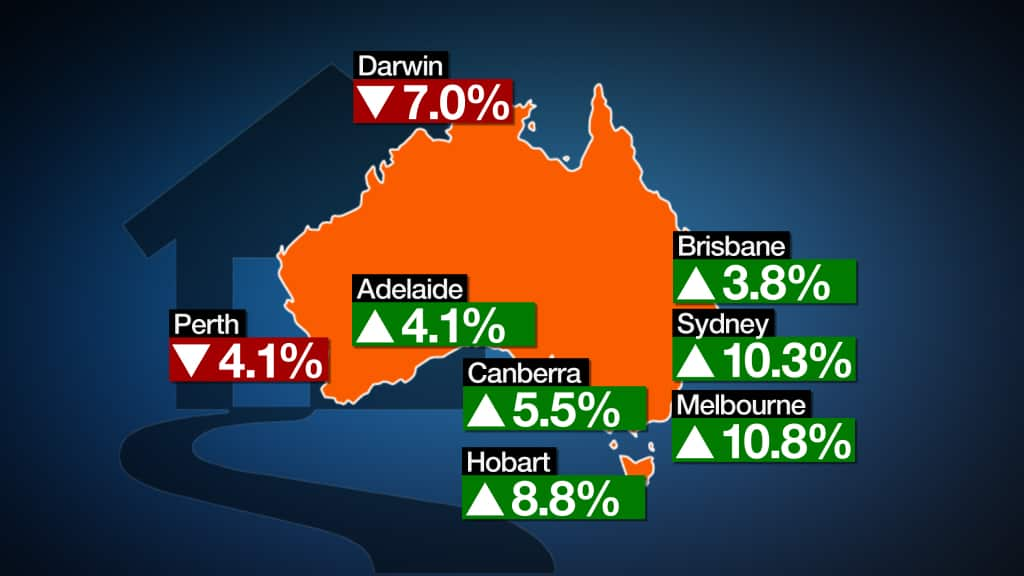

The Bureau of Statistics says capital city house prices rose nearly 8 per cent in 2016.

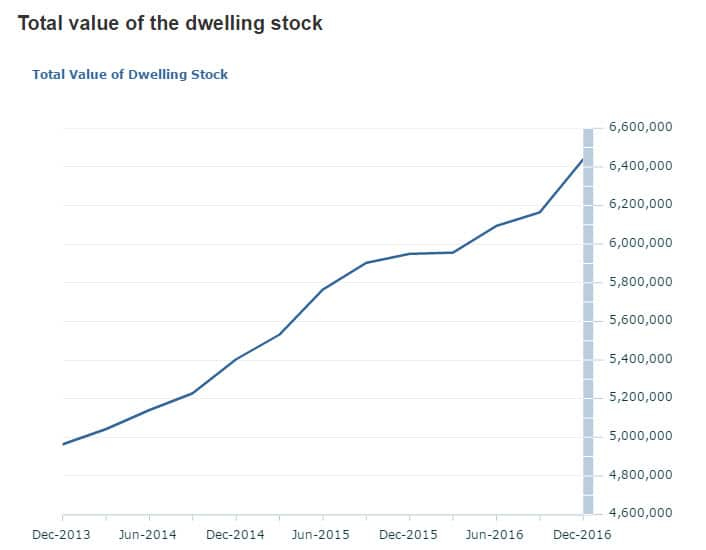

That means collectively Australia's 9.8 million residential dwellings are worth $6.4 trillion, while the average home is worth $656,800.

Sydney and Melbourne drove the price gains, both up by more than 10 per cent last year, followed by Hobart.

BIS Oxford Economics Residential Property Senior Manager, Angie Zigomanis says Australia's biggest cities are expensive.

"Sydney's prices have gone up about 80 per cent in the last four years, Melbourne probably 50 to 60 per cent," he said.

The Reserve Bank is worried, revealing in its March board meeting minutes today that "recent data continued to suggest that there had been a build-up of risks associated with the housing market."

Senior Analyst at Shaw and Partners, David Spotswood says low interest rates are to blame.

"You read a lot about the supply of apartments, Chinese buying, but the dominate factor in the determination of house prices is interest rates, interest rates, the availability of credit and if people have got a job or not, it is as simple mathematical equation," he said.

He adds that cheap credit is encouraging borrowers despite soft wages growth.

"House prices were five times yearly salary, now they are 8 times," Mr Spotswood said.

But credit won't remain cheap forever.

Mr Spotswood says a 2 per cent lift in mortgage rates, or the official cash rate, would prompt a 5 to 10 per cent fall in house prices nationally.

"The way we come up with that is, if you look at historically when house prices have fallen it's when interest costs have been about 33 per cent of wages, and at the moment they're at 25 per cent," he said.

"So they look ok, but if interest rates went up by 2 per cent that would take that up to 33 per cent and that would cause some problems for house prices."

The Reserve Bank's official cash rate currently sits at a record low 1.5 per cent.

"Interest rates of 1.5 per cent in any historical context are incredibly low so over the medium term, 2 to 5 years, there is every chance of cash rates of 3.5 per cent in Australia, in fact if they weren't 3.5 per cent something would be wrong," Mr Spotswood said.

While the RBA has indicated official rates may stay on hold for now, the commercial banks are lifting mortgage rates independent of the Reserve, prompting calls for borrowers to be more cautious.

"Have a buffer to allow for higher interest rates, and use that buffer now to pay down your mortgage instead of spending it on other things as well," advises Mr Zigomanis.

The Feed: Could you move to Tamworth?