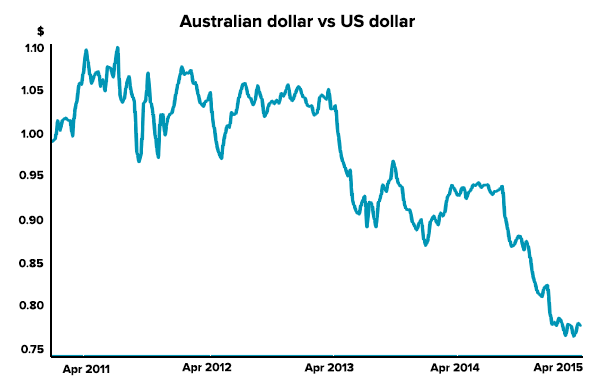

Anyone who has travelled overseas or shopped on an overseas website recently will have noticed that Australian dollars aren’t worth as much as they used to be. After reaching an all time high of $1.10 against the US dollar in May 2011, the Australian dollar has been on the slide and now languishes around $0.70. While this has been bad news for some holidaymakers, many investors in Australian and global shares, property and bonds have profited from the Australian dollar’s fall.

While this has been bad news for some holidaymakers, many investors in Australian and global shares, property and bonds have profited from the Australian dollar’s fall.

Source: Supplied

What’s caused the Australian dollar to fall?

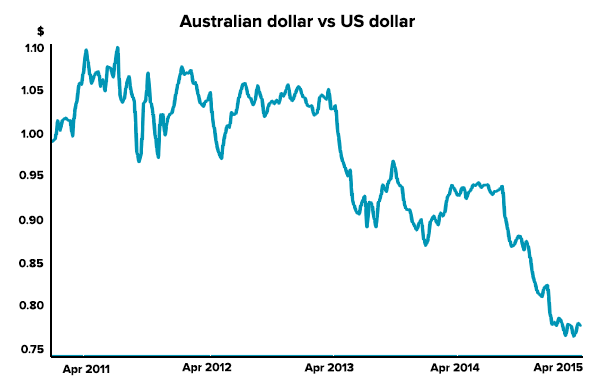

The weakness in the Australian currency has been caused by a combination of domestic and global factors. Locally these factors have included a slowing Australian economy due to weaker export prices and rising unemployment. Falling interest rates have also been a contributor. The fall in the Australian currency has been most noticeable against the US dollar since the American economy has been punching above its weight since the Global Financial Crisis. Sectors like technology where the US is a global leader have helped to drag the US out of recession and into a strong economic position. This has helped their dollar strengthen against most other global currencies including the AUD.

The fall in the Australian currency has been most noticeable against the US dollar since the American economy has been punching above its weight since the Global Financial Crisis. Sectors like technology where the US is a global leader have helped to drag the US out of recession and into a strong economic position. This has helped their dollar strengthen against most other global currencies including the AUD.

Source: Supplied

Impact on investments

Australian shares

The drop in the Australian dollar benefits Australian companies with operations overseas or exporting to overseas markets, particularly to the US. Lower interest rates are also positive for shares in companies paying dividends as their relative yield has become more attractive compared to money left in the bank. Property stocks have also benefited from this trend.

On the other hand, mining stocks have suffered due to low commodity prices and this has meant that overall, Australian shares have lagged other markets such as the US, Japan and Europe. This is likely to reverse if and when commodity prices turnaround, however there are mixed view about when this may happen.

Global shares

Investing in global shares means you can take advantage of economies and markets growing faster than Australia’s. The US (S&P 500), Japanese (Nikkei), Hong Kong (Hang Seng), German (DAX) markets have performed better than the Australian market (S&P/ASX 200) over the past year. Many of these countries have benefited from very low or zero interest rates which have pushed people into buying stocks and property rather than leaving cash in the bank. Recently this has also started to happen in Australia as the Reserve Bank has started cutting rate further to stimulate the economy.

Local investors who own unhedged global shares have enjoyed the double benefit of rising share prices and a falling Australian dollar. As we believe investors should aim to have diversification across different currencies as well as different sectors and shares, our Stockspot portfolios are invested in unhedged exchange traded funds (ETFs).

