The Australian Tax Office will soon end an initiative, which temporarily softened penalties for those who haven't declared offshore income, as part of a global crackdown on international tax evasion.

Project DO IT (Disclose Offshore Income Today), which will end on December 19, allows eligible taxpayers to come forward and voluntarily disclose unreported foreign income and assets.

Deputy Commissioner Michael Cranston told SBS World News: "for example, if you have bank accounts, you're an Australian resident say in Switzerland, or you have shares in America and earn dividends, that income would be taxed in Australia."

Penalties of only 10 per cent will be applied to those tax payers who do disclose this income ahead of the December 19 deadline, instead of a maximum of 90 per cent. The ATO is also providing assurance to those who voluntarily disclose, that no criminal investigation will commence.

Mr Cranston adds, "We believe there're a lot of people who have come to Australia, who have assets overseas, and whether they didn't understand their obligations, or intentionally ignored their obligations, there is still some money overseas that this project will allow us to clean it up and it's a last chance opportunity."

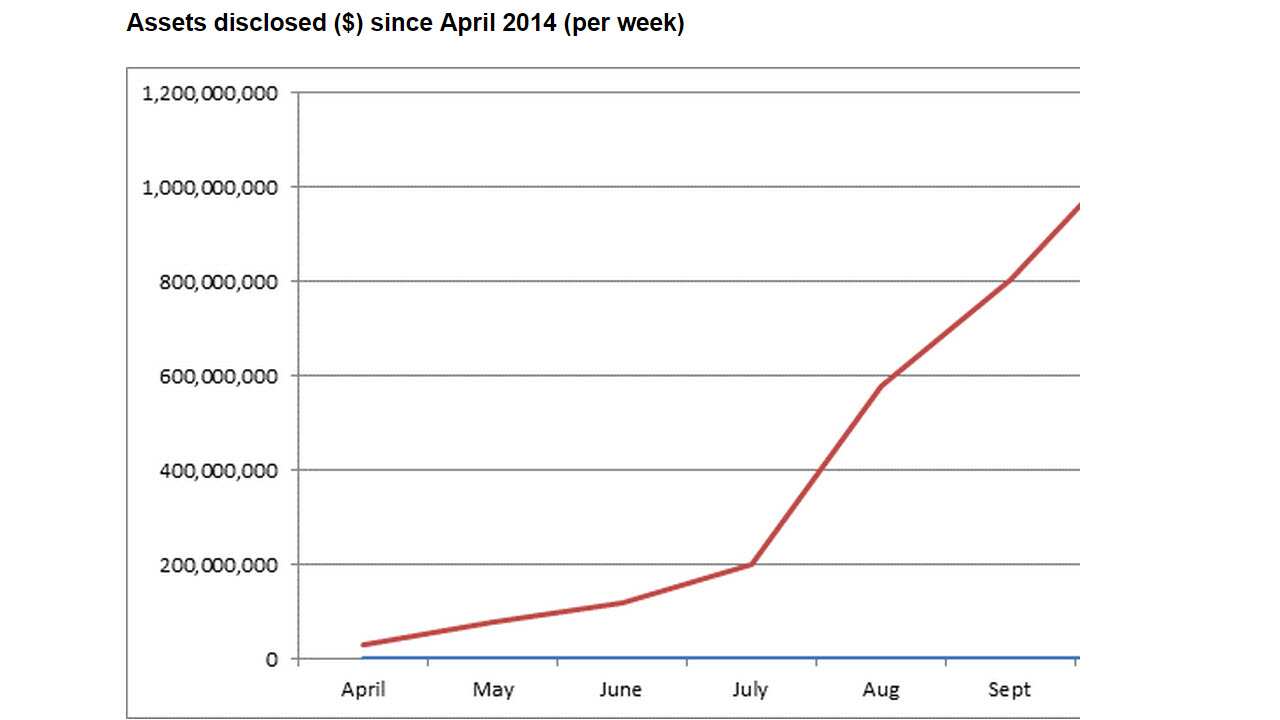

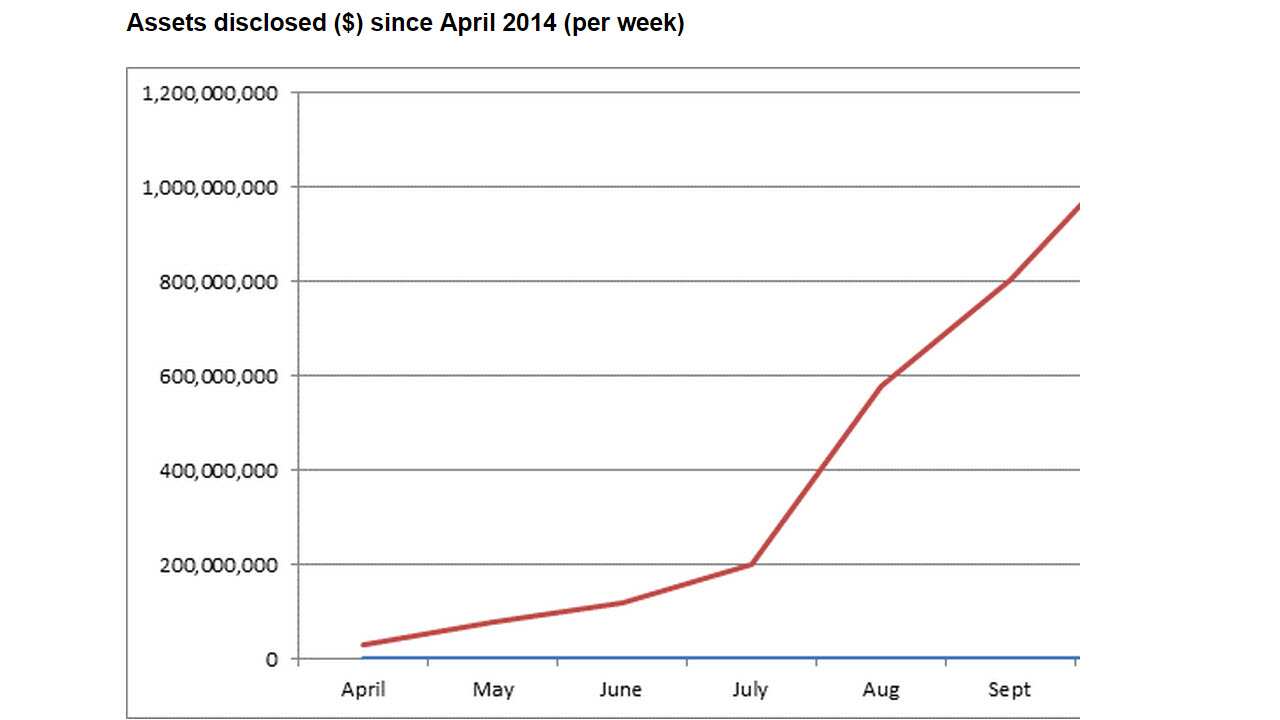

Project DO IT was launched in March earlier this year, and since then more than $1billion dollars in previously unreported offshore assets have been disclosed.

Michael Cranston says it will be harder for people to avoid paying their fair share of tax from income earned overseas in the future, especially for those trying to hide funds in secrecy jurisdictions.

