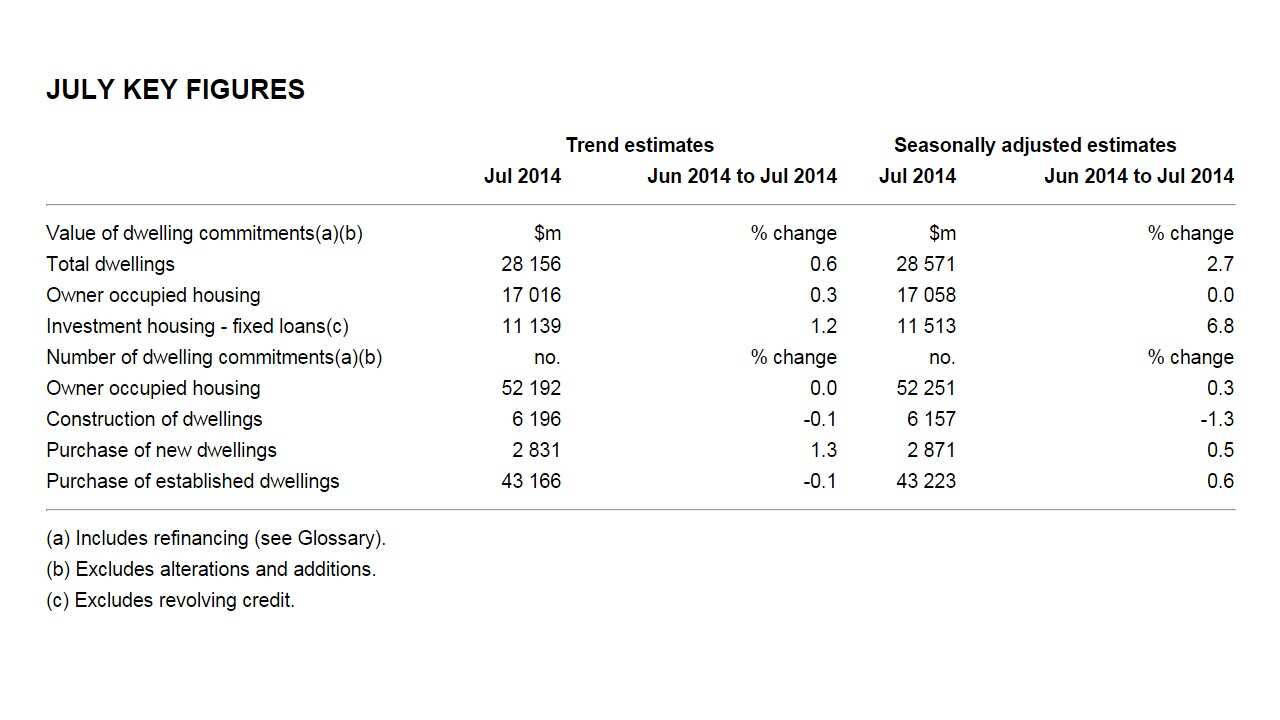

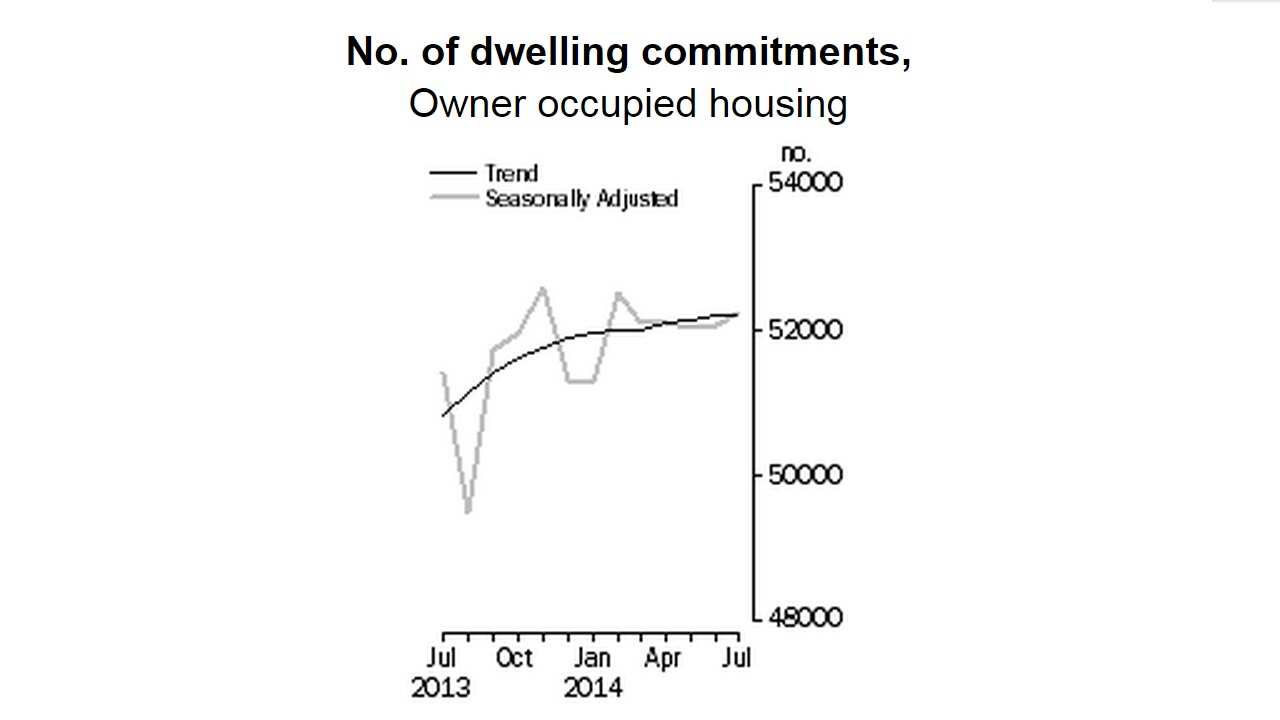

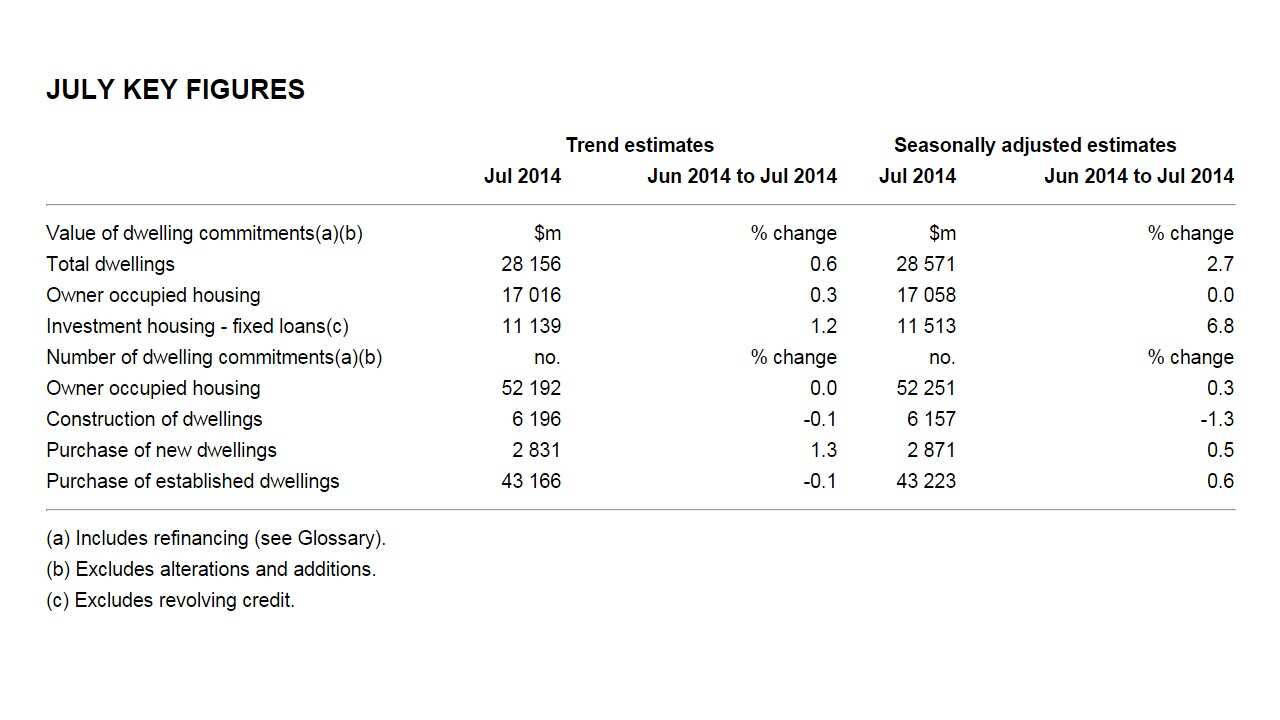

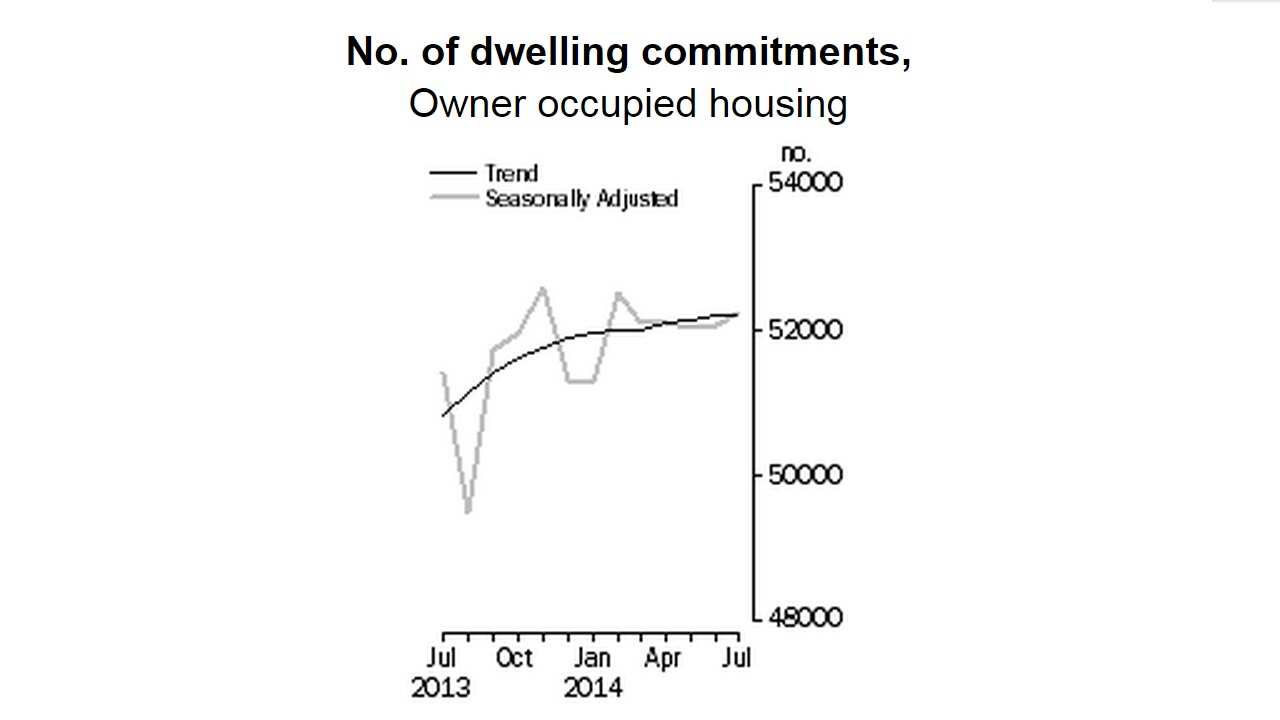

Record low interest rates are continuing to encourage property buyers to apply for more loans, with housing finance rising 2.7 per cent in July to $28.6 billion, according to the Australian Bureau of Statistics. But the number of dwelling commitments from owner occupied housing has stalled.

But the number of dwelling commitments from owner occupied housing has stalled.

