There has been a pause in the cost of living for retirees in the March quarter.

Lower petrol prices more than offset an increase in the cost of pharmaceuticals and health and medical services.

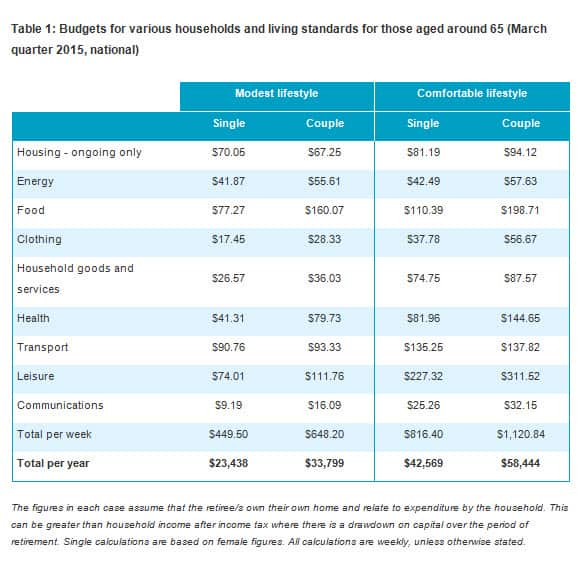

The Association of Superannuation Funds of Australia said couples aged about 65 will need to spend a little more than $58,444 per year for a comfortable retirement, up just 0.1 per cent.

For singles, they'll need $42,569, which is $35 less than the previous three months.

Here is a breakdown of the costs involved for singles and couples aged 65, wanting to lead either a modest or a comfortable lifestyle.

ASFA chief Pauline Vamos said changes to the Age Pension announced today would have an impact on the savings we all need for a comfortable retirement.

"We know that there has been a substantial drop in the number of people who need to rely on the full age pension," she said. "There has not been a such a significant drop in people who need to rely on the part age pension. This is part of bringing that reliance down, and that means for a lot of people they need to look at what they're putting away and really look at how much debt they are retiring on to ensure that they've got enough to last them all the way through their non working years."

Under the current Age Pension assets-test framework, ASFA estimated that a couple would need a joint superannuation balance of around $510,000 to meet the minimum amount required for a comfortable retirement.

That assumes however that as a retirees drawdown on their capital and their income decreases, a part Age Pension will cover some of that shortfall.

"The most important thing people can do today, is ensure that they found any lost money they have in super, put it in an active account, consolidate accounts, check their insurance benefits and check and check that they're in the right fund for them," Ms Vamos said.