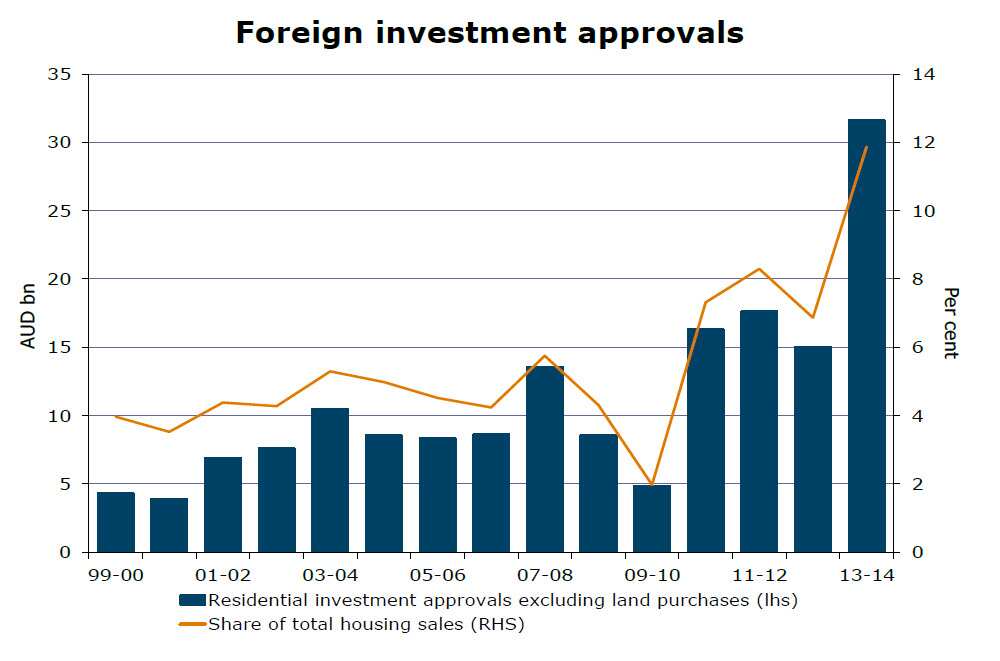

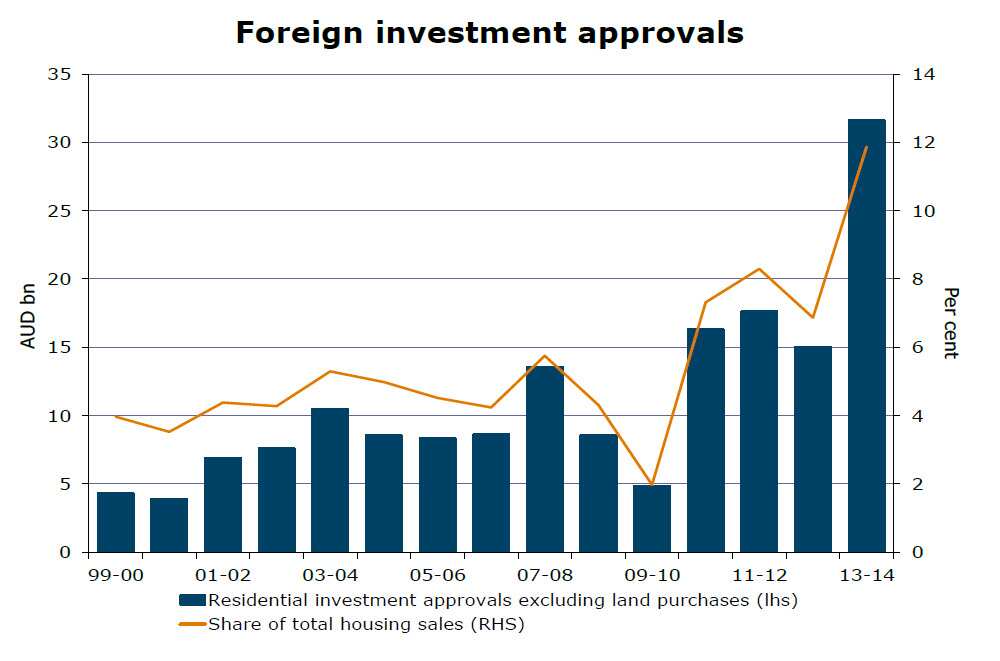

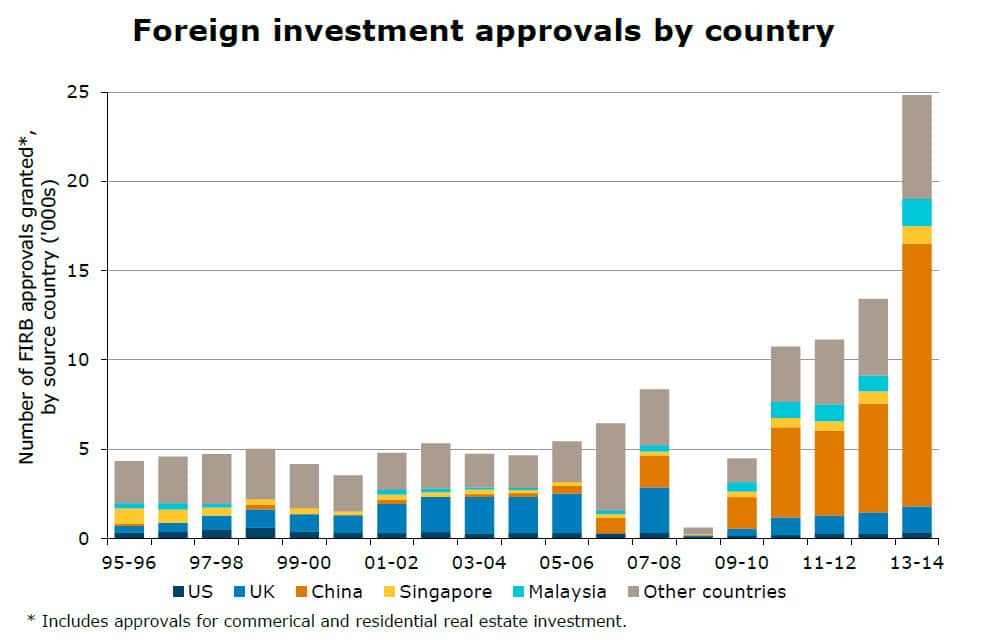

