Is China going to be a cashless society soon?

Two years after studying in Beijing's Tsinghua University, when awkward counterfeit money detectors were still seen in shops, friends told Australian Michael Norris that the biggest change to happen in China since he left was that thanks to the increased popularity of digital-only payment methods "you can now go around without using cash."

The Melbourne-based management consultant decided to use his recent trip to China to test if the theory was true. He started by downloading and registering WeChat Pay and Alipay which both require users to link to a local Chinese bank account that enables internet banking.

"2016 saw transactions increase 300% across the country to 38 trillion yuan ($7.2 trillion)"

In China, Alipay and WeChat pay are two of the most popular digital payment methods, more popular than credit card in Western countries. You are able to use the virtual wallet system to make instant payment online, in-store and on vending machines, in a word, to live your every day life without the hassle of remembering to bring sufficient cash or a physical wallet.

The mobile payment market is now so popular in China that 2016 saw transactions increase 300% across the country to 38 trillion yuan ($7.2 trillion), according to consulting firm iResearch and businesses of all sizes are fast updating to accommodate the trend.

Norris's experiment has proved how effectively these fast-developing epay systems have changed everyday life in China - and how quickly and easily businesses have responded and adapted.

During 11 days in Eastern Chinese cities Shanghai and Hangzhou, Michael didn't use cash or card once, which makes him conclude that China is "well on its way to becoming a cashless society."

"Australia's 'Tap and Go', with vendors chucking on a surcharge in some instances, now feels primitive."

Norris says that the world's biggest country is fast overtaking Western countries when it comes to evolving and adapting to the change.

"Even a small-time, shoddy-looking bakery accepts mobile payments (my AUD 2.50 purchase is pictured). Australia's 'Tap and Go', with vendors chucking on a surcharge in some instances, now feels primitive."

Another amazing discovery is to see how the technology has cut through with a wide variety of different demographics.

Norris tells SBS Mandarin, it's "not only for young people, old generations use it too."

"You see grandparents using Alipay and WeChat for things like grocery shopping."

Norris tells SBS Mandarin that in the majority of instances the signs for availability of those payment methods are quite clear, while for smaller places you may need to ask.

But he also admits in his final wrap-up post that the experiment hit a slight hiccup when he went to buy train and subway tickets.

"Some train and subway stations don't support mobile payments," he says. "With a little bit of wrangling in Chinese, I got the person standing in line behind me to use cash to buy the tickets, and then transferred money electronically using WeChat Pay or Alipay. Where there's internet and a mobile phone, there's a way! "

Background:

What is WeChat Pay?

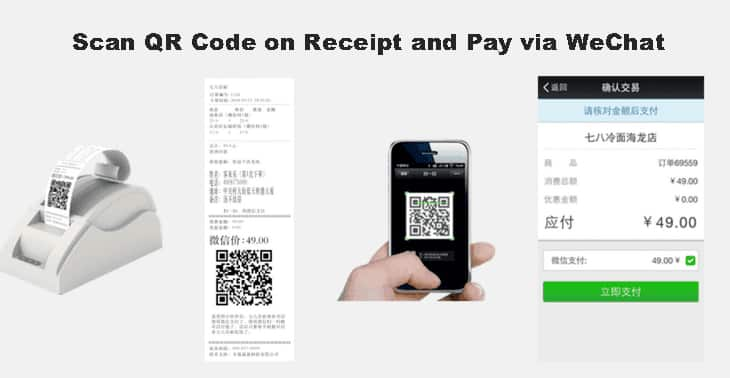

WeChat Pay is a payment feature integrated into the WeChat app (a Chinese social media app, not unlike Facebook or Twitter, with over 650 million monthly active user accounts), which allows users to perform mobile payments and send money between contacts. Every WeChat user has their own WeChat Payment account. Users can acquire a balance by linking their WeChat account to their debit card, or by receiving money from other users.

What is Alipay?

Alipay.com is a third-party online payment platform, launched in China in 2004 by Alibaba Group and its founder Jack Ma. With 450 million daily customers in China who make 180 million payments each day through their mobile phones, Alipay is the world's largest mobile and online payments platform since 2014. Alipay has also expanded to Australia through a payment deal with Commonwealth Bank of Australia.

