Property price growth around the country has eased in September according to RP Data.

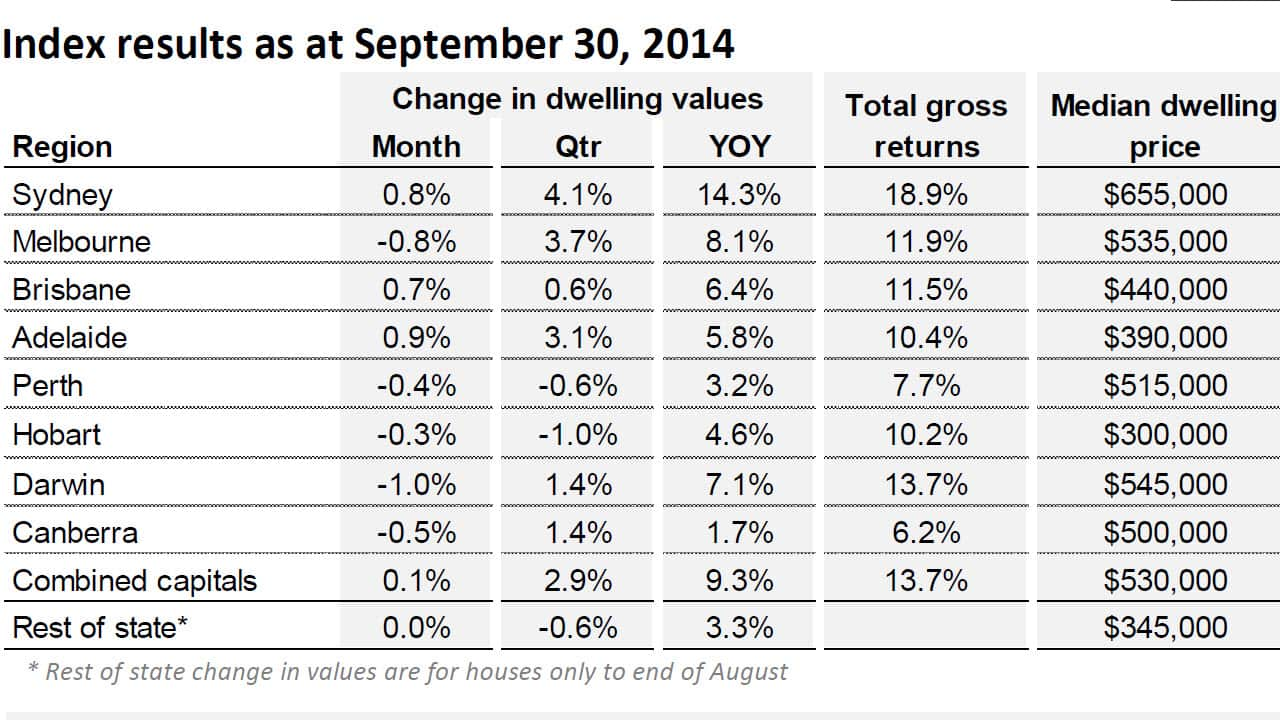

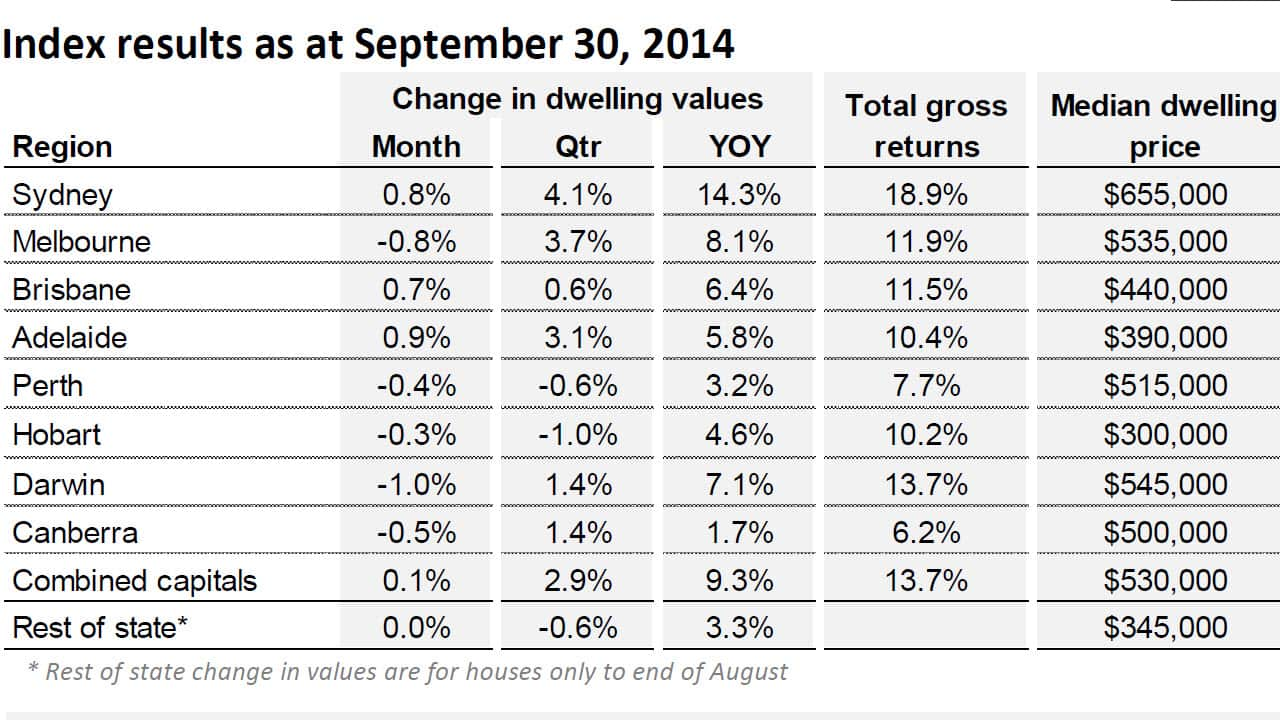

Capital cities saw an average 0.1 per cent increase last month, with Adelaide and Sydney enjoying the biggest increases.

It's good news for the Reserve Bank.

Governor Glenn Stevens has been vocal in cautioning property investors about the market recently. Still, home prices are up 9.3 per cent year on year, while in Sydney they're up 14.3 per cent.

Still, home prices are up 9.3 per cent year on year, while in Sydney they're up 14.3 per cent.

RBA's Financial Stability Review last week confirmed it is in discussions with other regulators about "further steps" to tighten bank lending standards in an attempt to contain prices.

The RBA doesn't want to lift official interest rates just yet, because the whole economy isn't ready.

Harry Triguboff is the founder of the nation's largest apartment builder Meriton, which has about 15,000 units in the construction pipeline.

He believes supply is close to matching demand.

"Because the rents are steady, prices can be influenced by interest rates, rents aren't influenced by anyone, it's just supply and demand... and it looks to me that supply is correct at the moment," he told SBS reporter Ricardo Goncalves.

Harry Triguboff speaks with Ricardo Goncalves

Instead of lifting interest rates the Reserve Bank may consider so-called macro-prudential options may include stricter serviceability tests by the big banks, as Scott Haslem, Chief Economist at UBS explains:

Saul Eslake, Chief Economist at Bank of America Merrill Lynch thinks the government should play a bigger role. He wants to see negative gearing curtail and explains the move is an effectively an after tax interest rate rise.

What do you think about these options? Should the government scrap negative gearing?

Share