The US Federal Reserve held its key interest rate near zero on Thursday last week, with Fed chair Janet Yellen citing a weak global economy, low inflation and unsettled financial markets.

Analysts say the Fed's decision to keep benchmark interest rates near zero is concerning because it suggests that the headwinds facing the global economy are stronger than thought.

Chris Weston from IG Markets explains what is behind today’s sell off on the Australian sharemarket, along with his thoughts for the direction of the Australian dollar.

Also, investors are still uncertain over whether or not the Fed will lift interest rates this year.

"We're really on the canvas at the moment, obviously cueing off a very weak lead from Wall Street - that was after they had 24 hours to digest Janet Yellen's comments," Mr Le Brun said.

On the positive side, Mr Le Brun said the lower market should attract bargain-hunters in the near term.

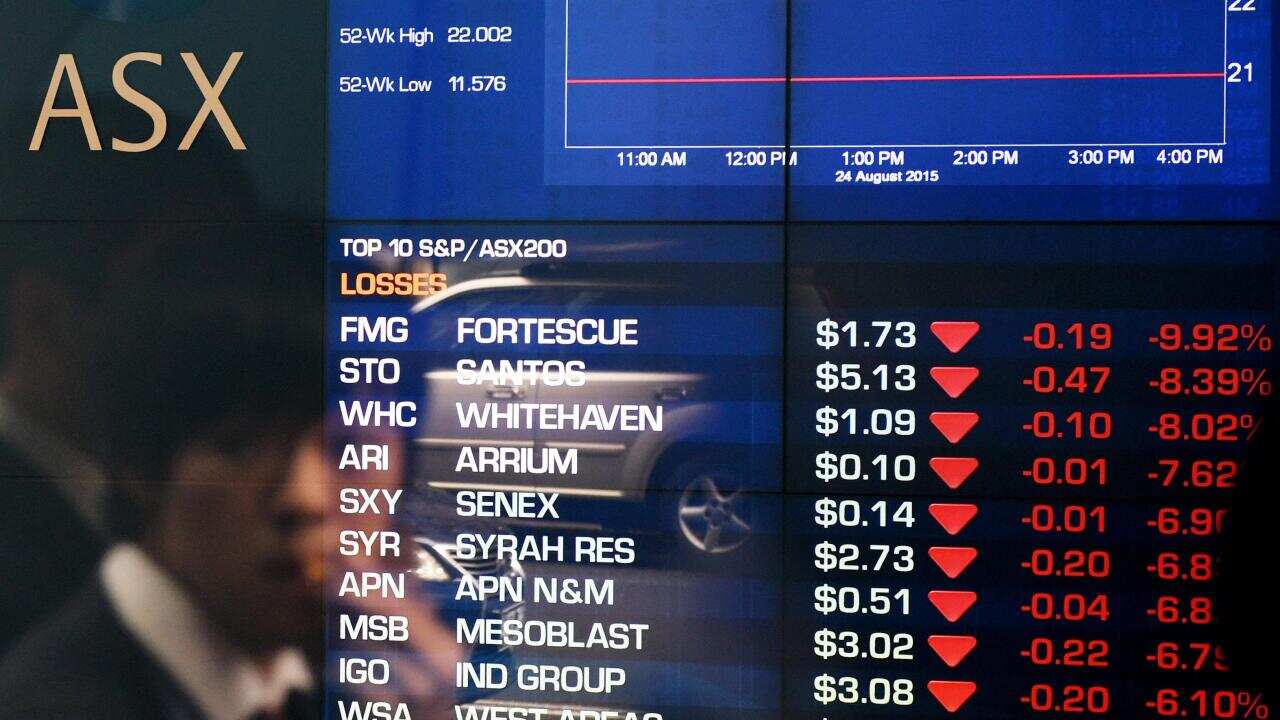

Among the major banks, Commonwealth Bank dropped $2.21 to $73.62, National Australia Bank dumped 59 cents at $30.47, Westpac reversed 90 cents to $30.85, and ANZ retreated 68 cents to $27.72. In the resources sector, global miner BHP Billiton descended 61 cents to $23.85, Rio Tinto weakened $1.48 to $49.78, and Fortescue Metals surrendered 8.5 cents to $1.975.

Rare earths miner Lynas was off 0.1 cents at 3.7 cents as it looks to bolster sales in a difficult market after sharply narrowing its full year loss.

Oil and gas producer Woodside Petroleum lost 86 cents to $28.83, and Santos firmed three cents to $4.78.

Key facts

* At 1615 AEST on Monday, the benchmark S&P/ASX200 index was down 104.3 points, or 2.02 per cent, at 5,066.2 points.

* The broader All Ordinaries index was down 98 points, or 1.89 per cent, at 5,096.3 points.

* The December share price index futures contract was 95 points lower at 5,053 points, with 37,055 contracts traded.

* National turnover was 1.36 billion securities worth $3.94 billion.