Federal Treasurer Scott Morrison has announced income tax relief for low and middle-income earners in the Federal Budget 2018-19.

There will be up to $200 a year for low-income earners and up to $530 extra a year for people on middle incomes.

“Tax relief will encourage and reward working Australians and reduce cost pressures on households,” Minister Morrison told parliament.

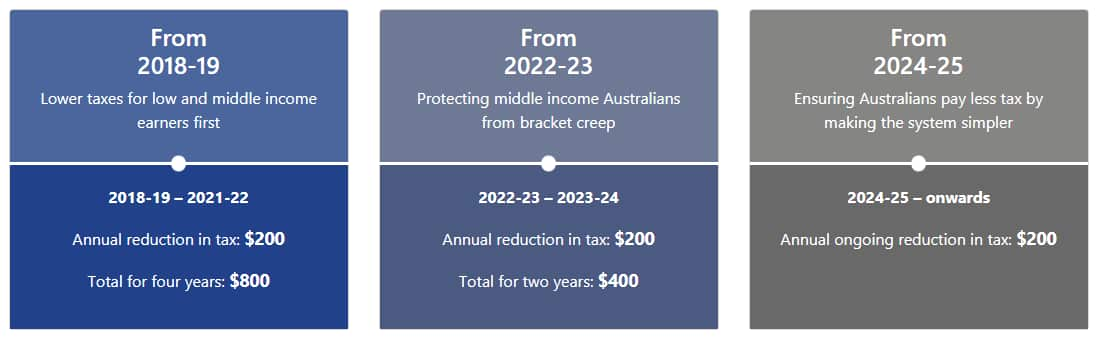

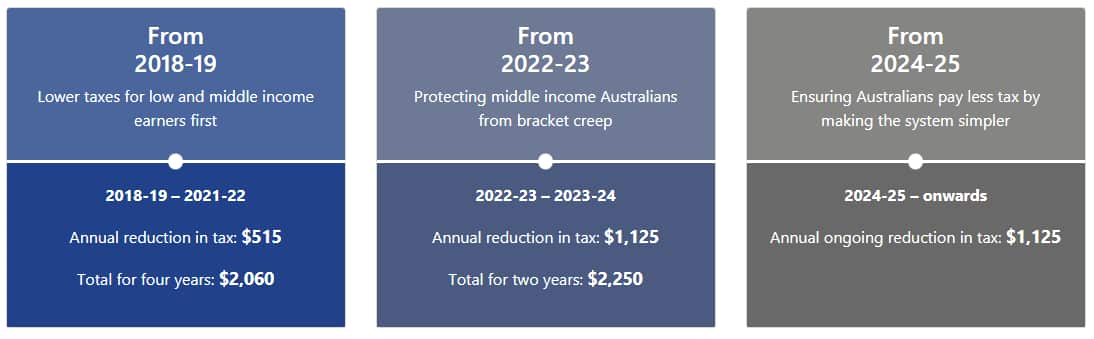

“The plan has three parts. One, tax relief for middle and low-income earners now. Two, protecting what Australians earn from the impact of bracket creep and three, ensuring more Australians pay less tax by making personal taxes simpler.

“As a result of the plan around 94 per cent of taxpayers are projected to face a marginal tax rate of 32.5 per cent or less in 2024-25,” he announced.

Tax refunds will increase for all Australians earning up to $125,000 year but will be most lucrative for those earning between $48,000 and $90,000.

At least 4.4 million Australians will receive the maximum benefit of $530 under a new tax refund plan.

The refund will be available to those earning between $48,000 and $90,000, as a lump sum on their tax return at the end of the financial year.

In addition, Australians earning up to $90,000 will pay a reduced income tax rate of 32.5 per cent, when the middle-income tax bracket cap increases from $87,000 to $90,000.

Those earning up to $41,000 will pay the lower 19 per cent income tax rate by 2023, raising the bracket from $37,000.

By 2023, higher income earners will also pay less tax. Those earning up to $120,000 will pay 32.5 per cent income tax.

By 2024, the 37 per cent tax bracket will be abolished entirely. Vinod Mishra, Associate Professor of Economics at Monash Business School at Monash University says the reduction in income tax affects most Indians living in Australia as they are employed and receiving a salary.

Vinod Mishra, Associate Professor of Economics at Monash Business School at Monash University says the reduction in income tax affects most Indians living in Australia as they are employed and receiving a salary.

Federal Parliament & Dr Vinod Mishra Source: Supplied

“Tonight’s tax relief is going to affect a majority of our community as most of the Indian migrants are into jobs,” Professor Mishra told SBS Hindi.

“Economic theory says any amount of disposable income increases one’s wellbeing. When consumption increases, people feel happy. $520 tax cut for middle-income earners is not a big amount but is likely to be taken positively by the community,” he says.

But he warns that most of the taxpayers are aware that elections are looming and this budget announcement by the Turnbull government is ‘an attempt to get a favourable outcome’ for them.

CALCULATE YOUR TAX RELIEF

For those earning an annual taxable income* of $37,000, your total combined tax relief will be $1,400. For those earning an annual taxable income* between $48,000 and $87,000, your total combined tax relief will be $3,740.

For those earning an annual taxable income* between $48,000 and $87,000, your total combined tax relief will be $3,740. For those earning an annual taxable income* of $100,000, your total combined tax relief is $5,435.

For those earning an annual taxable income* of $100,000, your total combined tax relief is $5,435. Want to check your income tax according to your exact income, click here.

Want to check your income tax according to your exact income, click here.

Source: budget.gov.au

Source: budget.gov.au

Source: budget.gov.au

Share