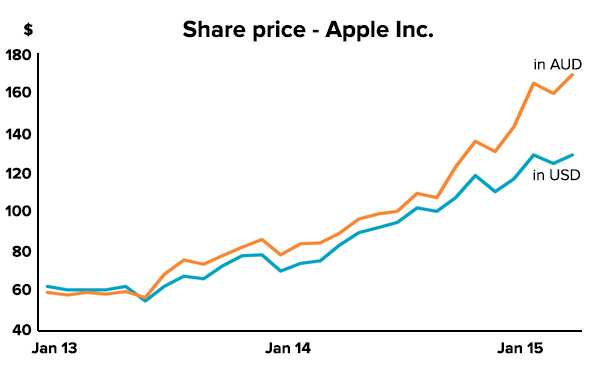

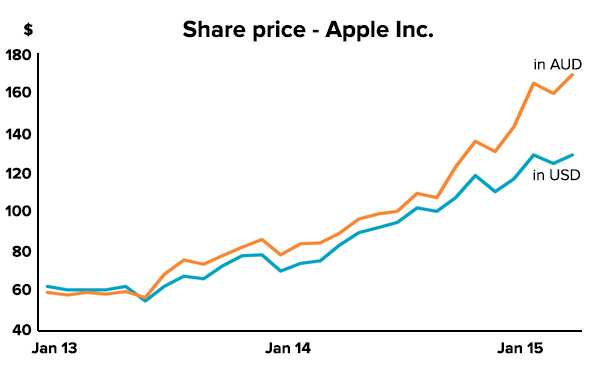

As an example, Apple shares (one of the companies in our portfolios) have risen 90% for an Australian investor compared to 55% for US dollar investors since April 2014.

Source: Supplied

Bonds

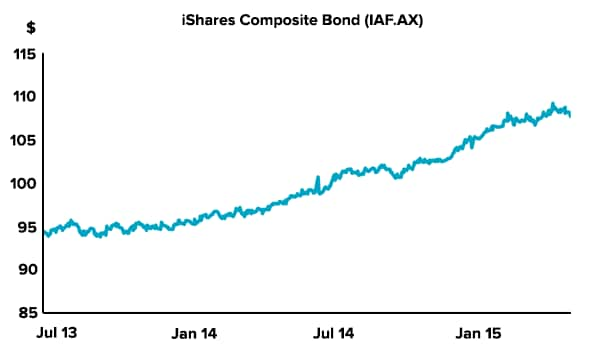

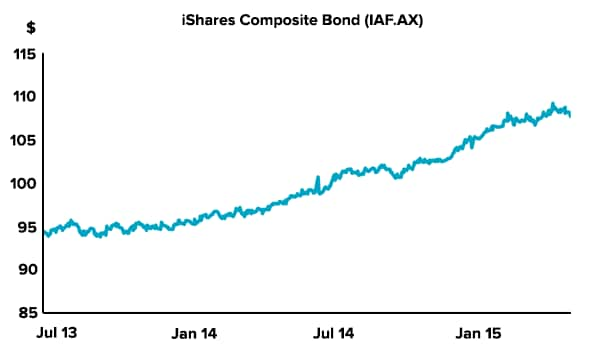

Bonds typically rise as interest rate expectations fall. Falling interest rate expectations have also sent the Australian dollar lower as global investors look to other countries for higher interest rates. The interest rate market is currently factoring in at least 2 more interest rate cuts in Australia (from 2.25% to 1.75%) with a 60% chance of a third to 1.50%. If the falling dollar starts leading to imported inflation (higher prices of imported goods), this might temper some of the recent strength in bonds and term deposits since it could indicate interest rates need to be raised sooner.

If the falling dollar starts leading to imported inflation (higher prices of imported goods), this might temper some of the recent strength in bonds and term deposits since it could indicate interest rates need to be raised sooner.

Source: Supplied

What it all means

Cash in the bank is the big loser as the Australian dollar falls with lower interest rates. Not only are you receiving less interest, but you also have lower purchasing power when buying things from overseas. That’s why many are looking for investment options with the ability to generate higher returns at the moment.

A weak Australian economy often translates into a weaker dollar, but investments can act more positively as their returns become increasingly attractive compared to bank deposits. This has been apparent over the last year.

The Australian dollar is notoriously difficult to predict so you shouldn’t need to place all of your bets one way or another. Investing across different countries, sectors and stocks helps to reduce the impact of big currency moves on your investments. This means you’re able to enjoy smoother returns over the long term compared to only buying shares in a few companies.

Share