The headline Consumer Price Index rose 0.2 per cent in the March quarter, and is 1.3 per cent higher for the year.

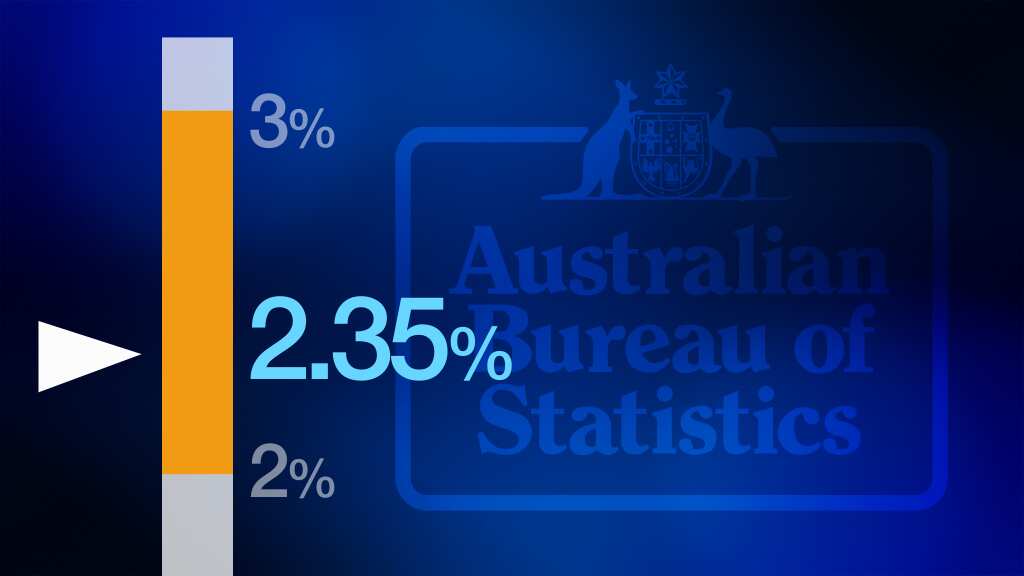

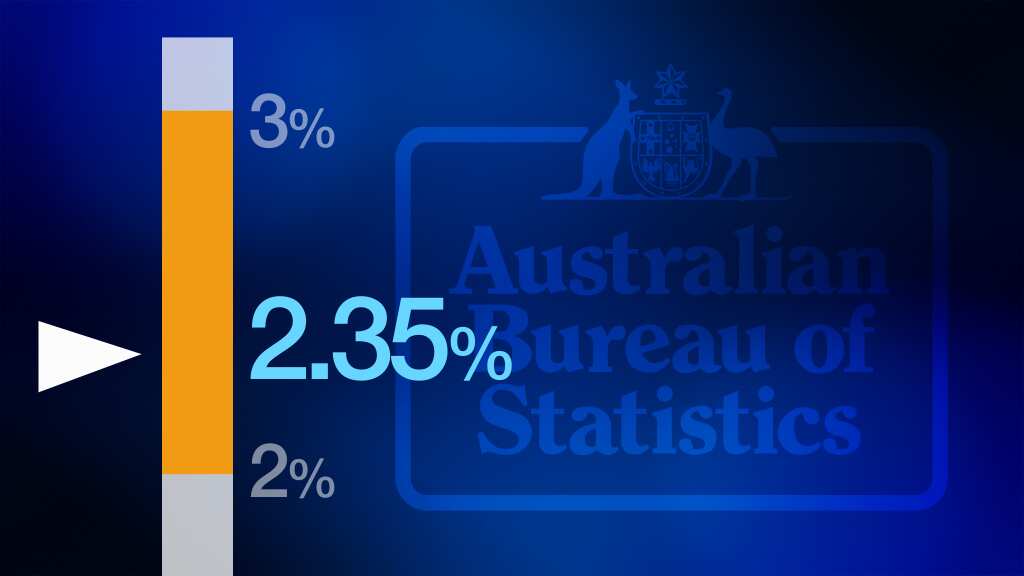

While that number gets the most media attention, it is the core or underlying rate which the Reserve Bank is more concerned about.

That's because it strips out one-off volatile moves in the index, to give a more accurate read on inflation.

The Reserve Bank likes to keep underlying inflation between its 2 to 3 per cent target band, which it says is a rate which sufficiently low enough that does not material distort economic decision in the community.

At 2.35 per cent, it is well within the RBA's comfort range. NAB Chief Economist of Markets, Ivan Colhoun told SBS World News, "The Reserve Bank would like to lower interest rates because the economy is not growing particularly strongly, and unemployment is higher than it would like, but it is also concerned that housing prices are quite elevated, and that also it may be encouraging people to borrow more than is warranted."

