.

"I think an off the plan purchase is a fine way to go if you're an owner occupier. You might even be able to get a bit of control over what you end up with in terms of colour scheme and even sometimes room arrangement. When it comes to owner occupiers they can be a good option."

While there are other advantages apart from price gains like tax, stamp duty savings and an extended builders guarantee on off the plan purchases, a lawyer should be employed to tighten contract conditions to protect the buyer.