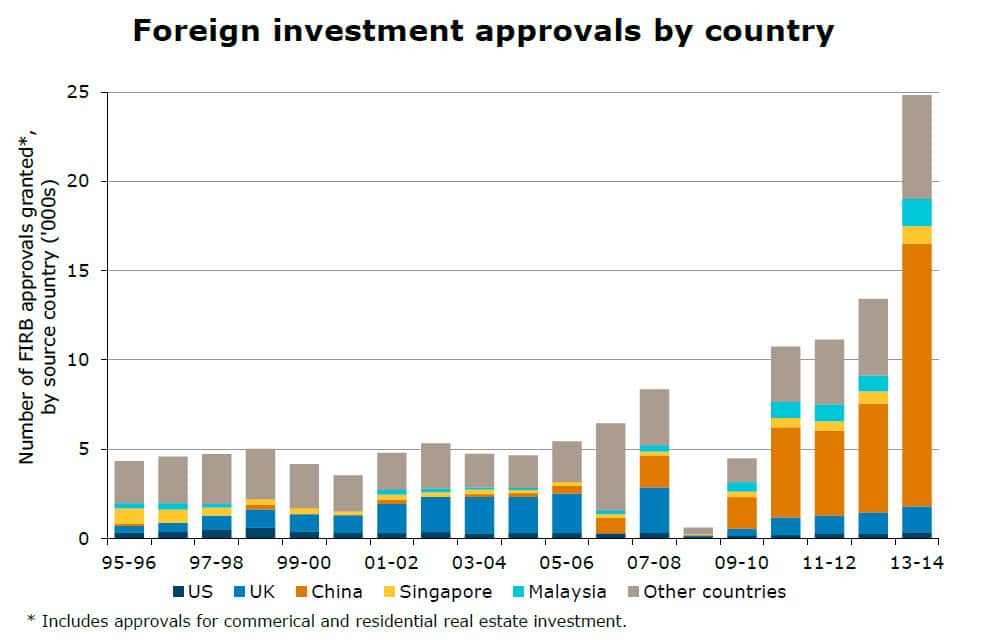

Foreign investment approvals are at record levels.

