When the Global Financial Crisis hit in 2008, the impact on world economies was profound, and has since loomed as both a past event and future threat.

Then a global investment banker, John Baini remembers landing in the United Arab Emirates in 2008 in boom-time Dubai, to an economy "built on sand" in more than one sense.

During that year he watched as a "ghost town" replaced the frenetic energy of a city under construction - the money had stopped flowing, and the effect was disastrous.

"What the GFC demonstrated is that any over-reliance on a single system for providing capital to an economy is very dangerous. In the case of the GFC, the complete paralysis of the banking system was the core problem."

Close to a decade on, Baini has left the sector and co-founded a new business, TruePillars, which facilitates private borrowing and lending, a move he says can shield economies from the threat of recession.

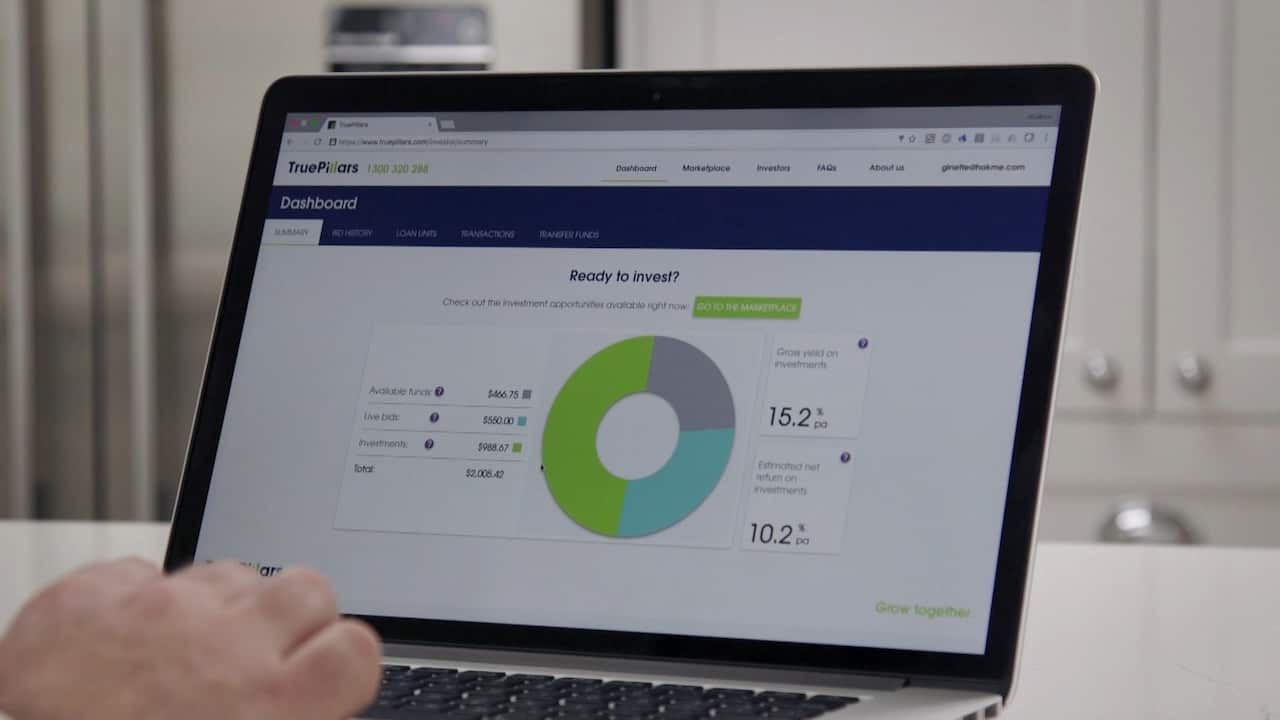

"TruePillars is an online marketplace that connects small businesses borrowers with private, everyday investors that are looking to earn a regular income," he said.

"We have everything from individuals to trusts and self-managed super funds acting as lenders. They are assessed in a similar way as a bank would assess them, they enter the marketplace and can bid on loans for the businesses on our platform."

Investors registered with True Pillars can contribute a minimum of $50 to a loan for any business on the site; these are unidentifiable, but reveal details of their profit margins, revenue and sector.

TruePillars is in its infancy but has already attracted dozens of small to medium borrowers across a range of industries, with cafes, hairdressers and even a legal firm.

"These are businesses that might need a small loan to buy something new, like a pizza oven, or a new staff member to expand their business, so they are too small to be of interest to large-scale investors," Baini said.

Many small businesses raise capital by borrowing from the bank, almost always using their private residence as equity.

It is this phenomenon Baini says excludes a growing demographic of entrepreneurs from the field; without a house, banks are less likely to consider an application for a business loan.

"By allowing these operators to pitch for loans to a number of people, the risk is diversified for the lender, but also, the borrower," he said.

"Once an investor has put their capital into an array of loans, theoretically they could have a small income coming in every month... we aren't driving people away from the stock market, but the problem with blue chip stocks is they will pay but only twice a year."

Sharing business secrets of inspiring entrepreneurs & tips on starting up in Australia's diverse small business sector. Read more about Small Business Secrets

Have a story or comment? Contact Us