Potts Point in Sydney's eastern suburbs is one of the most densely populated areas in the country.

Space comes at a premium and architects have come up with innovative ways to make the most of the limited space. This 27-square-metre apartment, in a 1950's style block, has no parking and uses sliding partitions to create more space and storage areas.

This 27-square-metre apartment, in a 1950's style block, has no parking and uses sliding partitions to create more space and storage areas.

Source: Ricardo Goncalves

It last went for sale for $405,000 in 2013, after being sold - unrenovated - for $295,000 in 2011.

It has just been auctioned for $520,000.

The new owner, who will be moving in, out-bidded the eight investors who were interested in the property.

Richardson & Wrench Elizabeth Bay Agent, Luke McDonnell, says interest in the property has been high.

"It's currently rented at $440 a week."

"I'd say 80 per cent of potential buyers are investors."

Mr McDonnell had predicted the property might go at the top end of its price guide.

"The guide is between $420,000 and $460,000."

Pete Wargent, a property buyer at AllenWargent, says small spaces aren't for everyone.

"Historically financiers haven't been that keen to lend against micro-apartments which should tell you something, it's generally a good idea to buy something with broad appeal, and particularly with this stage in the construction cycle."

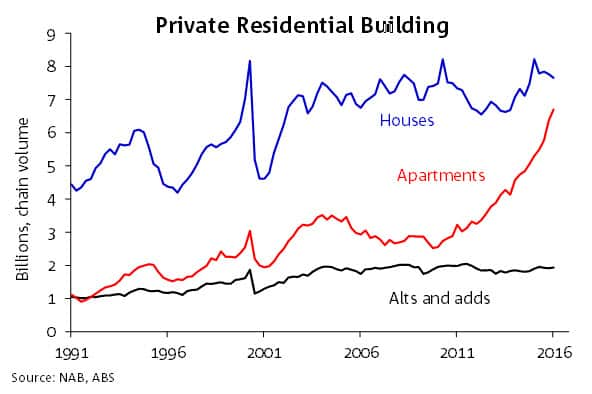

The Bureau of Statistics says the value of residential work done reached more than $16.5 billion in the March quarter, a near 6-per-cent increase from the same time last year.

Although, that rate of growth is starting to slow.

Apartment construction at record levels Source: NAB

With about 200,000 new dwellings coming onto the market this year, Pete Wargent says prices may come under pressure.

"We're looking at some looming pockets of oversupply. That said, if Australia is going to successfully grow its population by 3.5 million and 4 million people per decade, we're going to have to get used to the idea of constructing more apartments.

Like the Reserve Bank Governor warned yesterday, Capital Economics Chief Economist Paul Dales says prices can fall.

"I'm not at all suggesting that Australia is going to suffer from a US style housing collapse."

RELATED READING:

'House prices can fall': RBA's Stevens warns property investors

But he's expecting declines in 2019 and 2020, as official interest rates rise, catching many interest only borrowers - who form 40 per cent of the market - off guard.

"Those people are going to get quite a shock because they've been used to servicing their mortgage at record low cash rates."

For now though, most economists predict interest rates have further to fall.

Morgan Stanley is the latest investment group to predict the official cash rate will hit 1 per cent by this time next year.

Share