As Australian companies welcome the new year, IBISWorld business information analysts have revealed the sectors to fly and fall in 2018.

The top flyer is wind and other electricity generation sectors, which is expected to see revenue growth of 35 per cent.

It is followed by sports and recreation facilities and operation up nine per cent, dairy cattle farming eight per cent, petroleum exploration seven per cent, and nature reserve and conservation parks six per cent.

Source: SBS / IBISWorld

Shannon O'Brien's small business uses the majestic Sydney Harbour National Park as its playground.

"We are paddle-sport specialists, we represent the market for manufacturing, for tours, for rentals, for lessons," she told SBS News.

Paddleboard manufacturing and retail are key parts of the business but it is the tours, or "guided experiences" unit, which is expanding.

"We've grown in the last few years from about 6 per cent of our business to about 12 per cent," Ms O'Brien said.

"I think it's grown because people are looking for different experiences that are safe on water, you're going out with a guide or a professional paddler."

While the sector looks set to benefit from a pick-up in tourists, it doesn't necessarily guarantee more business.

"I think they always leave small business out of the equation. It sounds fantastic, more tourists from all over the world coming to Australia, absolutely brilliant but they're still driving people through on these big group packages and they boost numbers that way," Ms O'Brien said.

That leaves small operators like Ms O'Brien to find innovative ways to capture a greater share of inbound tourists.

"Asian social media, we've got to be early adapters with that, we've got to make sure that all our communication is within foreign language, we already started working with tourism colleges who offer foreign interns," she said.

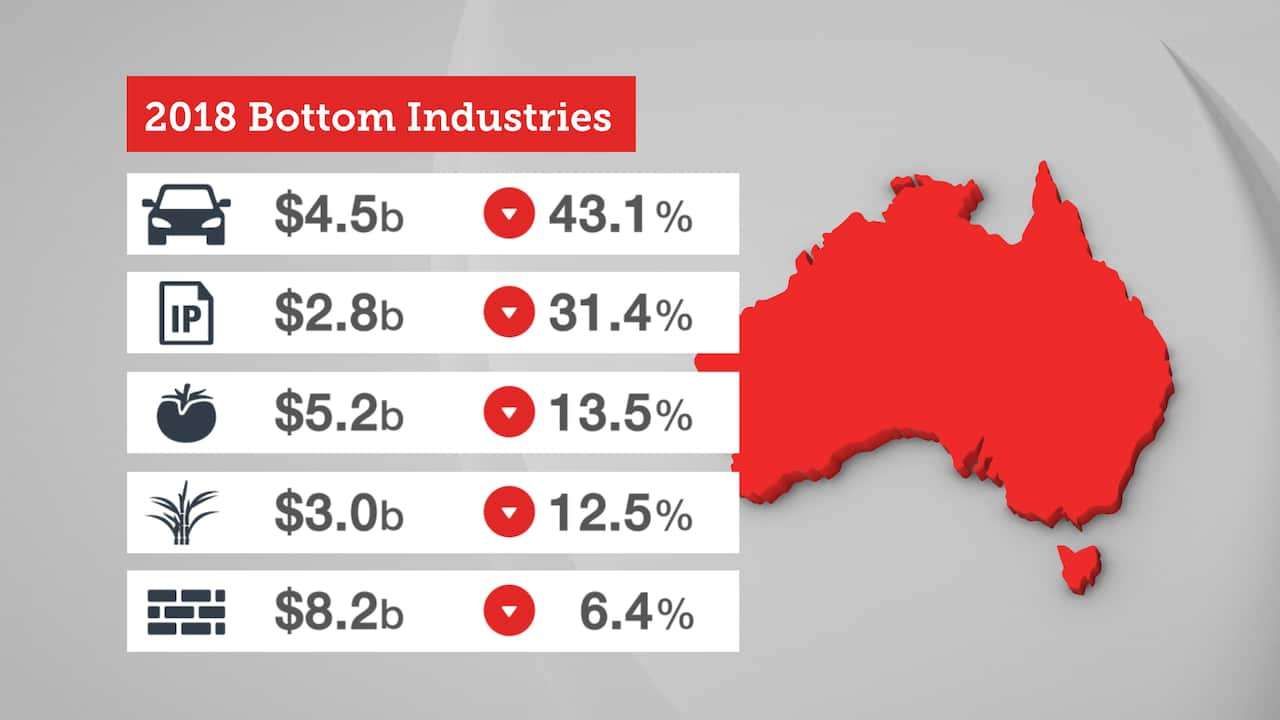

The challenges are greater for business operating in IBISWorld's fallers list which includes motor vehicle manufacturing as the biggest loser - down 43 per cent - followed by Intellectual Property Leasing at 31 per cent, outdoor vegetable growing at 13 per cent and sugar manufacturing at 12 per cent.

Source: SBS / IBISWorld

IBISWorld industry analyst WIlliam McGregor says concrete services wraps the bottom five down six per cent.

"For residential concreting servicing firms, they're expected to fall due to an oversupply in inner city apartments and townhouses," he said.

"The commercial segment of the concreting services industry there are expected to be some increases in this segment as major engineering projects such as the WestConnex and NorthConnex in Sydney are undertaken over the current financial year."

That is not good news for James Agius who has been a concreter in Melbourne for five years.

"We basically do domestic concreting, so driveways, pathways, all the decorative sort of stuff 13 but we'll also do small house slab extensions or shed slabs," James Agius, who had seen business slow, said.

"If we don't pick up, I'll have to resort to work for somebody else and that would be a massive waste of money for me.

"We've spent a fortune sort of developing our company, in advertising and tools and equipment and logos as you can understand, so if it doesn't pick up it'll be a bit stressful for us."

Holding onto staff is another great challenge for Mr Aguis.

"I have to pay the boys what I earn, I have to make the money that pays their wages, that pays their families, and if I tell them to come to work when we physically can't work because of the weather, it's money out of my pocket," he said.

Still, with revenue of more than $8 billion, concreting services are still a huge sector, with most of the new work this year coming from the commercial sector keeping generally large-scale concreting firms busy.

Share