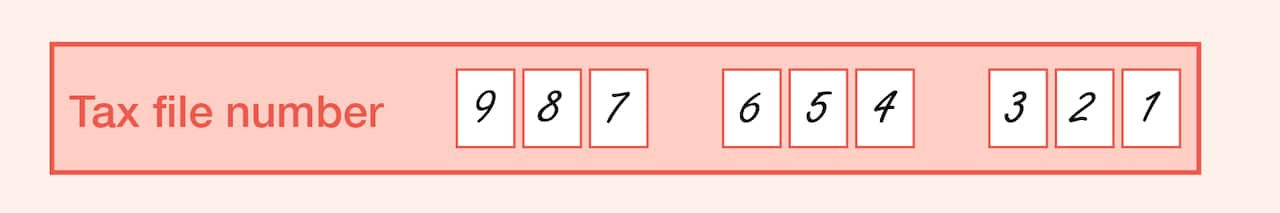

Your tax file number (TFN) is your personal reference number in the tax and super systems in Australia. Your TFN is an important part of your tax and super records as well as your identity, so you need to keep it secure. When you have been assigned a TFN, it is yours for life. You keep the same TFN even if you change your name, change jobs, move interstate or go overseas.

How you apply for a TFN will depend on your circumstances. There are three main cases.

- Foreign passport holders, permanent migrants and temporary visitors (details)

You can apply for a tax file number online if you meet these three conditions:

- You are a foreign passport holder, permanent migrant or temporary visitor

- You are already in Australia

- Your visa is one of the following:

- a permanent migrant visa

- a visa with work rights

- an overseas student visa

- a visa allowing you to stay in Australian indefinitely (including New Zealanders automatically granted a visa on arrival)

To apply online you must have a valid passport or relevant travel documents. Within 28 days you will receive your TFN at the Australian address you provide on your application. You can click here to apply.

- Australian residents (details)

If you are an Australian resident you can apply in many different ways:

- At an Australia Post office

- At an ATO shopfront

- By post

Here you can find all the details.

- People living outside Australia (details)

If you are a non-resident of Australia for tax purposes, you don't need a TFN if you receive only interest, dividends or royalty payments from an Australian source. Non-resident withholding tax will be deducted before you receive these payments. The amount deducted will vary depending on your country of residence for tax purposes.

You need a TFN if you:

- receive income from an Australian source other than interest, dividends or royalty payments

- have a spouse who is an Australian resident and is applying for Family Tax Benefit

- need to lodge an Australian tax return or apply for an Australian business number (ABN)

In this case you can apply for a TFN by downloading and completing this form.

If you need more information you can visit the nearest Tax Office shopfront site or phone 132861. If you do not speak English you can contact the translating and interpreting service (TIS) on 131450.

Links to useful information:

- General Australian Tax File Number information click here

- How to apply for an Australian TFN click here

- Lost or Stolen TFN click here

- How to update your details click here

- Information about your superannuation and how to access it when you leave Australia click here