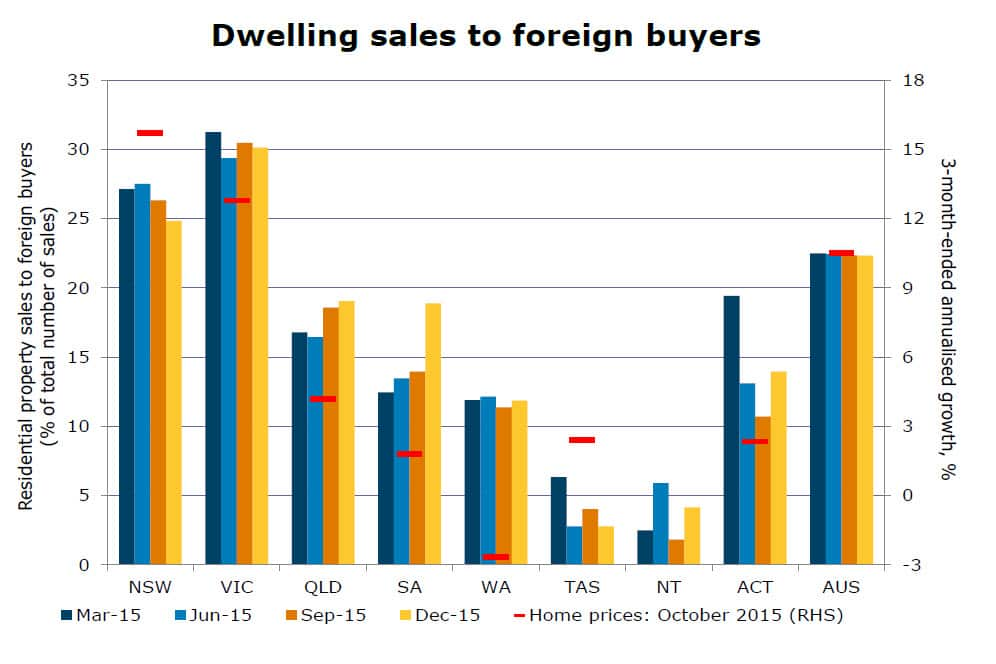

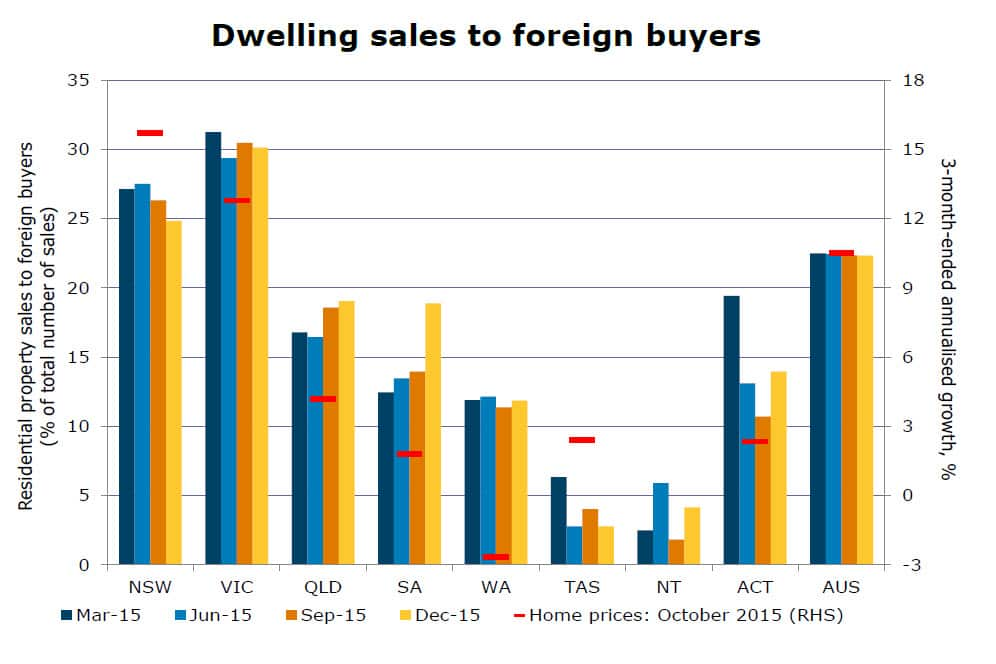

Last financial year, foreign buyers rose to about 12 per cent of the market, making for nearly $30billion in total housing sales.

