The Reserve Bank of Australia (RBA) is widely expected to cut the cash rate when it meets on 12 August.

Economists are predicting a drop of 0.25 percentage points from 3.85 to 3.6 per cent., following the RBA’s surprise decision in July to hold rates steady despite easing inflation.

If announced, a cut could help lift consumer sentiment amid global uncertainty, but some experts are warning that the benefits are a 'double-edged sword'.

How likely is a rate cut?

Economists say two factors are likely to influence the RBA's decision: easing inflation and growing unemployment.

The Australian Bureau of Statistic's (ABS) June quarter Consumer Price Index figures showed annual inflation easing from 2.4 to 2.1 per cent.

June labour figures from the ABS also show unemployment has risen to its highest level since November 2021 at 4.2 per cent.

"When you put rising unemployment, overlay that with disinflationary trends, and then you look at the GDP report which painted a really tepid picture of growth for the Australian economy, it really does warrant further interest rate cuts," IG market analyst Tony Sycamore said.

However, Sally Tindall from financial comparison site Canstar says that while a cut is "highly likely", it’s important to remember that "nothing is guaranteed until the RBA actually does make that decision at 2.30pm on Tuesday".

Who benefits from an interest rate cut?

Tindall said mortgage holders can expect to see the biggest benefits.

"The winners are mortgage customers, particularly those who use the market to their advantage by going and haggling with their bank or refinancing," she said.

People thinking of buying a home may also have more borrowing power. Households that earn $150,000 before tax may be able to access more than $17,000 extra.

Tindall urged caution because rate cuts can sometimes be a "double-edged sword" as it can lead to an increase in house prices.

Why could an interest rate cut mean higher house prices?

More buyers on the market squeezes an already short supply of houses.

"It brings buyers to the market, buyers have deeper pockets and they can spend more on a home," Domain’s Nicola Powell says.

A report from the Commonwealth Bank of Australia (CBA) found the RBA’s February reduction in the cash rate saw housing prices increase by 3.1 per cent.

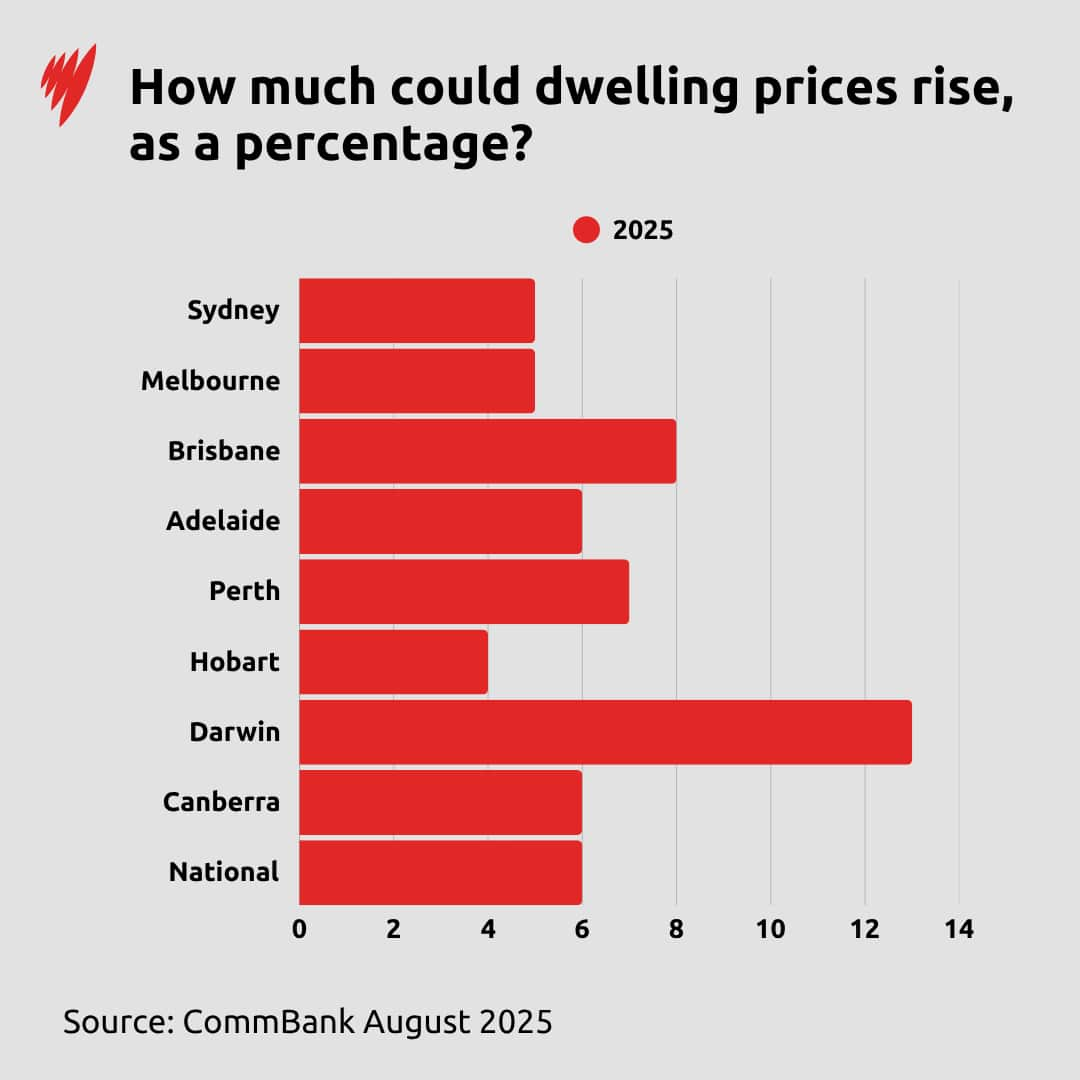

It forecasts that RBA rate cuts in August and November would lead to house prices rising by 6 per cent in 2025 and 4 per cent in 2026.

Where will housing prices be affected?

Capital cities tend to see bigger shifts, with Sydney and Melbourne more sensitive to interest rates changes.

The CBA also forecasts that an interest rate cut could lead to house price increases of 8 per cent in Brisbane, 7 per cent in Perth and 6 per cent in Adelaide.

But Canstar’s Tindall says this is not a reason why the RBA shouldn’t reduce the cash rate.

"What will help cool the situation is increased stock, and I think that still needs further intervention from the government," she said.

What about people who don't own a home?

Tindall says renters may also be hit with higher costs.

"Rents are rising at four-and-a-half per cent every year, which is a difficult hurdle for many households to clear, and unfortunately it's still going to be tough times ahead for renters."

Sycamore from IG Markets says a common knock-on effect of higher house prices is that landlords may be encouraged to put up rent.

"And that’s not really something we need at this point in time."

So is an interest rate cut a good or a bad thing?

Sycamore says an interest rate cut would be a symbol of growing optimism in the Australian market.

"There is real benefit in terms of just lifting the gloom which has really been lingering over the Australian economy since COVID, because that's when the cost of living crisis really came to the forefront," he said.

Tindall says it is a good time to re-examine your finances to make sure you’re getting the best deal for your circumstances, especially since interest rate cuts are not always passed on by banks.

“What ultimately matters is the rate you’re currently on."

For the latest from SBS News, download our app and subscribe to our newsletter.