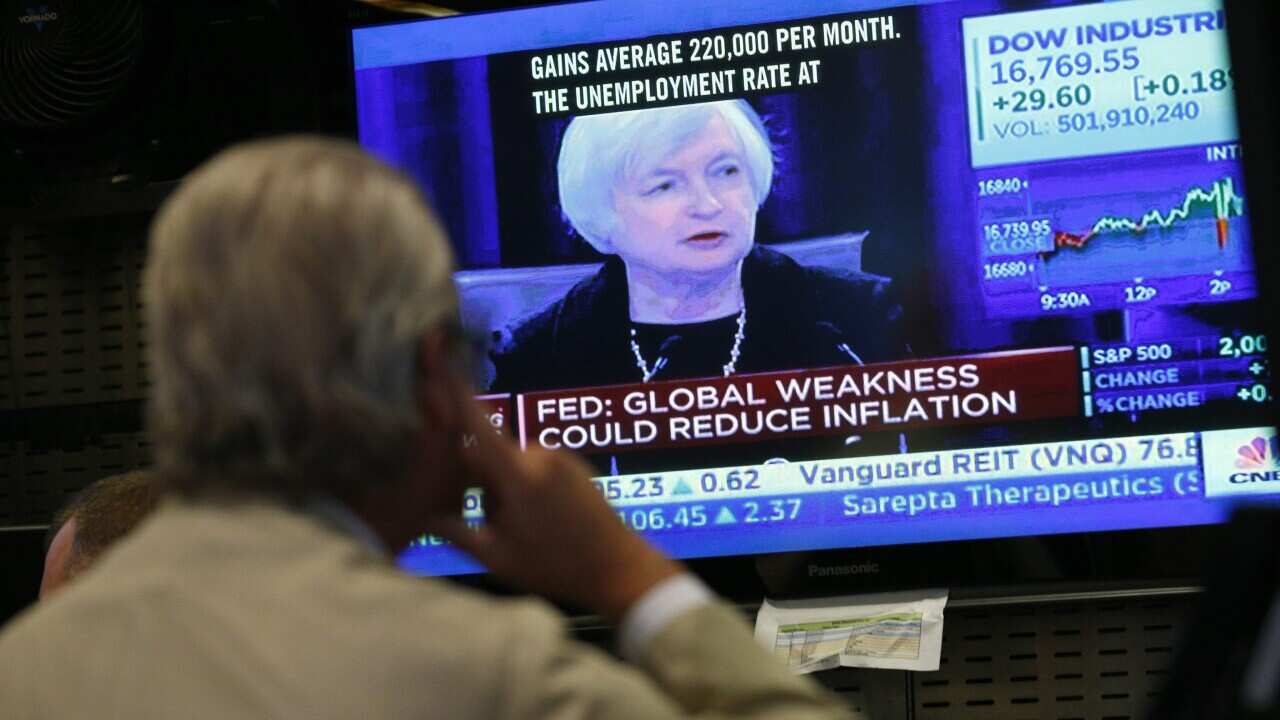

The Federal Reserve has held its key interest rate at zero, citing worries about how the slowdown in China will hit the US economy.

Fed Chair Janet Yellen said the economy continues to grow moderately and that a rate increase could still take place before the end of the year.

However, policy makers were still focused on the spillover from China's troubles and those in other major emerging market economies.

"A lot of our focus has been on risks around China, but not just China, emerging markets more generally and how they may spill over to the United States," she said at a news conference following the rate announcement on Thursday.

"We've seen significant outflows of capital from those countries, pressures on their exchange rates and concerns about their performance going forward.

"The question is whether or not there might be a risk of a more abrupt slowdown than most analysts expect."

At the end of a two-day meeting, such concerns prevented the policy-setting Federal Open Market Committee (FOMC) from making the long-expected decision to begin raising the benchmark federal funds rate from the zero level, where it has sat since the financial crisis in 2008.

After years on an easy-money stance, the prospect of a Fed rate hike has added to turmoil in global markets.

Both the World Bank and the International Monetary Fund have urged the Fed to be cautious as it begins tightening the reins on credit.

The decision came even as the FOMC stressed the US economy is on course and it increased its forecast for growth this year to 2.1 per cent.

The FOMC statement said household spending and business investment were increasing at a moderate pace, and that home construction was picking up, but exports were "soft".

It also said the labour market had strengthened since the July FOMC meeting, with slack diminishing since earlier this year

"We are looking at, as I emphasised, a US economy that has been performing well and impressing us by the pace at which it is creating jobs, and the strength of domestic demand," Yellen said.

But, she said, "we have some concerns about negative impacts from global developments and some tightening of financial conditions".

Nevertheless, members of the FOMC made clear, in projections accompanying their announcement, that they still expect rates to rise by the end of the year.

Of the 17 Fed officials at the meeting, 13 indicated they expect a rate hike by the end of this year, most of them pointing to a 0.25-0.50 per cent range.

Share