NAB Chief Economist of Markets, Ivan Colhoun told SBS World News, "The Reserve Bank would like to lower interest rates because the economy is not growing particularly strongly, and unemployment is higher than it would like, but it is also concerned that housing prices are quite elevated, and that also it may be encouraging people to borrow more than is warranted."

He adds, the latest data looks a bit better on the economy.

"It's a very close decision, tending to think the risk of another cut as early as May has been reduced."

NAB will make a formal forecast after the release of its Quarterly Business Survey tomorrow.

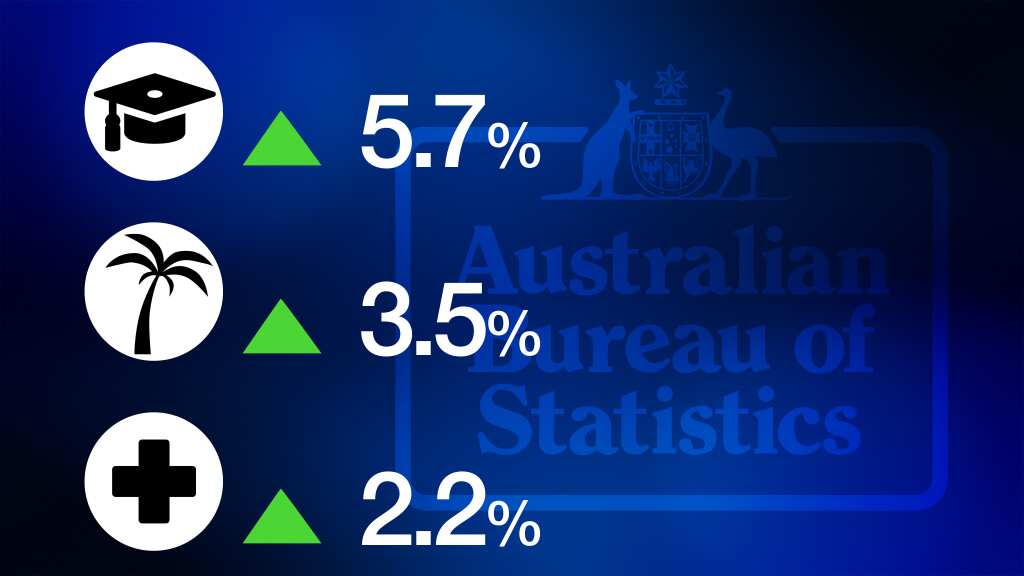

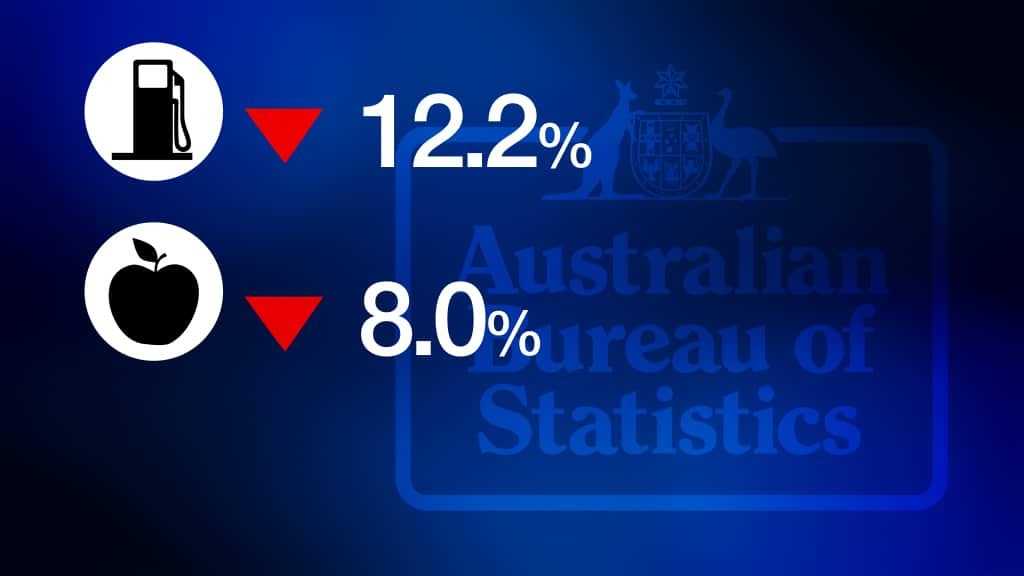

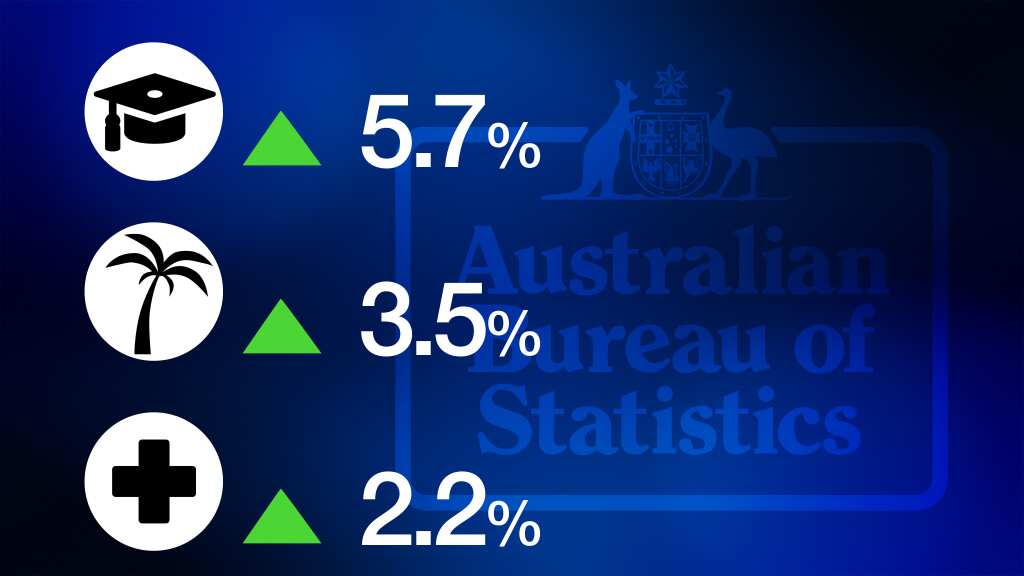

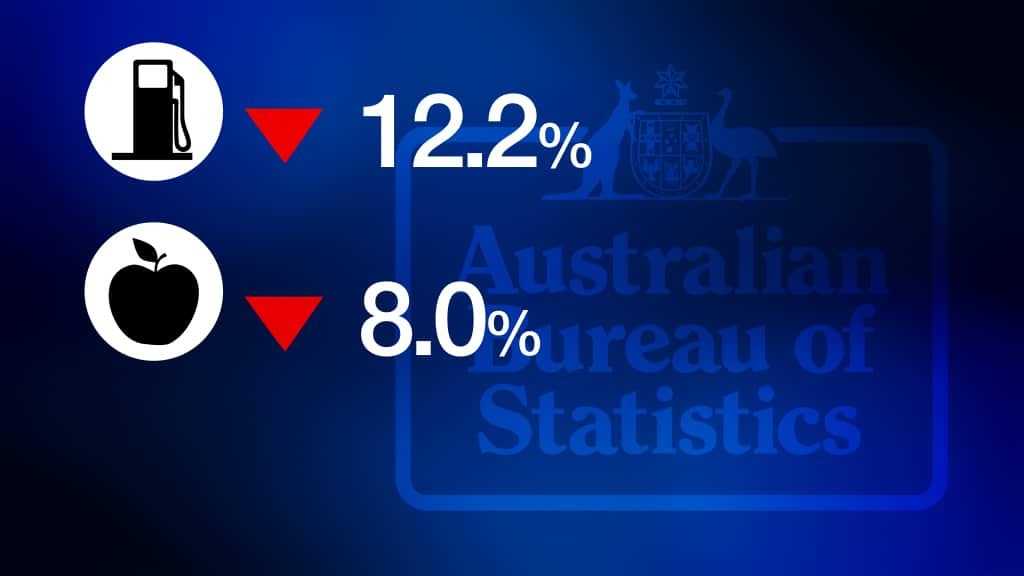

A closer look at the inflation numbers reveals prices rose the most in the three months to March in tertiary education, domestic holidays and medical and hospital services. The biggest price falls were seen in fruit and petrol.

The biggest price falls were seen in fruit and petrol. In fact, the quarterly petrol price fall was the biggest since December 2008.

In fact, the quarterly petrol price fall was the biggest since December 2008.

