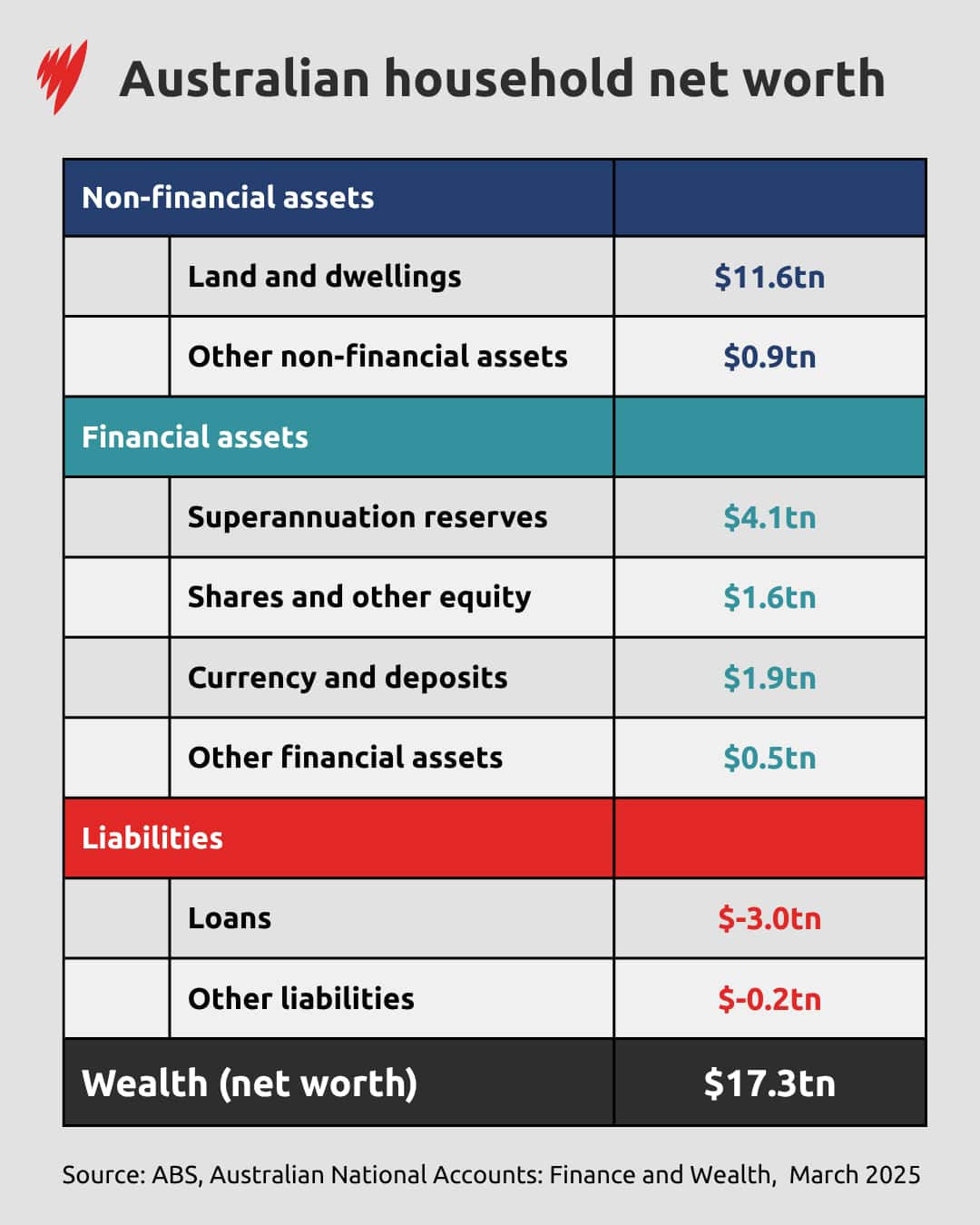

Household wealth grew 0.8 per cent in the March quarter, new data by the Australian Bureau of Statistics (ABS) has found, meaning Australians now own a total of $17.3 trillion in assets.

That increase was largely driven by the value of residential land and dwellings — up 1.2 per cent, or $125.3 billion.

February's interest rate cut — the first since November 2020 — wasn't just a win for those paying off mortgages; property owners in general have seen their value of their assets increase.

"We've seen that rate cut in Australia start in February, and the housing market has started to anticipate that. Even though the month of January was a bit soft, house prices are ticking up again," AMP chief economist Shane Oliver said.

"That, of course, is benefiting those Australians who have house and land. It's not so good for those Australians trying to get into it."

Where did wealth fall?

The ABS data showed superannuation assets fell 0.4 per cent, or $16.4 billion, in the March quarter, something experts attributed to market uncertainty.

"Household superannuation balances fell for the first time since the September quarter 2022 as global uncertainty weighed on share prices," ABS head of finance statistics Mish Tan said.

That fall continued into the early part of April with United States President Donald Trump's Liberation Day tariff announcements.

"April turned out okay for the share market and then saw a rebound as Trump backed away and went onto a pause for the tariffs. But the damage was done through the March quarter as share markets fell in response to the tariffs," Oliver said.

"A typical super fund would see about 60 or 70 per cent of its assets invested in shares. When shares take a tumble, that of course affects super fund returns."

Wealth among the wealthiest growing 'much faster'

While Australia might be getting richer, that wealth isn't distributed equally.

According to 2024 statistics from the Australian Council of Social Service (ACOSS) and UNSW, the wealthiest 10 per cent of households in Australia own 44 per cent of all wealth, with an average of $5.2 million per household.

The average wealth of the richest 10 per cent of households was also growing "much faster" than the wealth of the lowest 60 per cent, ACOSS and UNSW found.

With the majority of Australia's wealth in land and dwellings, it's not surprising that wealth inequality manifests itself in housing — where a generational wealth divide has become more pronounced in recent decades.

The most recent ABS Census found 66 per cent of Australian households owned their own home — a figure that has remained roughly the same since the 1970s.

However, home-ownership rates among younger Australians have declined dramatically in that period.

According to the Australian Institute of Health and Welfare, the home ownership rate of 30–to-34-year-olds decreased from 64 per cent in 1971 to 50 per cent in 2021.

In that same span of time, the rates of home ownership among Australians aged 25–29 declined from 50 per cent to 36 per cent.

Housing prices set to continue rising

Oliver said he suspects wealth increases will continue.

"Right now, it looks like interest rates are heading lower, which will probably push up house prices and land prices further. So, I suspect that the housing component of residential wealth will see further gains through the remainder of the year," he said.

"For the share market, it's probably going to be a bit of a volatile ride ... The noise around tariffs and the Middle East has led to a bit of roughness, but overall the trend has been up."

"Interest rates coming down will probably also support shares and therefore support superannuation returns."

For the latest from SBS News, download our app and subscribe to our newsletter.