Source: ANZ

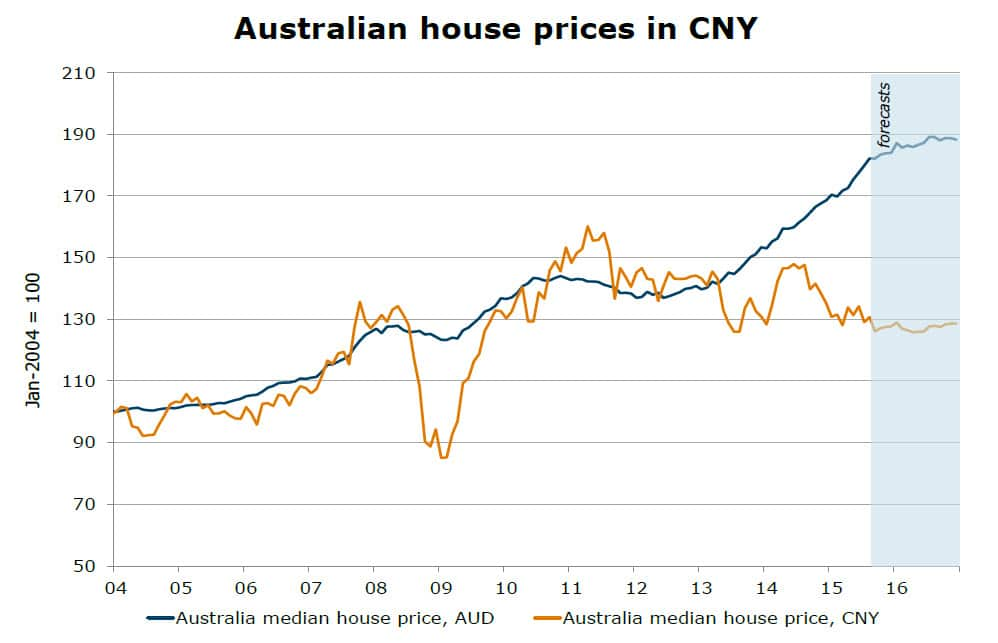

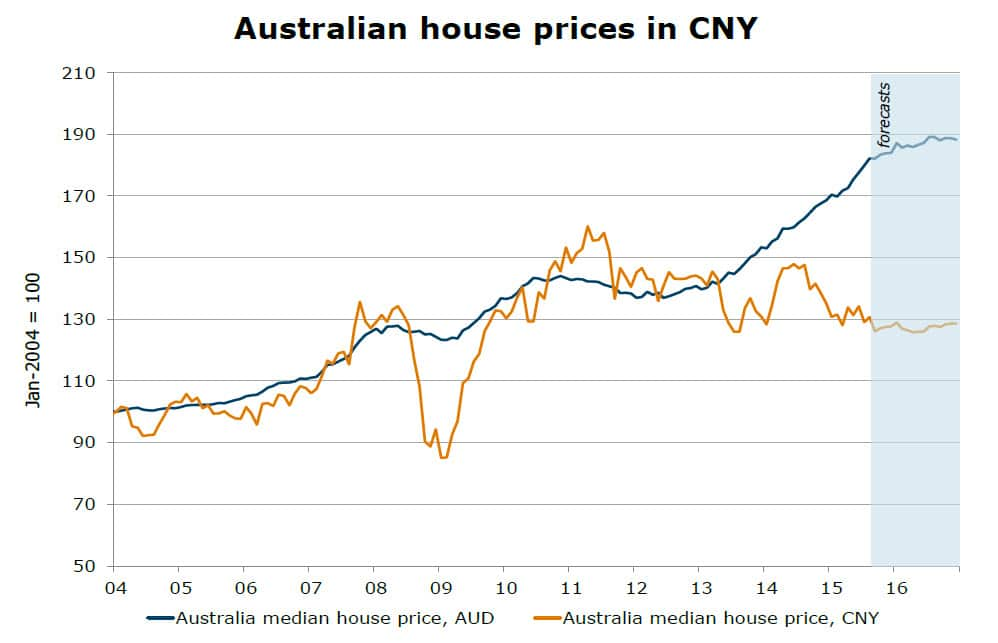

The recent decline in the Australian dollar is making property attractive for Asian buyers.

While property prices have risen dramatically since 2013 in Australian dollar terms, when viewed in Chinese Yuan, prices have remained fairly stable in that same period.

Source: ANZ

ANZ Senior Economist David Cannington says the exchange rate is giving Chinese buyers a significant discount compared to Australian purchases.

Unsurprisingly, Chinese buyers form the bulk of foreign approvals.

