Australia "needs to get serious about addressing intergenerational inequality" if we want an equitable retirement system, an author of a report on Australia's long-term retirement trends has said.

A "significant shift" in household wealth, super balances and health outcomes has pushed back the age at which Australians can retire, according to Kyle Peyton, a senior research fellow at the University of Melbourne.

Between 2003 and 2023, the average retirement age in Australia rose by five years, the 2025 Household, Income and Labour Dynamics in Australia (HILDA) survey found.

There is no official retirement age in Australia, but you must be at least 67 years old to qualify for the age pension.

The report found the average retirement age was not spread evenly across the sexes. Among women, it rose from 58.8 to 63.6 years old, while for men it went from 59.9 to 64.8 years.

In addition to more Australians retiring later, financial and health pressure are also making them less comfortable in retirement, according to the report.

While several factors lie behind these trends, household wealth was front and centre, Peyton said.

'Housing is really where it's at'

Housing wealth remains the most significant component of economic wellbeing among retirees, Peyton said.

"For the majority of retirees, housing wealth — the largest contributor to household wealth in Australia — serves as a key financial safety net," he wrote in the report's retirement chapter.

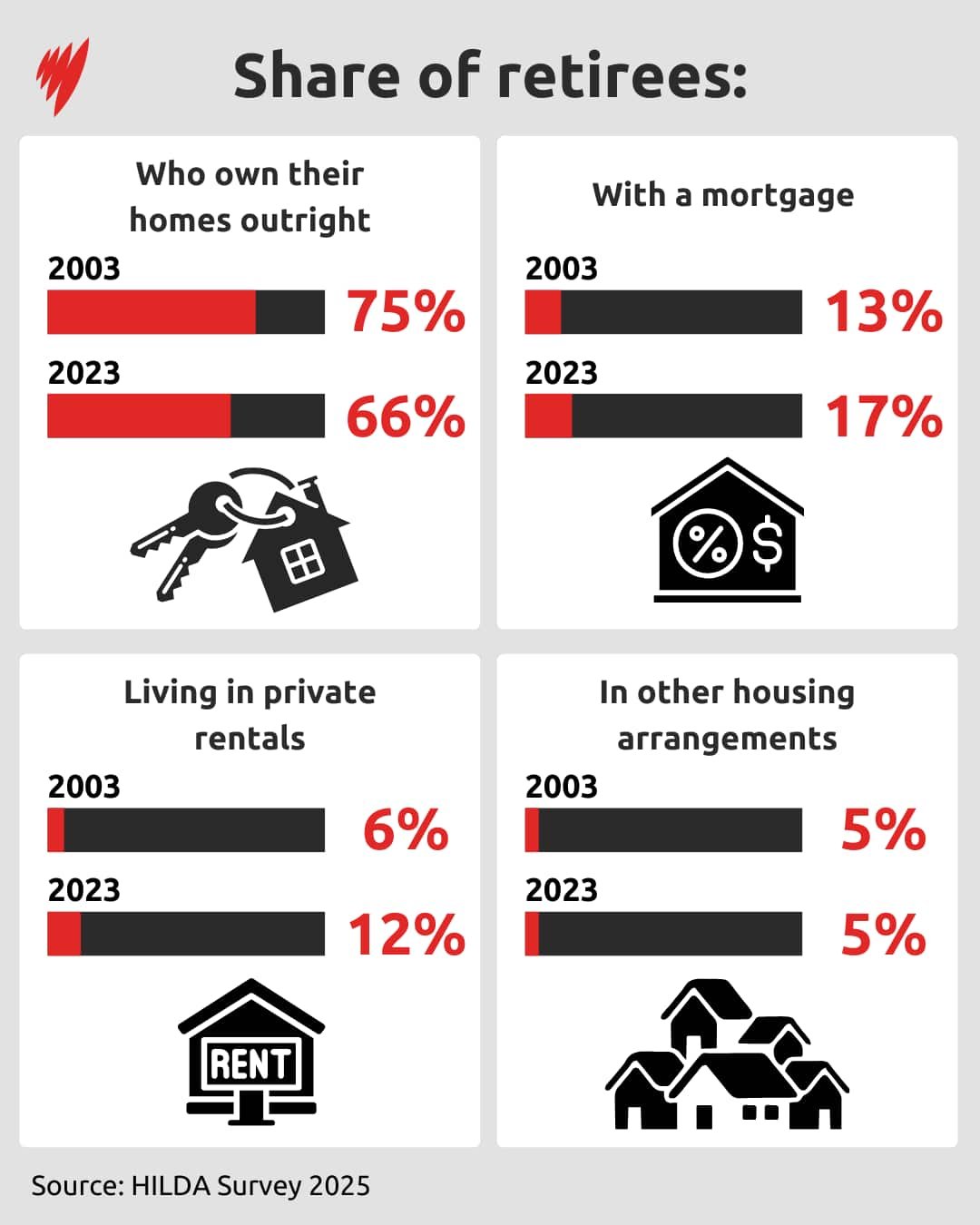

Peyton outlined several trends that have occurred between 2003 and 2023, including that the proportion of retirees who own their homes outright dropped from 75 per cent to 66 per cent, and the share of those with a mortgage increased from 13 per cent to 17 per cent.

Peyton was particularly concerned by the proportion of retirees in rentals doubling between 2003 and 2023 — from 6 per cent to 12 per cent.

"That's a pretty significant shift, because the retirement system in Australia is built on the assumption that people will own a home when they enter retirement," he said.

"This is a big problem for future generations, and I think we need to get serious in this country about addressing intergenerational inequality and housing is really where it's at."

Furthermore, housing wealth has a clear impact on one's super balance in retirement, Peyton said.

"You're going to have burn through a lot more of your super just to keep a roof over your head if you don't have that home, because just rent's really expensive in Australia," he said.

Super gender gap showing signs of closing

However, Peyton said that, while things may look dire in housing, there were some positive trends in superannuation, with "a really significant increase" in the size of super balances as people enter retirement.

The median super balance for women has increased by more than a 100 percent since 2015, while for men it's increased by about 40 per cent, he told SBS News.

- 'Super gap': The reasons two-thirds of Australians can't 'retire comfortably'

- Australia set to lead in retirement wealth, but women lag behind

- The superannuation gap for women isn't getting any smaller

"What that basically means is that we're seeing a closing of the gender gap in retirement [savings]," he said.

In 2015, the average Australian's super balance was $245,122, while in 2023 it was $383,217, the HILDA report found.

Meanwhile for men, it was $467,307 in 2015 and $504,420 in 2023.

Prognosis largely looking up

The report also suggests that improving health outcomes are another factor what Australians are working longer.

The percentage of recent retirees who cited health as their main reason for leaving the workforce declined from 39 per cent in 2003 to 29 per cent in 2023.

This 10 per cent drop "may reflect improvements in life expectancy and health outcomes among older Australians," Peyton wrote.

However, such health improvements are not uniform, he said, adding that First Nations women in particular suffered from health issues that put their average retirement age below that of other Australians.

For the latest from SBS News, download our app and subscribe to our newsletter.