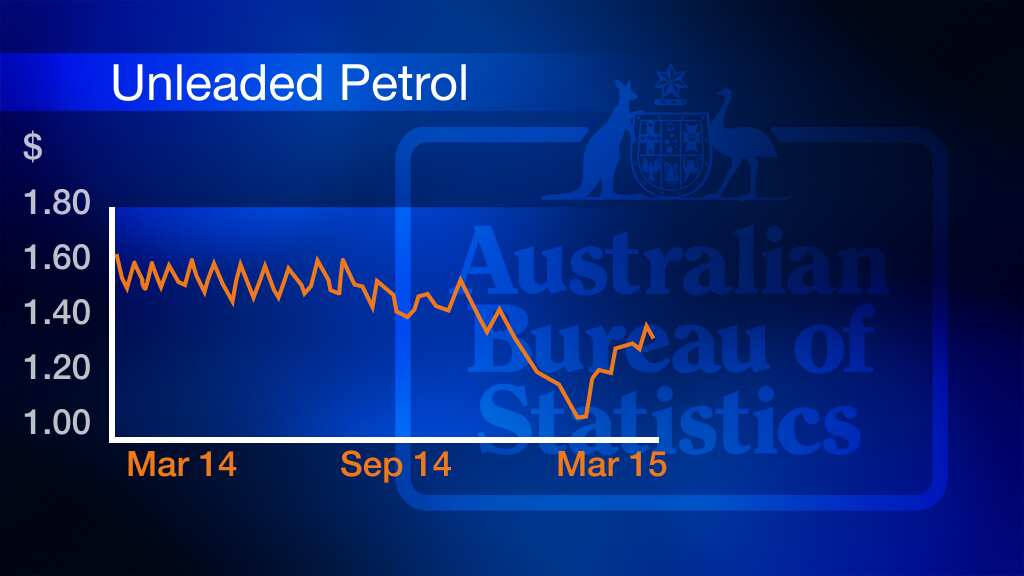

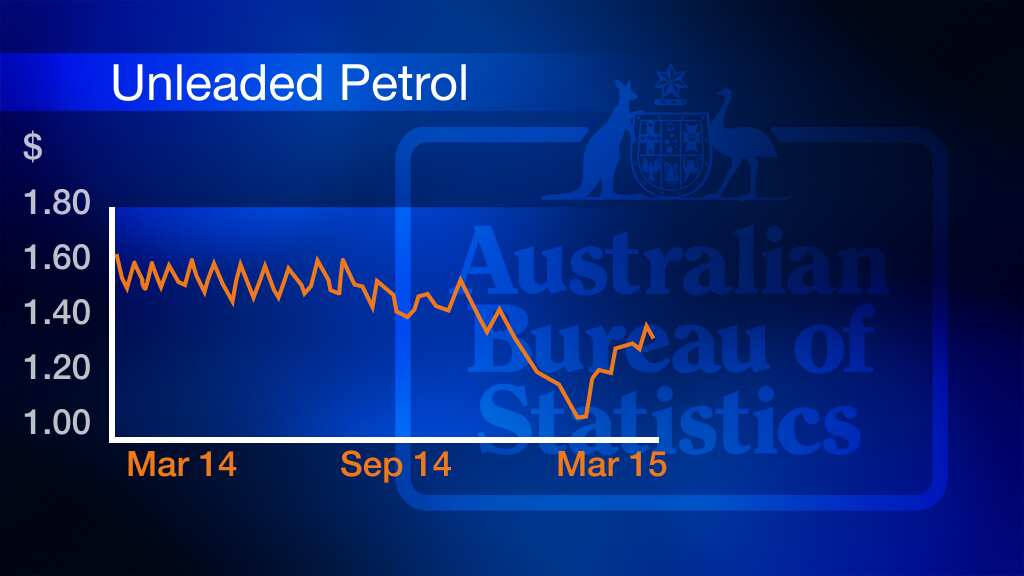

For the year, petrol is down 22.5 per cent, the largest decline in the history of the series.

But the ABS points out, prices for unleaded fuel across the country have already trended up since March, suggesting the low prices have ended.

What the economists are saying about inflation and interest rates

Riki Polygenis and Katie Hill (ANZ)

"While slightly above market expectations, there is not enough in today’s figures to justify a re-think of the moderate inflation outlook, which is neither too strong nor too weak to substantively impact on RBA deliberations. But the ongoing downside risks to growth in our view point to a further rate cut in May to support the transition underway in economic activity, although we admit that this is a close call."

Craig James (CommSec)

"At present inflation is very much under control; Overall the latest result is likely to see the Reserve Bank discuss the merits of another rate cut at the upcoming May meeting. CommSec believes that the cash rate will be cut by 25 basis points to a historical low of 2 per cent in May."

Janu Chan and Jo Horton (St George)

"The current below-trend pace of economic growth suggests another rate cut from the RBA is likely. Today’s inflation data confirms the RBA has room to cut interest rates again in May."

Share