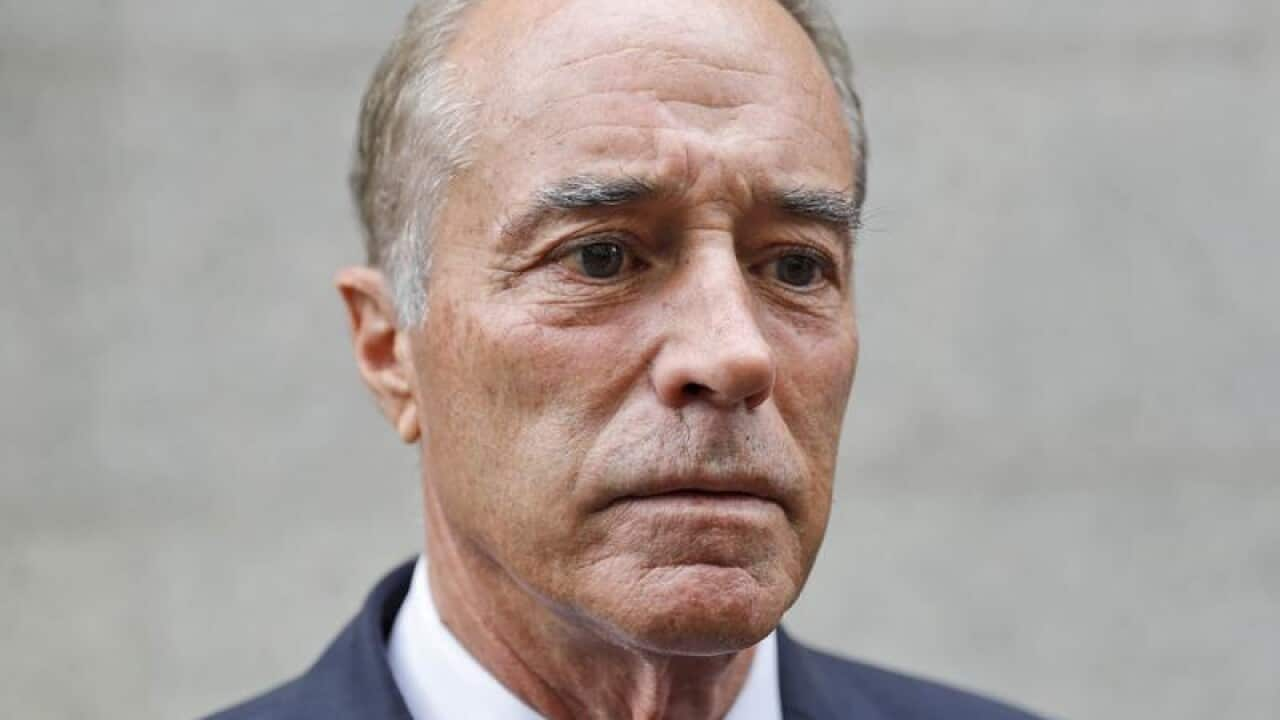

Former New York Republican congressman Chris Collins has pleaded guilty to taking part in an insider trading scheme involving an Australian biotech company.

Collins, 69, entered his plea before US District Judge Vernon Broderick in Manhattan on Tuesday, the day after he resigned from his seat in the US House of Representatives.

He faces a maximum of five years in prison for each of the two charges when he is sentenced on January 17, though prosecutors have agreed as part of a plea deal that a reasonable sentence would be a total of less than five years.

The criminal case arises from Collins' role as a board member and 16.8 per cent stakeholder of Australian biotechnology company Innate Immunotherapeutics.

Collins said in court on Tuesday that in June 2017, during a congressional picnic on the White House lawn, he learned in an email from Innate's chief executive that the company's experimental multiple sclerosis drug MIS416 had failed in a clinical trial.

Collins admitted that he immediately called his son Cameron Collins to tell him the news, allowing him to sell his Innate shares and avoid losses when it became public.

Chris Collins said he was in "a very emotional state" when he made the call because he was upset the drug had failed.

"When I did these things, I knew they were illegal and improper," he said.

"The actions I took are anything but those a model citizen would take."

The congressman did not trade his own Innate stock, which lost millions of dollars in value.

Prosecutors have said he was "virtually precluded" from trading in part because he already faced a congressional ethics probe over Innate.

However, they said, Cameron Collins went on to tip off his fiancee, Lauren Zarsky; her parents, Dorothy and Stephen Zarsky; and a friend. Stephen Zarsky went on to tip off additional unnamed people, the prosecutors said.

Prosecutors said the people who received the tips were able to avoid a total of more than $US768,000 ($A1.1 million) in losses when Innate's share price plunged 92 per cent after news of the drug's failure became public.

Cameron Collins, 26, and Stephen Zarsky, 67, have been charged in the case and are scheduled to plead guilty on Thursday, court records show.

Lauren and Dorothy Zarsky were not criminally charged, but agreed to surrender the money they made selling Innate stock to the Securities and Exchange Commission under a civil settlement without admitting wrongdoing.

Share