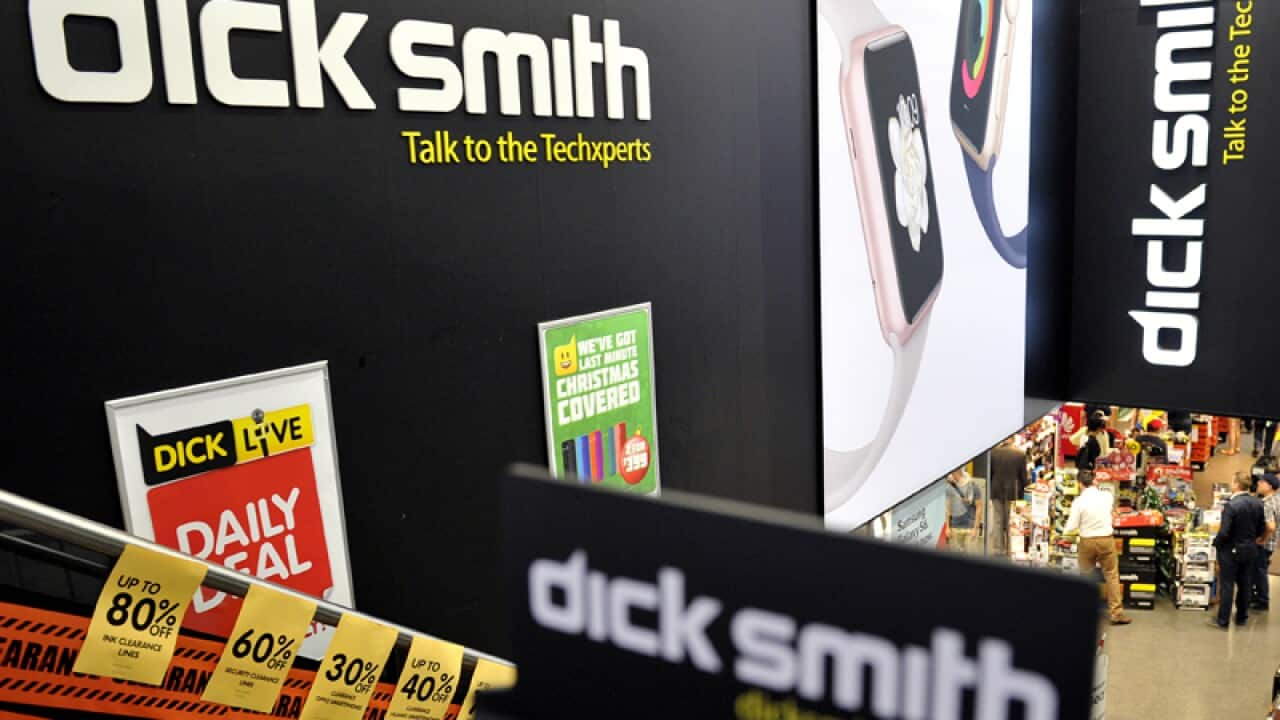

Dick Smith has been struck off the Australian share market's top 200 companies list just as its stores launch a mammoth clearance sale.

Shares in the electronics retailer have tanked more than 80 per cent, wiping millions of dollars from its market value after it issued two profit warnings following disappointing October and November sales.

The retailer will be one of five companies removed from the benchmark S&P/ASX200 index on December 18.

This comes as Dick Smith kicks off its mammoth clearance sale, including 80 per cent off big-ticket items on Friday to clear a backlog of unwanted stock that will cost it about $60 million in impairments.

The firesale is expected to flood the market with cheap stock and put pressure on rivals JB Hi-Fi and Harvey Norman to also lower prices.

Dick Smith's share price has tumbled 1.75 cents, 4.38 per cent, to 38.25 cents at 1241 AEDT, slightly up from its nadir of 28 cents a share.

The retailer listed on the share market for $2.20 a share two years ago, raising $345 million after private equity firm Anchorage bought it from Woolworths for $20 million in 2012.

Bell Direct equities analyst Julia Lee said Dick Smith shares would continue to slide in the short-term due to being cut from the S&P/ASX200 index.

"Some fund managers just track the index so they will be abandoning Dick Smith now," she said.

"This is significant because index fund managers are gaining popularity as a low cost option to diversify portfolios, so if stocks leave the index it is a short-term negative as those funds will be forced to drop them."

She said if Dick Smith manages to turn around its operations it won't take much for its shares to rally.

In October, Dick Smith slashed up to $8 million off its full year net profit guidance when it said earnings would fall between $45 million and $48 million.

On Monday chief executive Nick Abboud disappointed the market when he said the company could not stand by its previous profit forecast after revealing the inventory writedown.

Along with Dick Smith, energy firms Paladin and Drillsearch, mining and materials group Arrium and environmental consultant Cardno have also been cut from the ASX200.

The latest quarterly review of the S&P/ASX indices also replaces law firm Slater and Gordon with Sirtex Medical in its list of 100 top companies.

Slater and Gordon remains on the ASX200 list despite its value plummeting following revisions to its reported results and investor concerns over UK compensation law changes.

Share