Expat: "When I went to Australia to see my family I felt primitive"

Replies to his post (which gained over 35,000 views on the social networking platform LinkedIn) indicate that this cashless advance is not only confined to major cities, but also a reality in many other parts of China.

Many Australians echo Michael's post for their love for Alipay and WeChat Pay in China. Here are some of the replies on LinkedIn:

Warwick Donaldson (唐华威): "I live on WeChat pay and Alipay. I rarely carry cash. When I went to Aus to see my family I felt primitive."

Danny Henley-Martin: "I tried using my Alipay account in Sydney the other day at Chemist Warehouse but it wouldn't work. I really hope they open it up more for use in Australia so Aussies can use it more freely too."

"I really hope they open it up more for use in Australia so Aussies can use it more freely too."

Chloe X. Xu: "I felt so left behind when dad brought me an ice cream in a convenience store by using Wechat in Shanghai."

Kora Lu:"Every time I go back to China, I feel so behind in technology. It is, I would say, a completely cash free society now!"

Chris Renwick: "Couldn't agree more! I'm still using my WeChat/Alipay wallet in Melbourne to book accommodation via Ctrip or Agoda."

Jose Miguel Duque Vehils: "Living in China is cashless basically. I only use cash to pay parking.... sometimes!"

Greg Paschall: "How about eating in a Shanghai restaurant with a group and the bill is split among the group by mobile pay... incredible."

"There are countries further behind than Australia! Still waiting for our mobile payment revolution here though."

Taylor Rundell: "In the US, next to no-one accepted 'tap' payments when I went in 2014. So there are countries further behind than Australia! Still waiting for our mobile payment revolution here though."

John D. Evans CFA: "I think we all have unique experiences in China. I live in Shenzhen myself and I think I have more receipts in my wallet than cash! Even our toll roads accept mobile payments. Still, I had the honor to take a trip to Tibet last year and while I was there I lost my wallet, and I had a business emergency that required me to return to Shenzhen. I was able to get a car take the train and even a plane ticket all without needing a card or cash. China's got it right."

Jeffrey Barnes: "Here in China, you don't even need vendor accounts. You can send RMB directly through WeChat immediately any time, anywhere by just scanning a QR code. I pay for a lot of services this way - from splitting bills to paying my martial arts coach."

Simeon Duke: "I use Wechat and Alipay on a daily basis both in HK and mainland China, even in some parts of Korea. I do agree however with a previous comment that this has serious privacy issues. Accepting convenience over privacy and freely giving terabytes of data on our spending habits etc.. It's becoming even more convenient for example, when transferring money to your bank account which taking mere seconds … Both alipay and wechat are building there own ecosystem within their given platforms so there's almost no need for acceptance, but more of a necessity. Not to mention the vast amount of investment in blockchain tech just shows that China will be the leader in how we transact, communicate, control our assets, and the list goes on…"

Carlos M. Aquino: "Well done! It always amuses me when Western people coming to China naturally assume that China is behind in tech."

Some Chinese professionals have also joined the discussion. Jie He says that in China people are willing to accept the new technology and concept, especially the e-pay. Epay now is one of the base elements of living for many people.

Security concerns: Do not lose your phone!

As one user suggests - "do not lose your mobile" - there are also questioning voices around the security issues of widely used epay systems in China.

User Tommy Yuen commented: "it may be many Chinese people don't really care about privacy and security."

He questioned "will it be too risky to withdraw your cash too easy?" He cited news about a Chinese teenage girl secretly using her mother's WeChat e-wallet to buy gifts for her online livestream idols, splashing around $40,000 within six months.

User Roy Ramage addes: "When we become a 'cashless society' it will herd all citizens into a financial surveillance hub and eliminate our economic liberty."

In regards to epay safety, Michael mentioned a recent Chinese consumer report revealing that free wifi and public phone charging station could risk e-wallet safety.

He also warned others to be wary of using mobile payments in a free wifi environment, "I will always switch to my own network".

What could also worry some people is that, according to Michael, Alipay has been recording and memorising his spending habits and sending push notifications to remind you things you are likely to go and try. "They are quite targeted," he says, referencing Alipay.

"They recognised I like Sichuan and Hunan food, so they are sending me about those Sichuan and Hunan restaurants, interesting," he says.