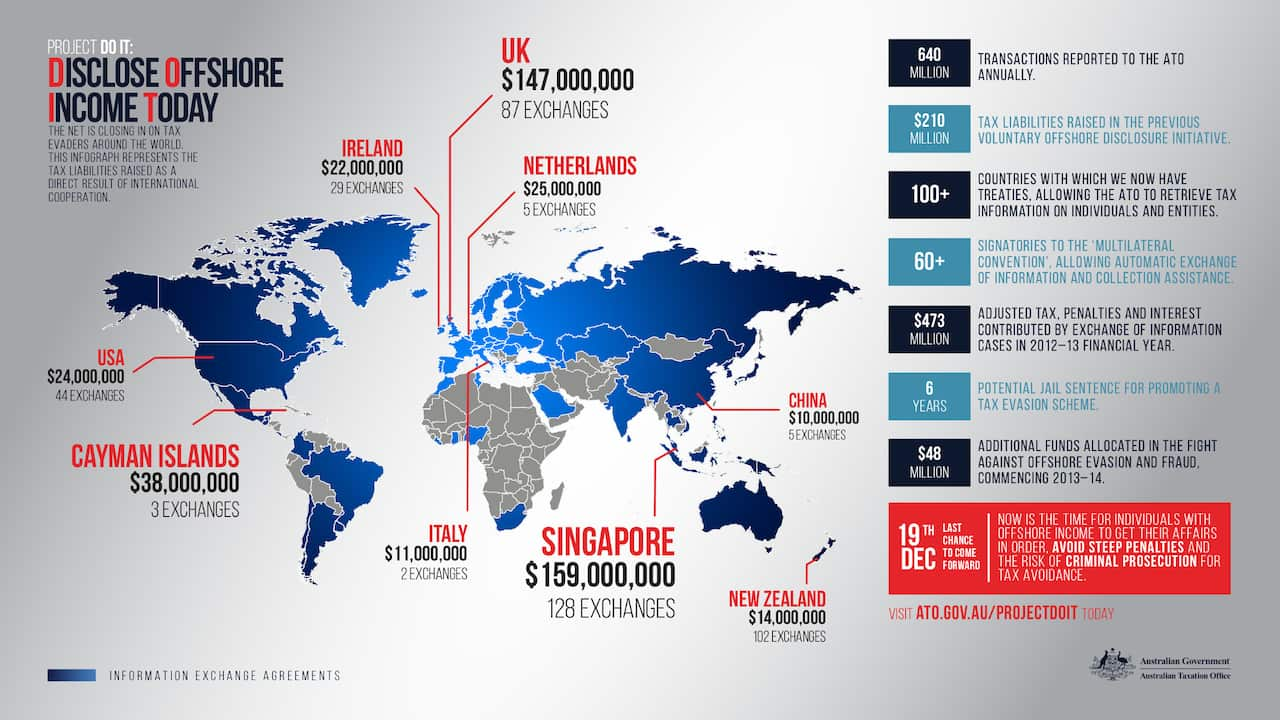

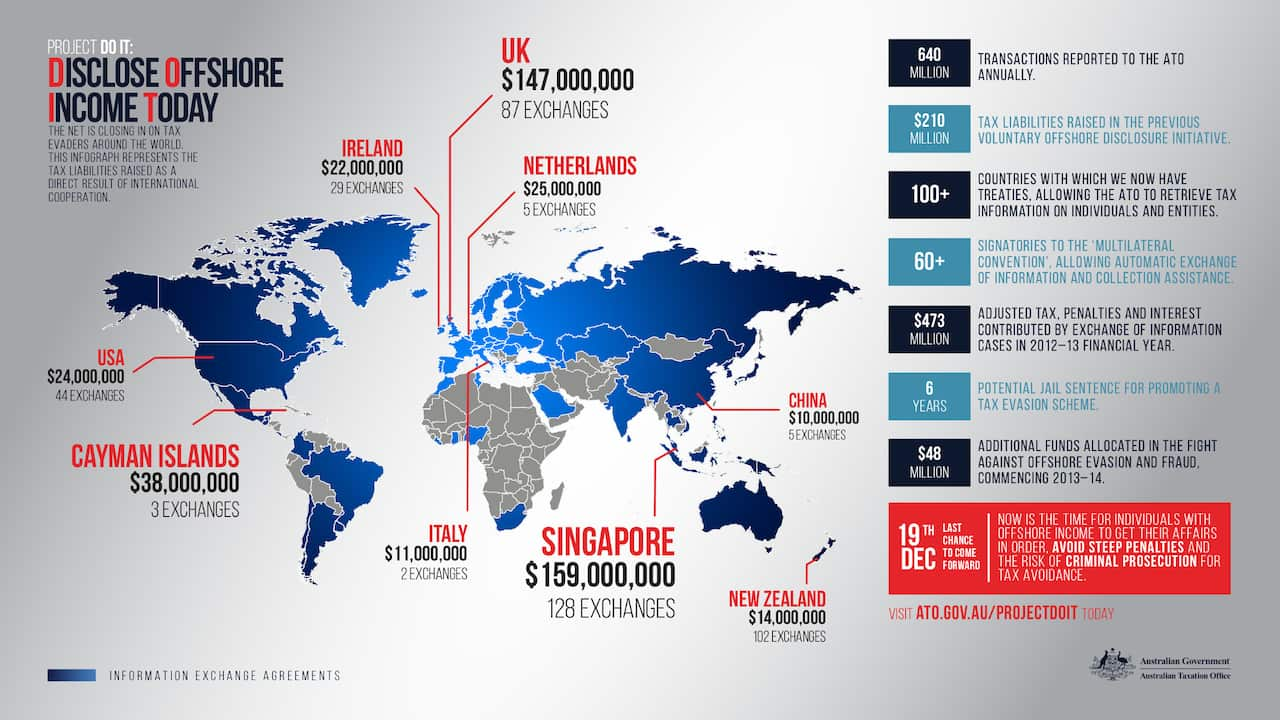

"The international environment is changing. We have over 100 exchange agreements. We've got AUSTRAC international flows of funds that we can analyse and we also work closely with financial institutions."

The ATO warns that the net is closing in on tax evaders around the world. $210 million in tax liabilities has been raised across the world as a direct result of international cooperation. The ATO can be reached for more information on 1300 132 346, or you can visit ato.gov.au/projectdoit for more information.

The ATO can be reached for more information on 1300 132 346, or you can visit ato.gov.au/projectdoit for more information.

Share