It's been a very strong 12 months for Wall Street, with shares up about 30 per cent, extending a long bull run which began in 2009, after the global financial crisis, as the Federal Reserve printed money to stimulate the US economy.

John Noonan, an analyst at Thomson Reuters, told SBS News: Barack Obama was president at that time, and he didn't make a big deal of it.

"The stock market went up 130 per cent under Obama, and when he came in 2008, the stock market had been absolutely trashed," Mr Noonan said.

"He never really once mentioned or used the rise in the stock market as validating his presidency. It's not what presidents do."

But US President Donald Trump is, taking to Twitter to crow about a string of sharemarket success.

Business is looking better than ever with business enthusiasm at record levels. Stock Market at an all-time high. That doesn't just happen!

"He certainly helped the market rise, probably more than would have, had he not been president," Mr Noonan said.

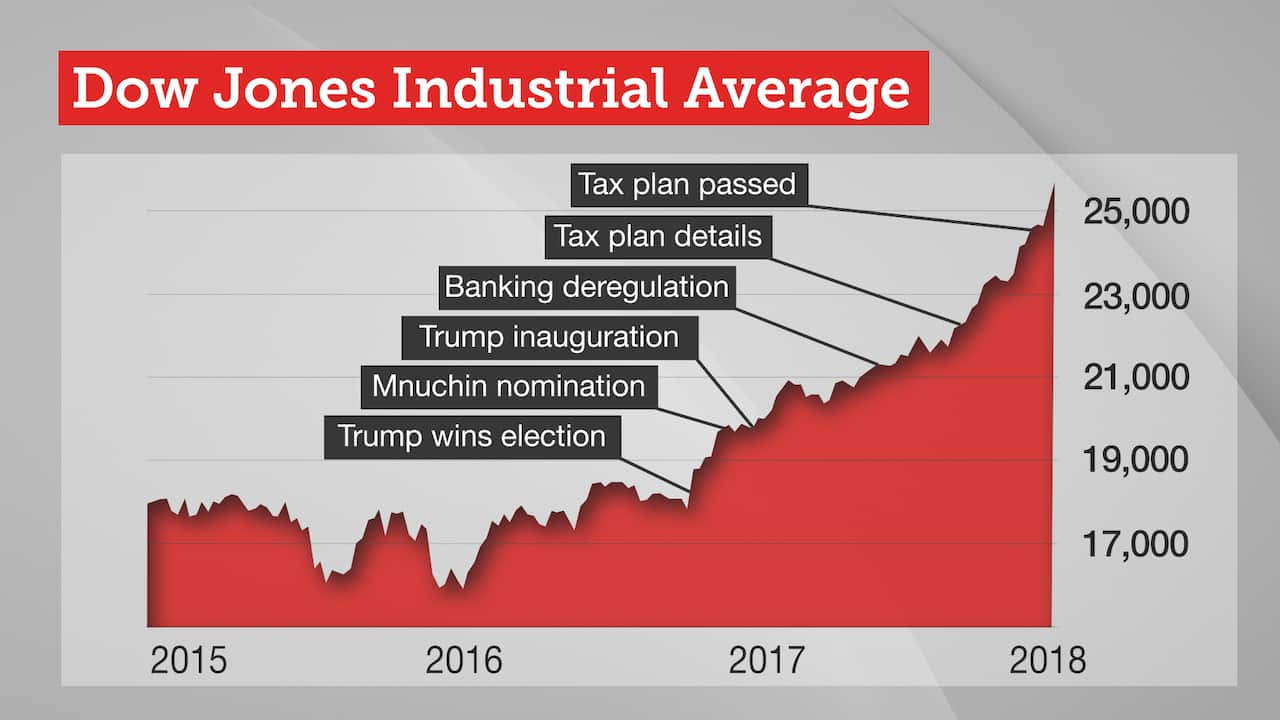

Mr Trump's influence on the US market has been dramatically rising after his election win.

Announcing Steve Mnuchin as Treasury Secretary appeased investors because, as a former Goldman Sachs executive, he's seen as pro-business.

Following Mr Trump's inauguration, the market jumped after he made public plans to deregulate the banks. But the real surge came after he detailed his tax plan and then after those plans were passed late last year.

"I think Trump's policies and Trump's business-friendly attitudes have certainly given the US market probably more of a lift than other global markets, and yes, he has added to what was already strong bull run," Mr Noonan said.

"They claim that was a big cut for the middle class, but it really wasn't, because in some states like New York, New Jersey and California, the middle class will probably be worse off from these tax cut than before, but for big business, for multinationals, for big Wall Street companies, that tax cut is fantastic. It will probably drive for the 6 to 12 months ... and Wall Street higher with it."

Those tax cuts will likely drive company profits too, which it is hoped may spill into an economy which continues to grow under Mr Trump's leadership.

More than 200,000 new jobs

"We've seen unemployment at 4.1 per cent, over 200,000 new jobs have been created over the last several months and that US economy is really driving away," Peak Asset Management analyst Niv Dagan told SBS News.

"I think the really big thing is the job creation, so Trump's been a really strong advocate of 'Buy America' and American jobs so Trump's really big mission has been to create over 25 million jobs over the next 10 years. He's also seen the removal of some corporate deregulation that's really been stimulating the market that we've seen."

But, Mr Noonan says, there may be a stumbling block ahead.

"It'll be interesting to see what will happen in the second half of the year because we are getting to levels where companies are very highly valued and we're also going to be seeing a lot of central banks tightening. We're going to see central banks starting to hike rates, normalise policy."

Mr Dagan agrees:

"The market is perceived as overvalued so. We believe the US Fed will increase interest rates by one or two times throughout 2018 and we believe that the US market or in terms of the stockmarket will probably top off at that 25,500 to 26,000 level and have a little bit of a pullback around that 3 to 5 per cent before another leg up."