Recently released HSBC Holdings Plc survey has found that the Australian millennials have the second-lowest level of home ownership.

HSBC defined millennials as those born between 1981 and 1998.

This is a survey that makes comparison with their peer group of more than than 9,000 people in 9 countries.

Canberra-based policy expert Usman W. Chohan says “The United Arab Emirates millenials are on 26 percent and France on 41 percent both far beneath China which is on 70 percent.” Usman points out that when compared to these countries, only 28 percent of Australians aged between 19 and 36 own a home.

Usman points out that when compared to these countries, only 28 percent of Australians aged between 19 and 36 own a home.

Usman W. Chohan Source: Usman W. Chohan

“The biggest barrier in owning a home for Australian millennials is saving a deposit,” adds Usman.

In addition, Usman points out that the Australian milenials also face the following problems:

- bank slashed interest rates,

- cheap cash fueling demand,

- domestic investors taking advantage of tax breaks and investing in properties, and

- foreign buyers, especially from China, investing in offshore market.

HSBC report found that 83 percent of Australian millennials intend to buy a home in the next five years.

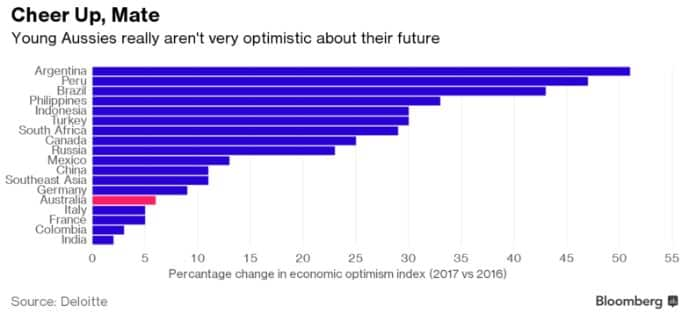

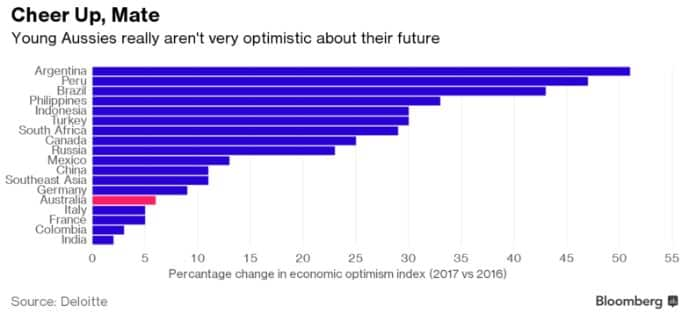

Similarly, a Deloitte report earlier this year has found Australian millennials are particularly pessimistic about their prospects of home ownership. The report said only 8 percent expected to be better off financially than their parents.

The report said only 8 percent expected to be better off financially than their parents.

Millenials Source: Deloitte

To know more about Australian millennial home ownership problems, listen to Amit Sarwal’s conversation with Usman W. Chohan.