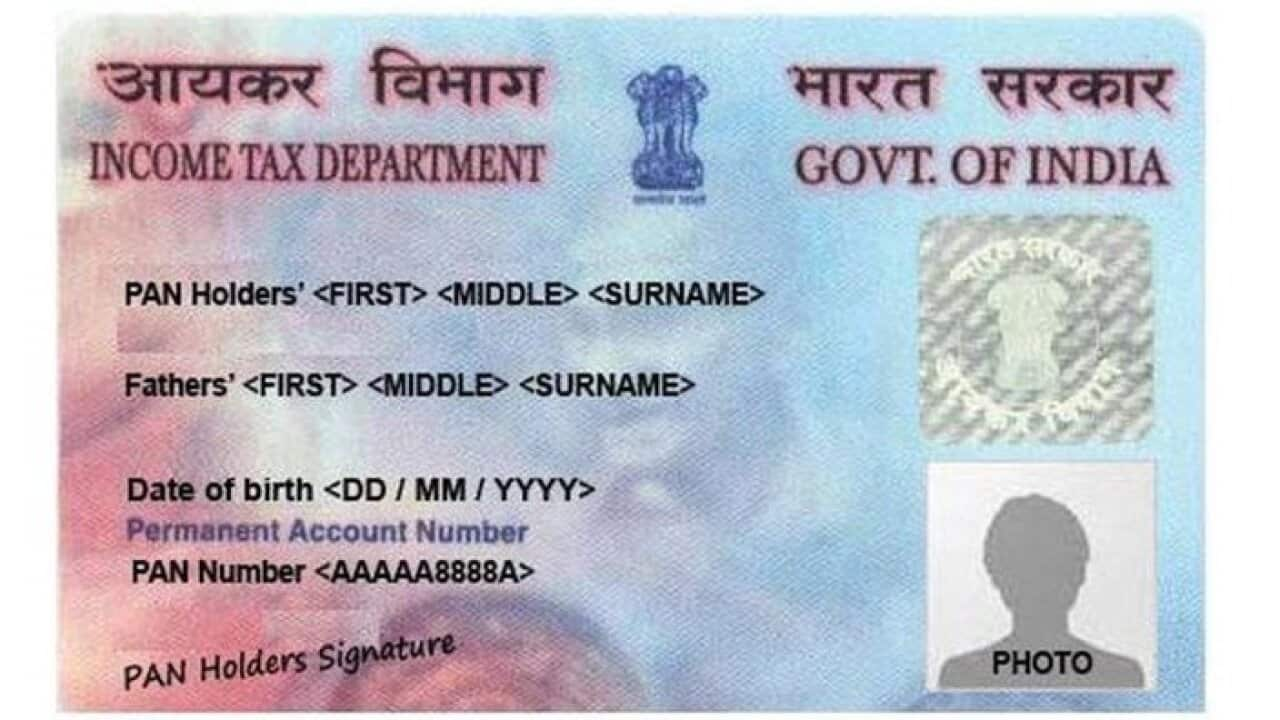

A PAN or Permanent Account Number is a unique, 10-character alpha-numeric identifier, issued to all judicial entities identifiable under the Indian Income Tax Act, 1961. PAN can be issued to individuals, families and corporates especially those who pay Income Tax. It can be issued to Indians or foreign nationals (subject to them having a valid visa) for purposes such as investments.

Associate Professor in The Department of Economics at Monash University, Dr Vinod Mishra tells SBS Hindi,

"The Liberalised Remittance Scheme was started by the RBI (Reserve Bank of India) in 2004 under which people living in India could transfer money abroad. Indians could send money abroad for travel, for supporting a relative to cover their expenses, for getting medical treatment or for investing in property or stock market. The scheme started with a maximum figure of USD $25,000 that could be transferred but in 2015 this limit was raised to $250,000."

"Until now, if you were sending $25000 or less, abroad, then it was not necessary to provide PAN number but now the RBI has made this rule that under this scheme, no matter what the amount, you will have to provide a PAN number," says Dr Mishra

Dr Mishra suggests that steps were being considered after the Panama paper leaks,

"RBI got to know that this scheme was being misused. This scheme was being misused in two ways 1) More money than the upper limit of $250,000 was being sent abroad through different transactions 2) Sometimes unaccounted money (black money), the money on which tax was not paid in India, perhaps that money was being sent abroad through this scheme. So to stop these two kinds of misuse, the government has taken stricter steps saying that the $25000 limit, for which PAN was not necessary, now even for those transactions PAN will be mandatory."

Dr Mishra also told SBS Hindi that the definition of a 'relative' has changed under the new rules. Previously it included many members of the extended family but now it is restricted to a few.

"In this circular, it is said that relatives will be defined as those defined in Companies Act 2013. Before this, relatives were defined by Companies Act 1956. In the earlier Act relatives were very broadly defined but according to the Companies Act 2013 relatives are restricted to husband, wife, mother, father, daughter, son, son-in-law, daughter-in-law, brother and sister. For instance, in the earlier Act, sister's husband or grandparents would also be counted as relatives which is not the case anymore."

According to Dr Mishra making PAN mandatory for all transactions involving the transfer of money abroad will not have any major impact on common people as the intention is to target those people who are breaching the law.

"Most honest people who are sending their hard earned money to their children for studies or for investments, they have a PAN number and their money is accounted for. Second, a lot of people don't send very large sums of money. People who send money for their children for fees and lodging, that is generally small amounts and they already have a PAN card."

However, Dr Mishra adds "Only issue is that compliance cost will increase, they will have to do a little more paperwork. At a personal level, I feel this could affect those people who perhaps came to Australia as students and they never got a PAN card made in India so perhaps they will have to get it made because of which there might be a compliance issue."

But Dr Mishra feels that this will not be a major problem for most people,

"By and large, I do not think that this will inconvenience a lot of people. My own experience is that the process of making a PAN card has become fairly straightforward in India. So even for someone who does not have a PAN card, getting one made is not that much of a problem anymore."

"The PAN is somewhat similar to the TFN in Australia and you don’t have to be an Indian citizen to make a PAN card, even an OCI (Overseas Citizen of India) can get one made."