Managing your spending is getting easier with the growing number of free apps that are now available. The more difficult task is trying to figure out which of those apps best matches what you need.

Having just returned from an overseas trip with twice the amount of luggage and a slightly dented credit card, I decided that it was a good time to start tracking my spending and be more disciplined with my budget. After doing some investigation, I decided to road test some of the more highly-rated apps currently available and share my findings.

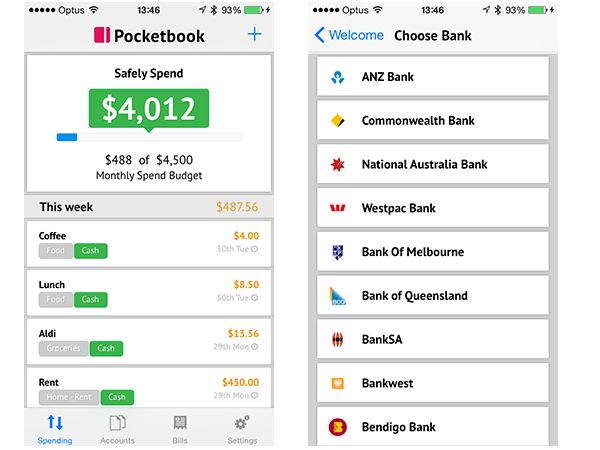

Pocketbook

Source: Supplied

You can also tag specific transactions in your bank account as regular income, periodic bills and payments, and the app will use the data to help work out your monthly spend. Other features include the ability to automatically categorise expenses based on keywords in your description, attach a photo of the receipt against an expense and mark an expense as ‘tax important’.

The limitation is that if your accounts are not with one of banks integrated with app, you won’t be able to benefit from its key advantage and will have to manually enter your income and expenses (like in other apps).

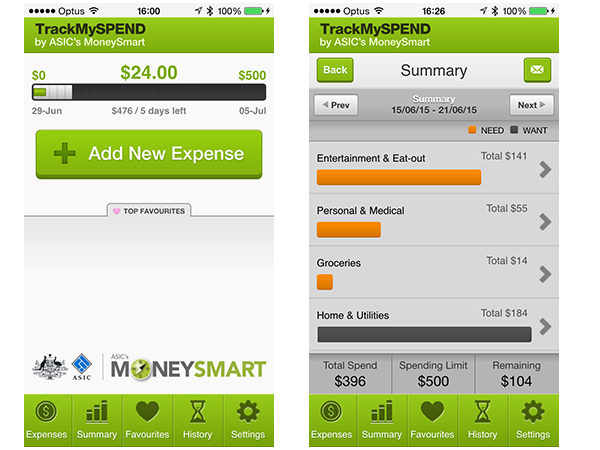

TrackMySPEND

Source: Supplied

The feature that I like the most is that you can flag an expense as a ‘need’ or ‘want’, which makes you ponder whether the spend is essential or an opportunity to save. You can also extract the data from the app into a spreadsheet which makes it handy to import into other systems like an accounting software.

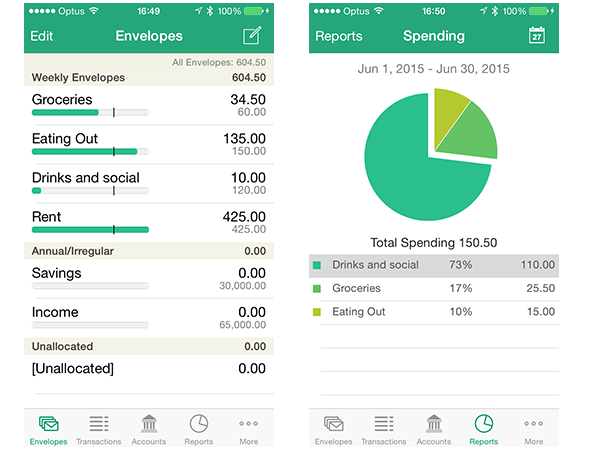

Goodbudget

Source: Supplied

This app is good for couples as you’re able to share a budget across multiple devices, so that you can set a combined household budget and know how you’re both tracking. The free version allows you to create 10 envelopes and share across 2 devices, but you’ll have to pay if you want more envelopes and share across additional devices.

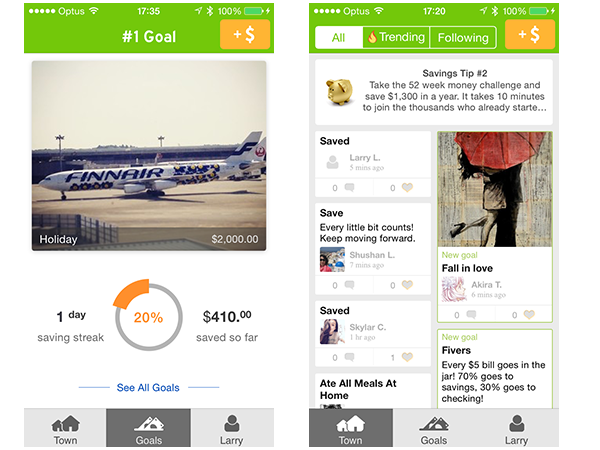

Unsplurge

Source: Supplied

The social aspect of the app gives you the option to share your goals with the Unsplurge app community as well as your Facebook friends. This means you’re able to share your achievements and compete with your friends on who can reach a goal first. You can also get ideas and inspiration for goals from the app community.

The app doesn’t really help you track your spending and expenses. But it does track your progress on how you’re going towards your goals in an enjoyable and motivating way.

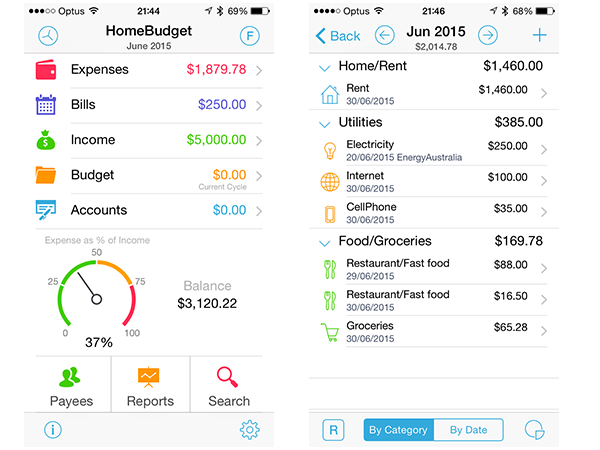

Homebudget Lite

Source: Supplied

This is the free version of ‘HomeBudget with Sync’ so you’re limited to only 20 expense and 10 income entries. Therefore it serves as a trial for their full version, which comes with the ability to sync your budget across multiple desktops and devices that can be useful for families. But for $6.49 on the App Store ($6.72 on Google Play), you do really need to be convinced about its features and benefits before investing in the full version.

Final thoughts …

Each app has different strengths which means there’s a solution to meet the varying needs and motivations that drive people to budget and save. If your goal is a few years away, it might be a good idea to think about whether it’s better to leave your money in the bank or consider other options like investing which can boost your savings even further.

Personally, I wasn’t able to take full advantage of Pocketbook’s useful integration feature as to minimise fees, my savings are with a credit union and I don’t have credit cards with the major banks. I ended up liking the simplicity of ASIC’s TrackMySPEND as it’s an effective tool to track the little spends (e.g. coffee, afternoon snack, beer) and I didn’t need extra features like recording receipts and organising my money into buckets. Using a budgeting app has been really useful as I’ve been more conscious of my spending and actually exceeded my savings target last month.

Share