The head of Australia's central bank told an luncheon in Brisbane today, but he's worried about house prices, particularly in Sydney.

"Yes, I am concerned about Sydney. I think some of what's happening is crazy."

Still he's left the door open for another interest rate cut.

"We remain open to the possibility of further policy easing, if that is, on balance, beneficial for sustainable growth," he said.

It's mixed news for first time home buyers, who are having to save a bigger deposit, to fund a bigger loan.

25 year old John Le, a pharmacist in Sydney's south-west, has been looking for a home for two years.

He considers himself to have a good job, but believes prices in his area is too expensive.

He's one of seven children to parents who've been renting most of their lives, and can't receiving a helping hand to scratch for a deposit.

"On top of just studying pharmacy for four years, we've got HECS bills to pay."

AMP Capital Chief Economist, Shane Oliver says while the RBA says there may be the potential for further official interest rate cuts, home buyers are going to have to borrow more.

"We've been taking on more debt than a generation ago. But whichever way you cut it, Australian housing is very very expensive."

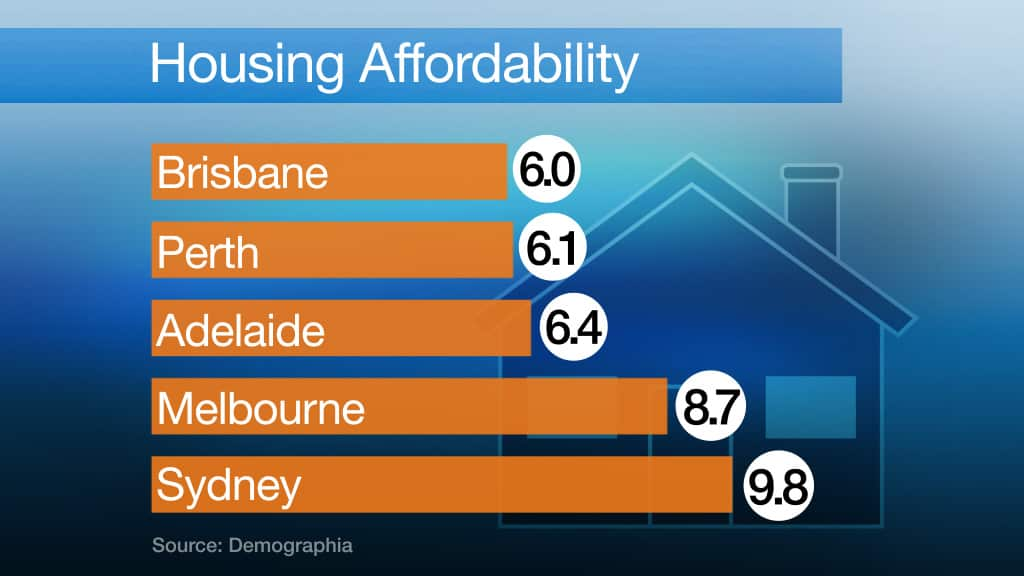

One of the problems is that wages aren't growing as quickly as house prices and while estimates vary, a recent report by Demographia claims it would take 6.5 times the average annual income to afford a home in Australia, but that figure varies depending on where you live. Of Australia's five biggest cities Brisbane is most affordable, while it takes Sydneysiders nearly 10 years of work - to pay off a home but that doesn't include living expenses.

Of Australia's five biggest cities Brisbane is most affordable, while it takes Sydneysiders nearly 10 years of work - to pay off a home but that doesn't include living expenses.

Source: Demographia

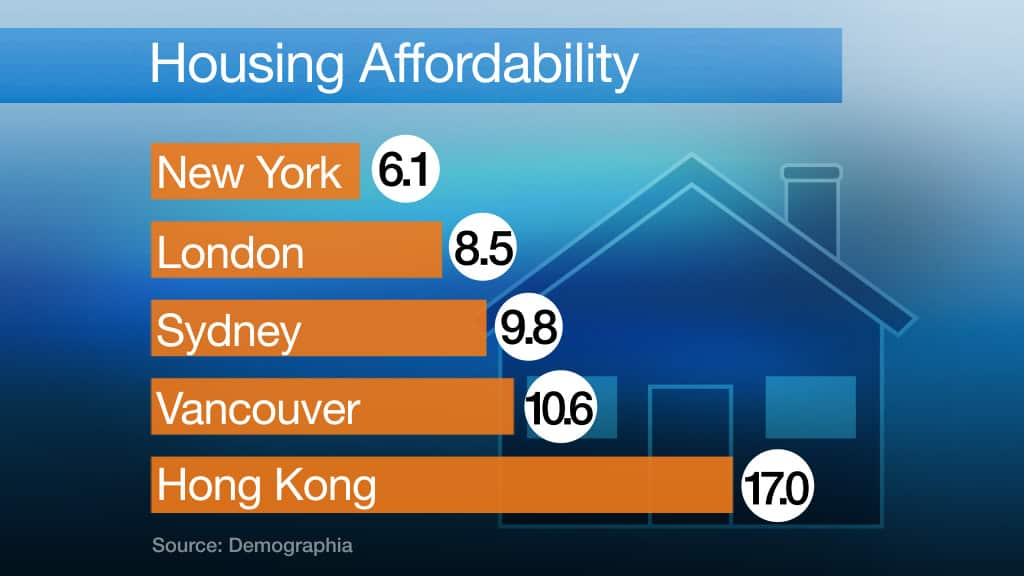

"So we're paying typically double what Americans are paying, relative to our incomes to buy an average house. That's what i mean by severely unaffordable," says Shane Oliver. A housing bubble however would require a lot of speculators entering the market, an increase in investor credit and deteriorating lending standards.

A housing bubble however would require a lot of speculators entering the market, an increase in investor credit and deteriorating lending standards.

Source: Demographia

Residential property buyer, Pete Wargent, says we've seen some of those indicators.

"Particularly strong growth in investor credit, but the deterioration in lending standards not so much and in fact APRA is trying to wind that back."

Shane Oliver says risks to the housing market include a Chinese economic collapse, local interest rate rising too fast and hard, and a supply surge which leads to developers oversupplying like the US around the global financial crisis.

"The problem with these things is that you never know where the problem is going to come from."

He adds, an increase in housing supply may over time, be a solution to rising prices.

"We need more years, like we're seeing right now of very strong levels of housing construction, if that occurs you get more competition, out there amongst the suppliers, and prices overtime will come down, at least relative to rents and at least relative to people's incomes."

Longer term however, he adds, Australians may need to move into regional areas.

"Do we need to concentrate in 6 capital cities? We need to be living in regional centres, much like America does, they've got lots of cities with a million people or less, where we've just concentrated ourselves in very expensive cities."

Share