William Lin started his project marketing firm LW Phoenix in 2010, with only three employees in a small Chatswood office.

Now 33, he has grown his company to employ 10 staff, and more than 30 sales contractors.

At 24, he did not realise the potential value of owning his own property.

“After I got my first professional job, she pretty much came to me and said 'son, you’ve got a proper job now, how about you save up and buy a property?'” Mr Lin says.

“And my first reaction at the time was no, I have a life ahead of me. The whole idea of carrying a mortgage was beyond me."

Mr Lin soon found out after his mother suggested he save up and purchase his first property.

“From my first purchase I realised how valuable real estate can be,” he says. Mr Lin’s company has capitalised on Australia’s recent property boom, which has raised the asset value of Australian housing to $6.8 trillion.

Mr Lin’s company has capitalised on Australia’s recent property boom, which has raised the asset value of Australian housing to $6.8 trillion.

Dalton Avenue apartments model. (Supplied) Source: Supplied

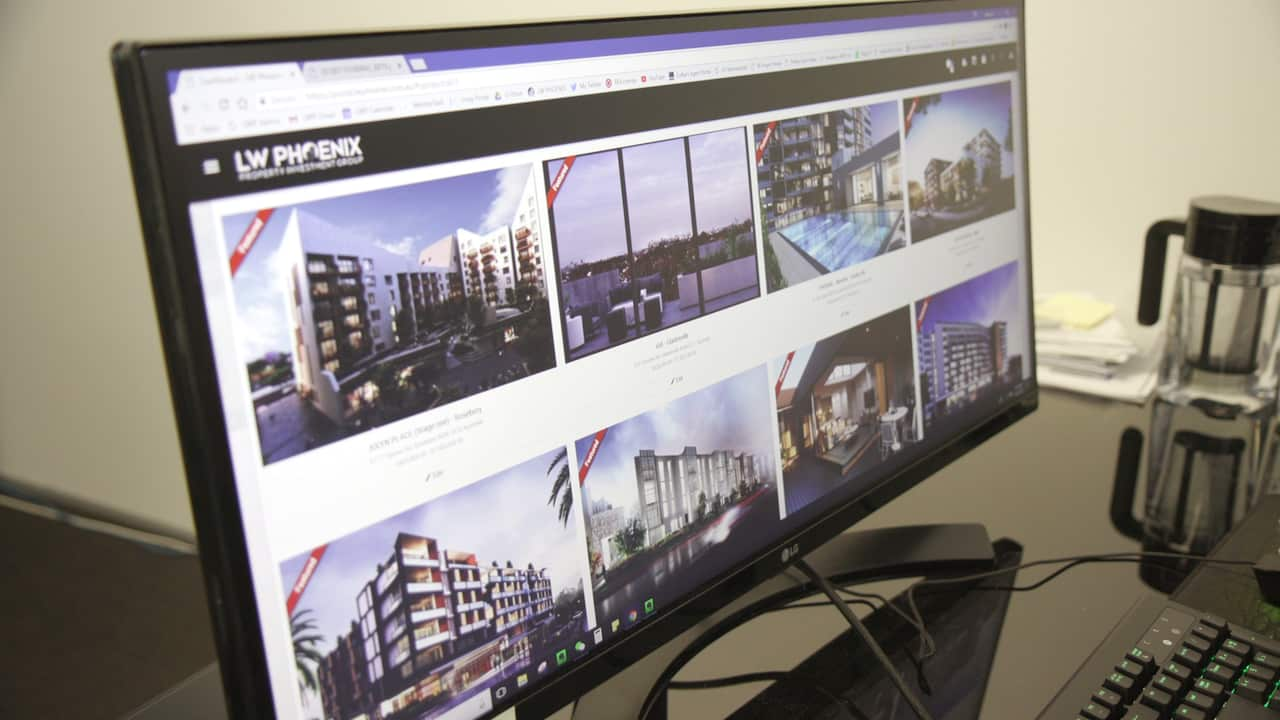

His company sells hundreds of properties off the plan to local and international buyers, and is currently marketing over 92 brand new residential apartment projects in the Sydney area. With high volumes in sales, Mr Lin says one of his company's most important assets is professional indemnity insurance.

With high volumes in sales, Mr Lin says one of his company's most important assets is professional indemnity insurance.

LW Phoenix website listings. (Supplied) Source: Supplied

“The real estate industry is dealing with products, multimillion-dollar products,” Mr Lin says.

“Without professional indemnity, in the very small chance of wrongdoings, it could cost the business a lot of money and it could also cost the client a lot of money.

“We’re actually very careful about this because we know this could happen.

"That’s why I actually tell my sales members to specifically check draft strata plan and tell that to the buyer instead of the marketing plan because the marketing plans could have changed,” he says.

Each sales contractor at his company is also provided with their own indemnity insurance as an extra layer of protection.

What is professional indemnity insurance?

Professional indemnity insurance protects your business, including staff, against financial losses for any legal action taken against your business for services or advice you have provided.

What is included?

- Material damage loss for your physical assets

- Financial loss due to Business Interruption

What does it cover?

Depending on what type of business you have, there are many different options to suit a variety of businesses. The following risk areas should be considered when making a decision about what cover best suits you:

- Legal and defence costs

- Damages awarded against you

- Claims investigations costs

- Court attendance costs