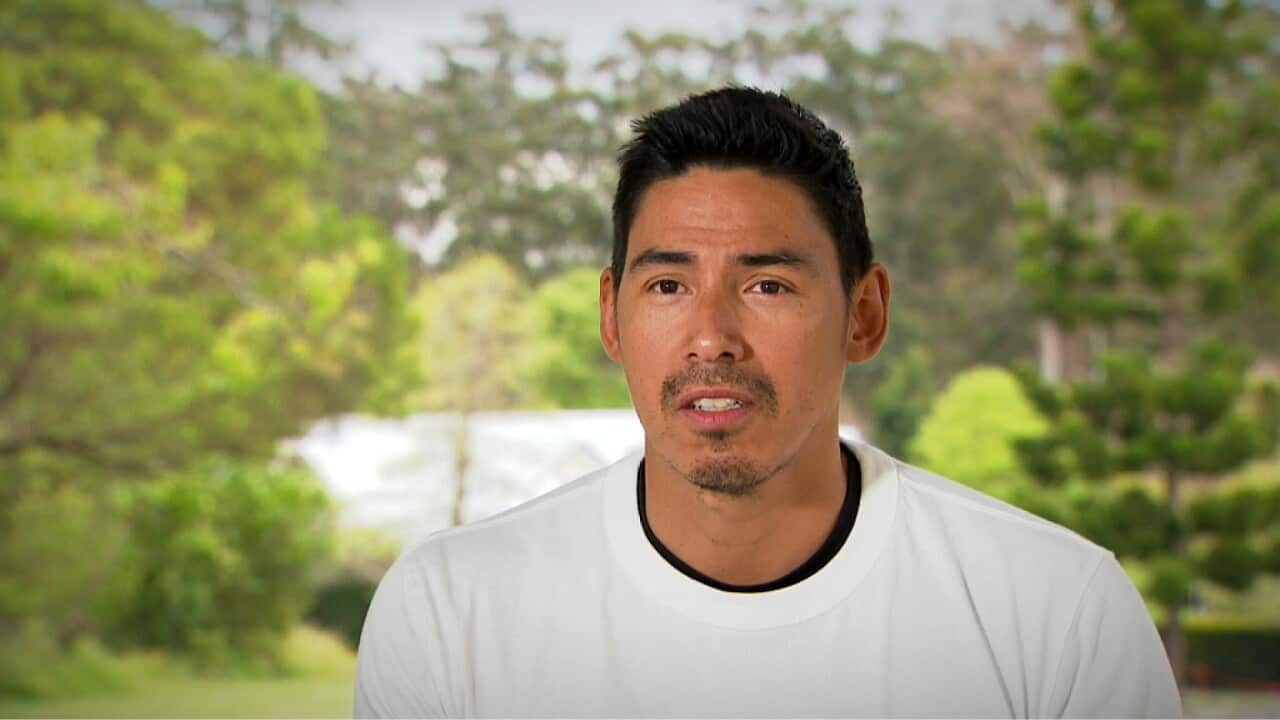

Alex Osmond was in his late teens when he says he was talked into getting insurance.

When he lost his job during COVID lockdowns, he started looking a little more carefully at his bank statements to try and save where he could.

Mr Osmond soon realised he'd been paying all these years for an insurance policy he didn't need or wasn't even eligible for.

CEO of Get My Refund Carly Woods says Mr Osmond's story is an all-too common one.

The Australian Securities and Investment Commission released a report in September and found at least 1.6 billion dollars is yet to be paid to an estimated, 2.7 million consumers for remediation for both junk insurance and non-compliance advice.

The Australian Banking Association says additional remediation programs continue to be delivered, and that banks have taken significant steps to identify and address issues in the past.

Mr Osmond got back 5-thousand dollars and he's encouraging people to come forward to see if they're entitled to some money back.