The global financial crisis may have kept overseas buyers away, but they came back strongly afterwards with around 25,000 foreign investment approvals granted by the Foreign Investment Review Board last financial year.

Source: ANZ

Most foreign buyers are attracted to the Victorian market.

About 30 per cent of all new residential property sales in Melbourne go to foreigners.

Source: ANZ

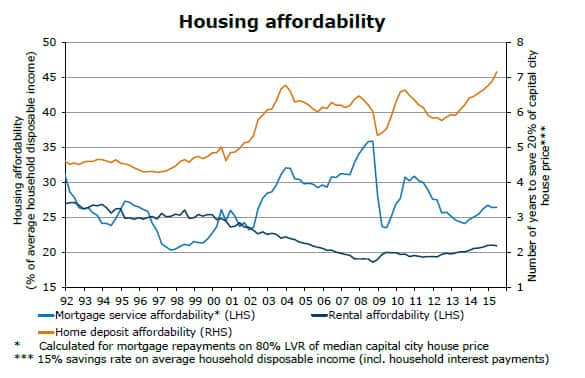

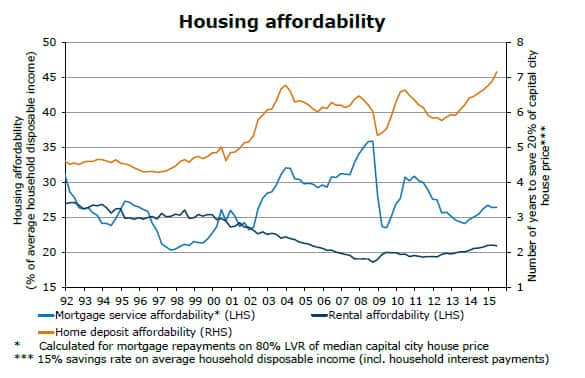

Meanwhile, housing affordability remains an issue for Australians.

