After two years of investing his retirement money in one of Australia’s major superannuation funds, Mohamed Mahmoud decided to make a switch.

The 35-year-old computer science engineer, who immigrated to Australia from Egypt four years ago, said his decision was driven by a desire to invest in a fund that was more aligned with his cultural values and principles.

“I was looking for an Islamic [super fund] because I know that most of the super funds here in Australia maybe invest in gambling, banks or arms manufacturers, which I believe is unethical.”

A year ago, he transferred his money to a ‘Sharia-compliant’ superannuation fund, which are governed by Islamic principles and considered a type of “socially responsible” form of investing.

He also persuaded his wife to put her money in the same fund. Their switch is proving to be popular routes as Islamic funds continue to grow internationally.

The Australian landscape

Australian superannuation funds are among the largest investment funds in the world, managing around $2.9 trillion, according to June figures by the Association of Superannuation Funds of Australia (ASFA).

Australia's superannuation funds are expected to grow by 170 per cent over the next 10 years to $6 trillion.

Consequently, competition is growing among funds to attract new customers, and recently, Sharia-compliant funds have emerged as worthy competitors.

Market share and non-Muslim investment

Islamic fund Hejaz Financial Services has been growing in size since it began operating in 2014.

In 2015, the fund managed 143 customers, before growing to 1323 by 2017. The fund currently manages the funds of more than 4000 people, an amount in the range of $155 million.

Hejaz operations manager Muzzammil Dhedhy said the fund’s growth can be attributed to many factors, including increased awareness and the uncovering of superannuation abuses during the Royal Commission into the banking sector.

“In the past, no one knew where their investments were going, and whether their investments went to the arms industry or to cigarette companies,” he said.

“Many Muslims and non-Muslims said they did not want to be associated with these [abuses].

“10, 20 and 30 years ago, people may not have been aware of the fact that if for example my super was being invested into a company that indirectly supported the military, or indirectly supported tobacco, or gambling or whatever.

“A lot of Muslims and non-Muslims were shaken up by that. They say ‘how can you engage in such practices, and how can I even support you engaging in such socially unacceptable practices.”

More than two-thirds of subscribers in Hejaz's superannuation savings fund, called the Global Ethical Fund, were male, and with an average age of 35. Furthermore, 25 per cent were non-Muslims.

Mr Dhedhy said the fund was able to attract such a high number of non-Muslim customers due to its ability to "distribute its investments well and ethically”.

Limited investment in Australia

Talal Yassine OAM, the founder of the Crescent Wealth Super, agreed with Mr Dhedhy on why more non-Muslims were investing in Islamic funds.

At Crescent, non-Muslims made up 8-10 per cent of its customers.

He said that the customers of his fund were attracted to the “moral framework” of its operations.

“We have a Jewish rabbi and several priests. We invest on a moral rather than a religious basis."

But these investments do not always reap the highest return for investors, Mr Yassine said, noting that Islamic investment had low risk and medium return.

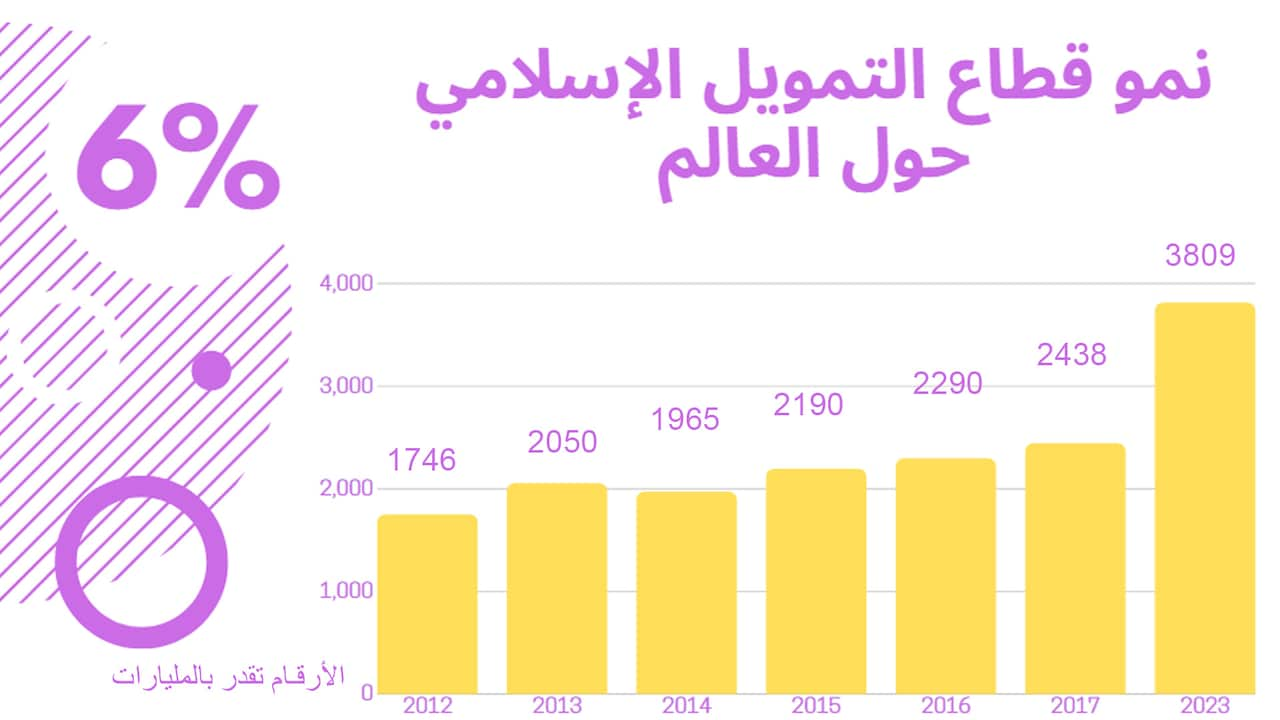

The Islamic financial sector was one of the largest financial sectors in terms of volume internationally.

According to the annual report issued by Reuters, the size of the Islamic financial sector reached $ 3.56 trillion in 2017, and the size of the sector is expected to reach $ 5.63 trillion over the next five years.

But the differences between the Islamic financial sector and other economic sectors were that it operated within the limits of Islamic Sharia ethics.

These limitations included not utilising fixed-interest banking, not investing in companies that relied heavily on debts, and not investing in non-Sharia compliant industries, including cigarettes, alcohol, weapons, sexual content, and gambling.

Mr Yassine points to the Woolworths supermarket chain which owns a 75 per cent stake in ALH, which is Australia's largest operator of poker machines.

"A very significant proportion of [Woolworths'] income comes from three areas that we won’t have an investment in.”

Many Australian companies relied on loans from banks for their operations, in turn detracting Islamic finance industry investment.

Mr Yassine believes that investments by funds should not be limited by geography.

“They don’t need to have home-bias. And Australia is less than 2 per cent of the world investment universe.”

The Hejaz fund invests in companies such as A2 milk and Rio Tinto Minerals.

The Crescent Wealth pension fund invests in the health and infrastructure sectors.

Outside Australia, Crescent invests in real estate, retail, and infrastructure in Canada, the US and Europe.

By law, pension funds are required to publish their performance data every year.

The Crescent or Hejaz did not appear on the top-10 funds in Australia, but both were planning for the future.

Mr Dhedhy said Hejaz was preparing to launch the takaful system, the Islamic version of insurance, in 2020, while Crescent has begun taking formal steps to launch an Islamic bank in Australia in 2023.