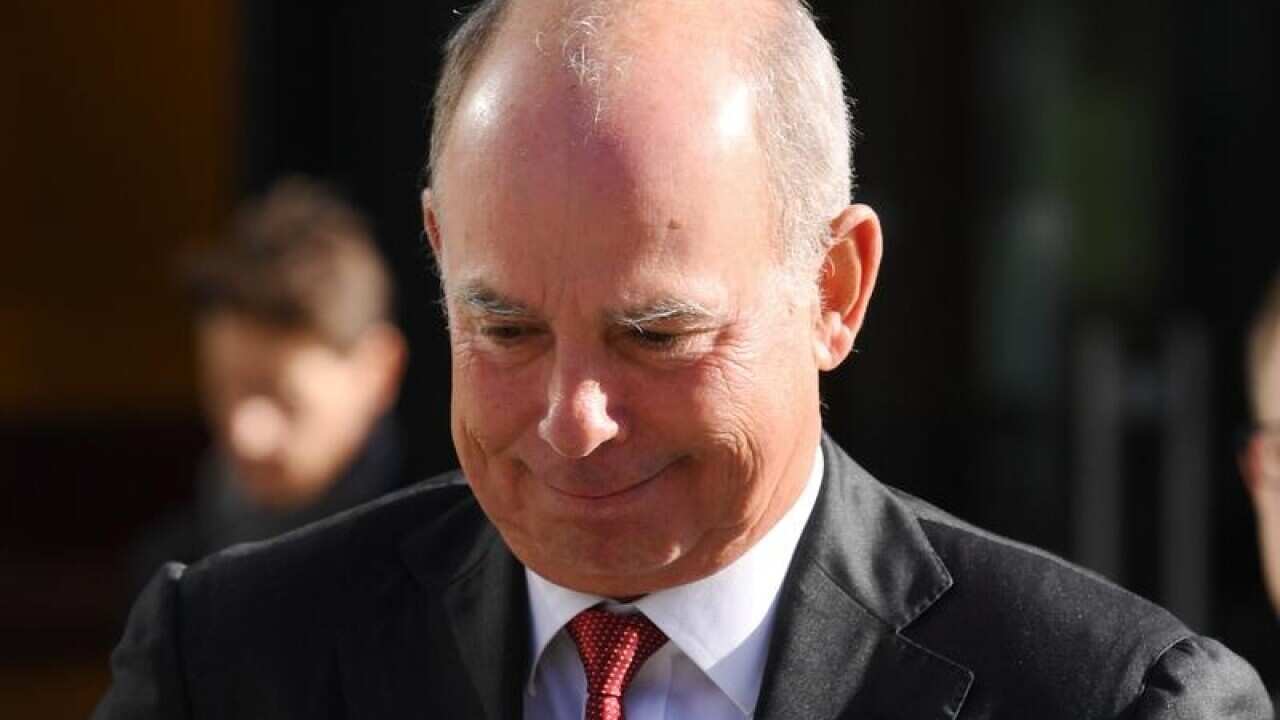

IOOF managing director Christopher Kelaher has left as the beleaguered wealth manager focuses on "restoring trust" amid a shareholder class action and court action by the prudential regulator.

Mr Kelaher has been on leave since December, when the Australian Prudential Regulation Authority moved to disqualify him and other top brass over accusations they had failed to act in members' interests.

IOOF said on Thursday that Renato Mota will continue as acting chief executive following the departure by mutual consent of Mr Kelaher, who will be paid $1.27 million in lieu of his notice period.

"In the interests of the company, it is time for IOOF to move forward under new leadership," said Mr Kelaher, who had led the funds manager for a decade.

George Venardos has been replaced as chairman by Alan Griffiths, who has been in the role on an interim basis since Mr Venardos went on leave at the same time as Mr Kelaher.

"I am entirely committed to restoring trust with all our stakeholders and accelerating the pace of change in respect of governance, culture and the resetting of relationships with stakeholders," Mr Griffiths said.

"The company has experienced difficult circumstances and disruption during the last six months."

APRA in December moved to disqualify a total five senior IOOF employees and impose new licence conditions, saying it had concerns dating back to 2015 and that IOOF had consistently failed to address them.

Shares in IOOF, which had already been mauled at the financial services royal commission, lost more than a third of their value on the day the action was made public.

Sydney law firm Quinn Emanuel then last month launched a shareholder class action, citing royal commission evidence that IOOF subsidiaries allegedly breached their trustee duties, and that directors and officers knew about it.

Mr Griffiths has said IOOF will vigorously defend "misconceived" accusations.

IOOF shares fell 9.5 cents, or 1.5 per cent, by 1211 AEDT on Thursday and are down more than 45 per cent over the past 18 months.