Scrapping the tax on tampons and sanitary pads is in the coalition's sights after Treasurer Scott Morrison pledged to exempt the items from the GST.

Mr Morrison will seek to move female sanitary items to the essential health category exempted from the GST at his next meeting with state treasurers.

"There's no great gender conspiracy here or any of that nonsense," Mr Morrison said in a Facebook post on Saturday.

"It's just a tax anomaly that we have already tried to fix once, and will now give it another try."

The move comes after years of lobbying for change from advocates who point to the unfairness in items like condoms and lubricants already being exempt.

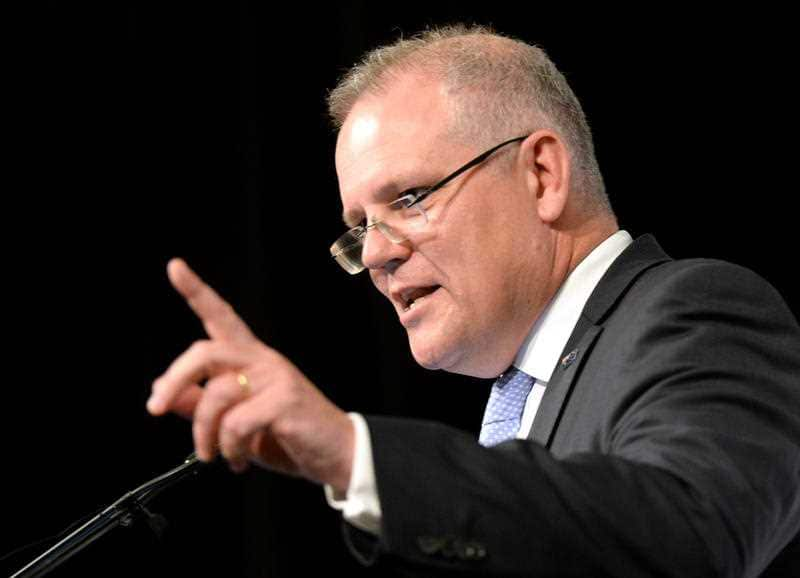

Treasurer Scott Morrison said the tampon tax is a source of frustration for Australian women and should be dumped. Source: AAP

"Huge community pressure has tipped the scales in our favour," Greens senator Janet Rice tweeted.

But the exemption requires the sign-off of states and territories to come into effect.

A 2015 push to axe the tax by then-treasurer Joe Hockey was knocked back by state treasurers reluctant to sacrifice the $30 million in revenue it produced.

Mr Morrison said the 10 per cent tax should never have been levied at tampons and sanitary pads in the first place.

"Slogans and manifestos should be left at the door as we get together, and we seek to agree on this," he said.

Minister for Women Kelly O'Dwyer called for the states and territories to get onboard.

"Millions of Australian women will benefit," Ms O'Dwyer told reporters in Sydney.

Kelly O'Dwyer has called on Labor to back the tax cut. Source: AAP

"It will mean a little bit of extra money in their pocket but ultimately it's the right and fair thing to do."

The government's decision comes three months after the opposition made a similar pledge.

"This is effectively a tax on women," Deputy Leader of the Opposition Tanya Plibersek said in April.

"Taxing periods is taxing women in a way that men never experience."

At the time, Mr Morrison described Labor's announcement as "cynical exercises."

While welcoming the government's move, Labor warned it risked failure if there was no plan to replace the lost revenue in order to win over the states.

State and territory Labor leaders have signed up to the opposition's plan, seeking to offset lost revenue by applying the GST to 12 natural therapies.

But the government claims the states will receive an extra $6.5 billion in revenue as a result of changes already made to the GST.

"So agreeing to this modest change is achievable from a financial point of view," Mr Morrison said.

Share