Highlights

- Various schemes rolled out for business owners

- Single-touch payroll introduced in 2019

- Instant asset write-off threshold has been extended to 31 December 2020

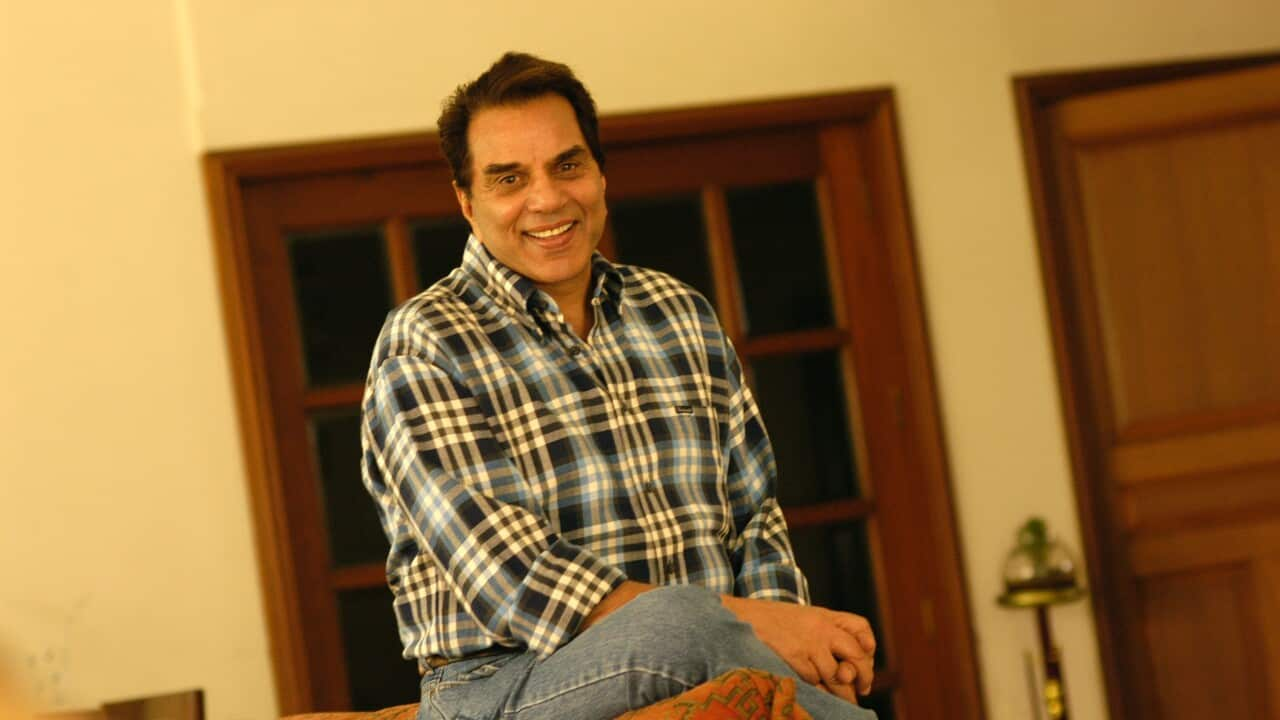

Tax Consultant and Chartered Accountant Raman Bhalla told SBS Hindi some of the stimulus packages provided by the Government are aimed at boosting the economy and helping businesses that are struggling.

“Besides the obvious impact on health and life, the coronavirus pandemic has impacted the economy of most countries including Australia. The Government has offered packages and incentives like JobKeeper and JobSeeker packages for individuals but there are some schemes for business owners”, Mr Bhalla, a registered tax agent told SBS Hindi.

“It’s time to file tax returns and one of the important schemes a business owner should know is of single touch payroll introduced last year by the Australian Taxation Office (ATO),” Mr Bhalla adds.

Single Touch Payroll (STP), is a new way of reporting tax and superannuation information to the ATO.

With STP, the business can report employees' payroll information – such as salaries and wages, pay as you go (PAYG) withholding and super – to ATO each time they pay them through STP-enabled software.

The Instant Asset Write off is the second scheme, business owners should be aware of.

"Under the instant asset write-off, eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year the asset is first used or installed ready for use."

The $150,000 instant asset write-off threshold has been extended to 31 December 2020.

"Another change brought in by the Government is the Insolvency Trading where the liabilities of a Director have been reduced”, Mr Bhalla advises.

Disclaimer: We’d like to point out that the information contained in this segment is general and is not specific advice. If you would like accurate information relevant to your situation, you should consult a registered financial planner.

Tune into SBS Hindi at 5 pm every day and follow us on Facebook and Twitter