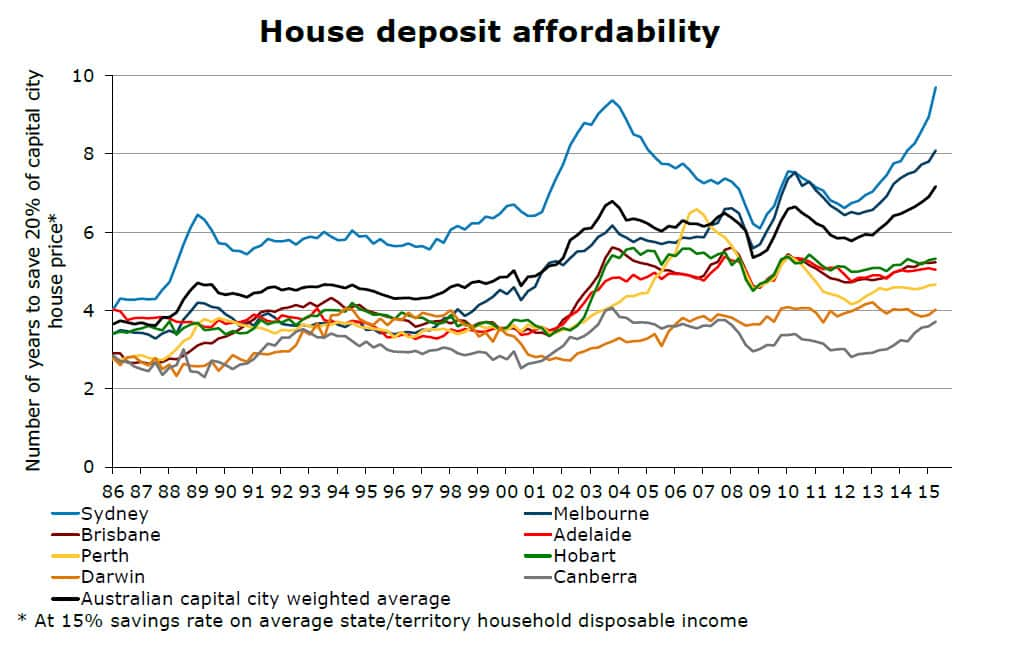

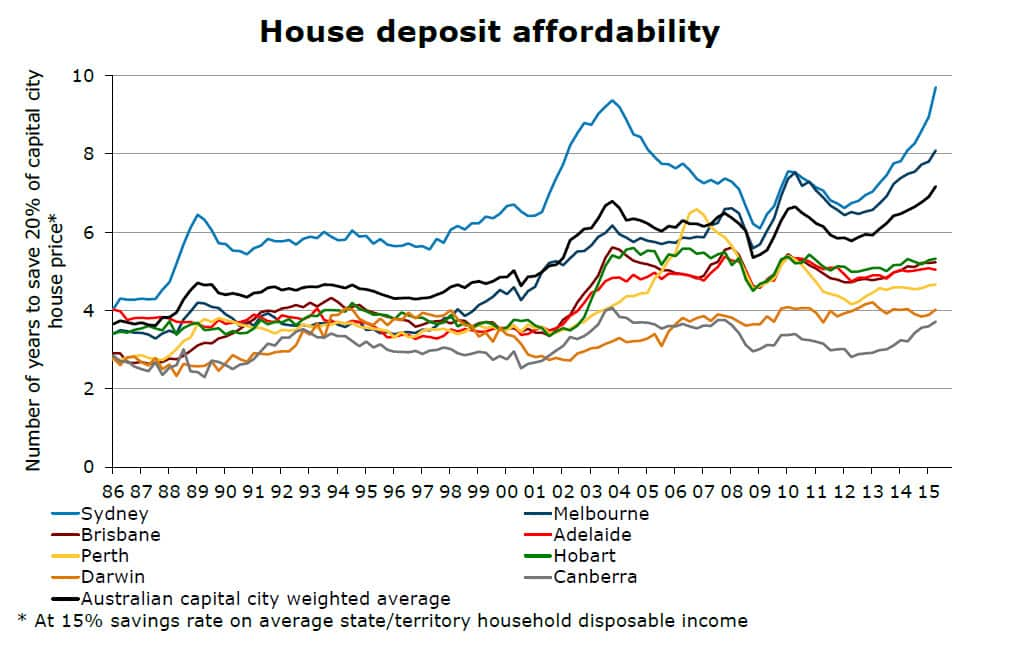

It takes more than 7 years to save a 20 per cent deposit for a capital city house.

Source: ANZ

Longer in Sydney.

Sydneysiders need to save for nearly 10 years just to be able to get a decent deposit for a house in the city.

Source: ANZ

Share