Joel Coelho, 27, arrived in Australia in 2014 as an international student and, like many, he said he felt he was under pressure to create financial security for himself.

"I didn’t have my family here to turn to for guidance on a lot of things so I had to learn and survive here by myself,” Mr Coelho said.

While his initial focus was on completing his engineering degree, once he had graduated and found full-time employment, he said he soon realised he needed some help learning to manage his money effectively.

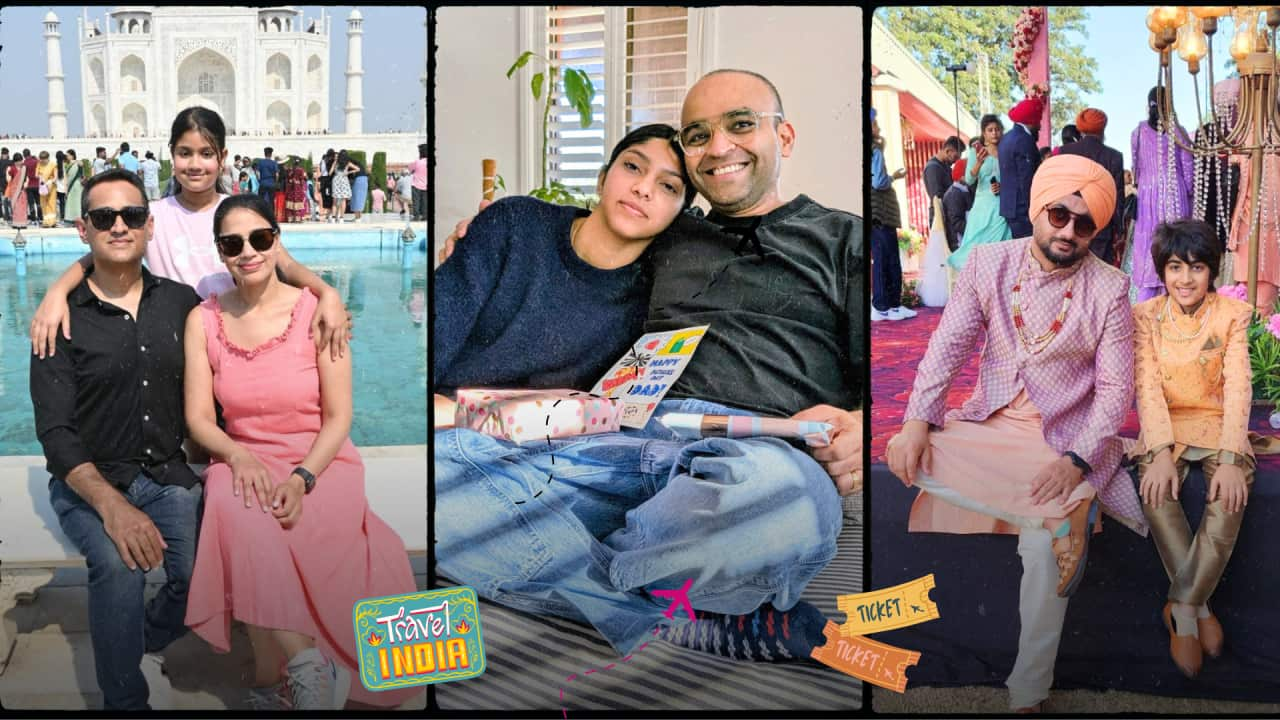

Joel Coelho was born in Mumbai. Credit: SkilledSmart

So, I was good at saving money because that was instilled in me growing up, and also because coming to Australia as a migrant, everything feels so expensive compared to prices back in India that I did hesitate to spend money.Joel Coelho

"I used to work three jobs at one point in time and... I was saving 80 per cent of my earnings every month while using the rest for my daily expenses," he said.

"I didn’t have a healthy relationship with spending money, I felt a lot of guilt spending money. I also wasn’t confident with the Australian system or things like tax, super, insurance.

“There were a lot of other areas where I didn’t have knowledge or confidence. I was scared to invest, especially in things like shares."

Mr Coelho said while there was a lot of information and support systems available to understand money management, for him it had still been a challenge.

"Self-education on personal finance can be bit confusing and difficult to navigate, so I decided to understand it more comprehensively, especially the investment part," he said, adding that there was a lot of online information available to understand money matters.

He said he thought that taking a financial course would offer him valuable lessons and insights so that he could feel more confident around investing.

“There were a lot of things that were eye-openers to me when I undertook the 'Mastering Money' course offered by SkilledSmart which I did online. (For example) I didn’t know much about insurance or the idea of financial independence," Mr Coelho, who said he had now grown his portfolio to over $175,000 in the span of three years, added.

"Initially, I was really anxious about what to invest in, and whether I’d get a return."

According to Mr Coelho, acquiring knowledge and making well-informed choices can result in efficient financial management.

I believe the best investment you’ll ever make is in yourself. What I got from getting financially educated was confidence in my ability to make financial decisions and rely on myself if things go wrong.Joel Coelho

According to research, Millennial generation men have 68 per cent more in savings than women. Source: AAP

According to research from Finder released last year, households earning over $100,000 per year have around three times as much money saved as households earning less than $50,000.

And, as the generation that's worked the longest, Baby Boomers (the cohort who were born 1946-1964) have the most in savings (at over $42,000), while Generation Z (the cohort born 1996-2012) have the least (at over $10,000).

The report said "the discrepancy between male and female savings is greatest among Millennial (the cohort born 1981-1996) Aussies, with men having 68 per cent more in savings than women."

"This is followed by Generation X (the cohort born 1965-1980), where the difference is 62 per cent, and Generation Z, where the difference is 53 per cent," it found.

Disclaimer: This article on financial matters is provided for informational purposes only and should not be considered as professional financial or investment advice. It is important to consult with a qualified financial advisor or professional before making any financial decisions.