The combined effects of low interest rates and a shortage of stock in some parts of the country continue to support property prices in Australia.

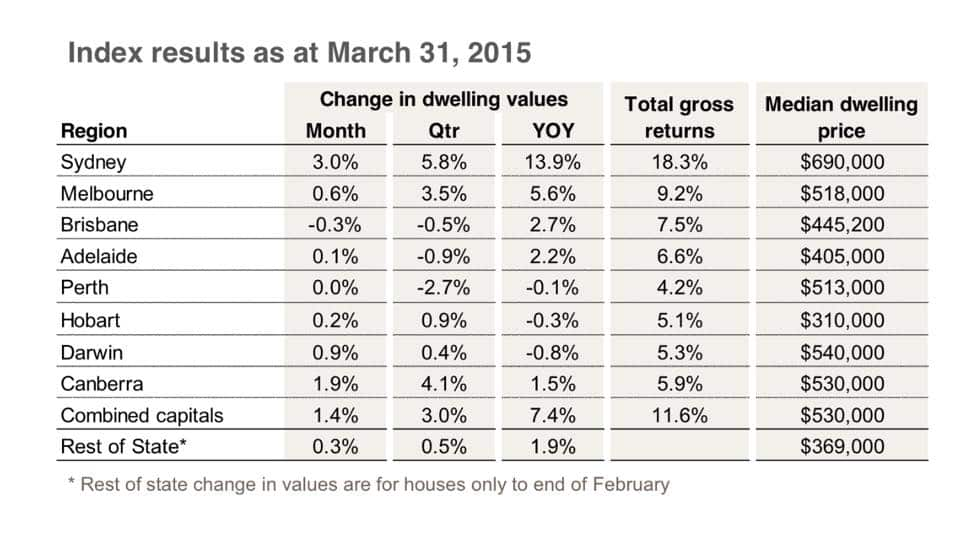

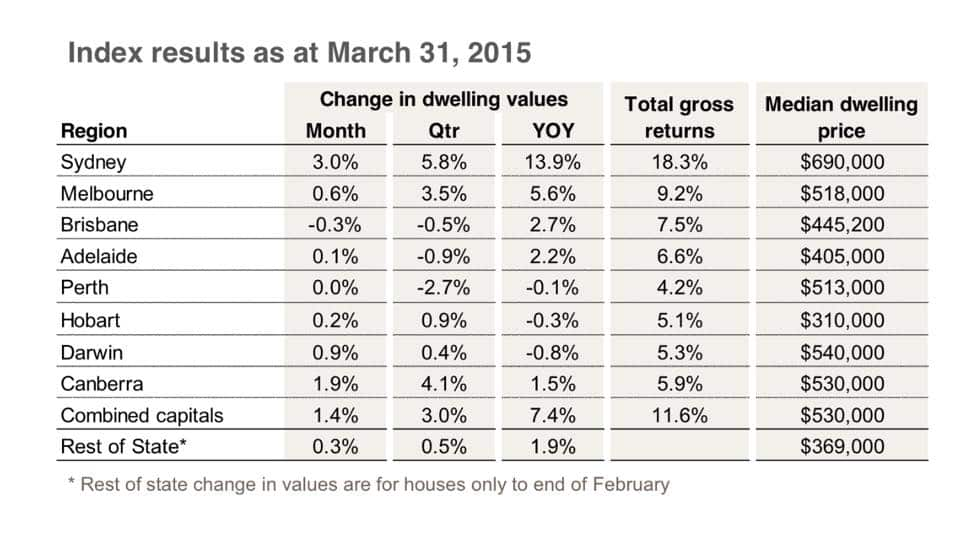

Capital city prices rose on average 1.4 per cent in March, up three per cent in the first three months of this year.

The national median dwelling price is now $530,000.

The biggest increase in the first quarter of the year was in Sydney, up 5.8 per cent, followed by Canberra which rose 4.1 per cent and Melbourne, up 3.5 per cent.

Values fell in Perth by 2.7 per cent, Adelaide by 0.9 per cent and Brisbane by 0.5 per cent. “Although value growth has started 2015 on a strong note, the annual rate of growth has moderated back to 7.4 per cent, which is the slowest annual growth rate since September 2013," said Tim Lawless, head of research at CoreLogic RPData.

“Although value growth has started 2015 on a strong note, the annual rate of growth has moderated back to 7.4 per cent, which is the slowest annual growth rate since September 2013," said Tim Lawless, head of research at CoreLogic RPData.

House prices as at March 31, 2015 (CoreLogic RP Data)

It comes as new home sales rose by more than 1 per cent in February, according to the Housing Industry Association, spurred by an 11 per cent increase in the sale of new apartments.

HIA Chief Economist Harley Dale says the gap between supply and demand is closing, but there is still some way to go.

"If you take a market like Queensland for example, it's been very very weak for a number of years, it's only been recovering for a year or two. The rate of supply coming onto the south east corner of Queensland is still far behind what's needed to catch up."

He said stamp duty is a significant barrier to entry for some, calling it the most inefficient tax in the entire economy.

"If we could tackle that from a housing perspective, that would give a massive boost to affordability. The current inefficiencies around the planning system, and land tax and land release are other key areas."

Property investor Margaret Lomas concedes Sydney may be unaffordable for many but argues the potential for ownership is still there.

"In comparison to 20 and 30 years ago, the cost of living of many of our basic staple items is comparatively less than it used to be, so young people, and anyone for that matter, has more disposable income these days to put towards a housing loan repayment."

Ms Lomas, who built a portfolio of 40 properties in 17 years, says young Australians may need to take another look at their investment strategy.

"In reality, what the dream needs to become, is a dream to get on the property ladder, and what that means, is that a young person today can very easily get on the property ladder in an affordable property, still in a capital city, but maybe not in Sydney, and become a landlord first."

WATCH: Margaret Lomas describes the biggest property investment mistake many Australians make:

The Feed's Jeanette Francis recently covered the topic of affordability, with a bit of a GenY perspective:

Share