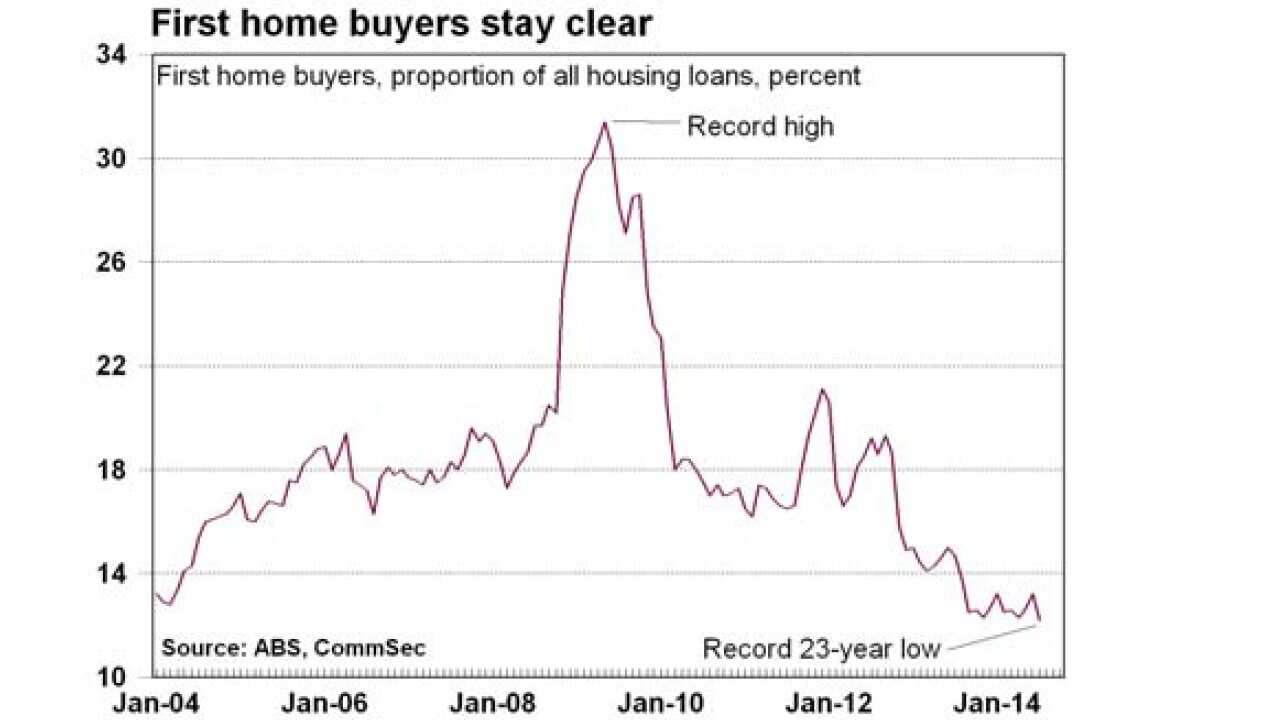

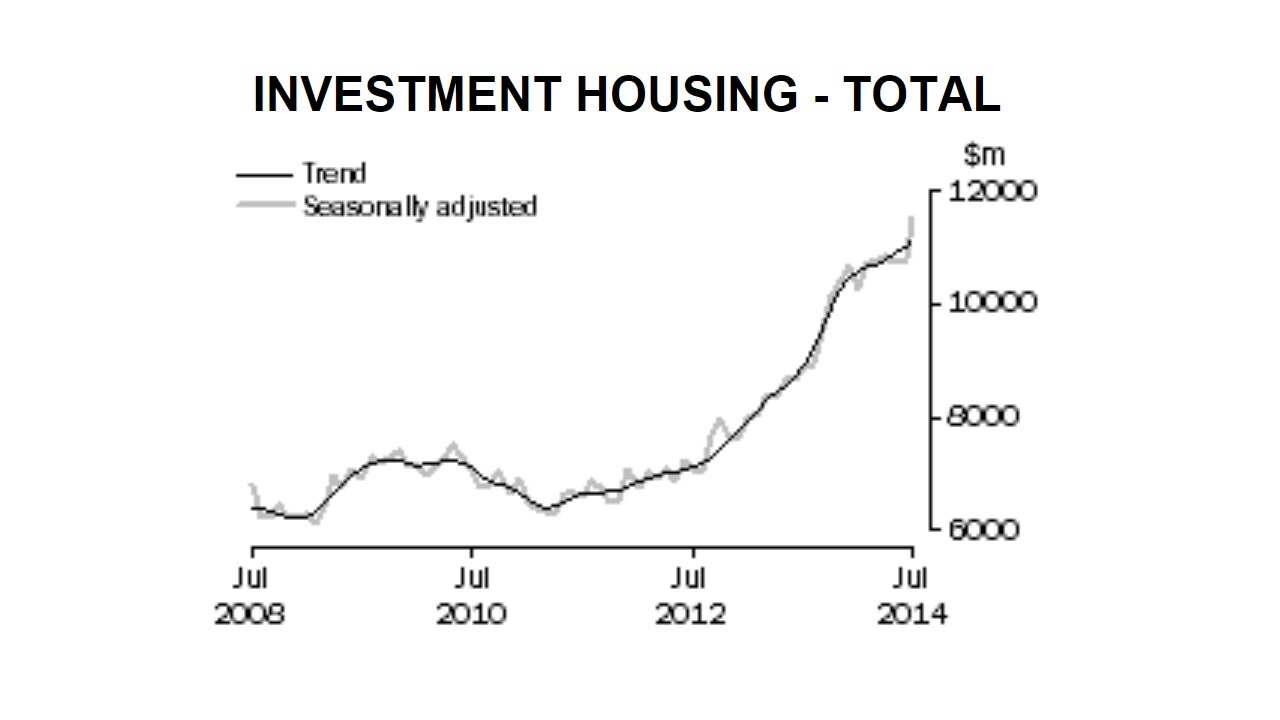

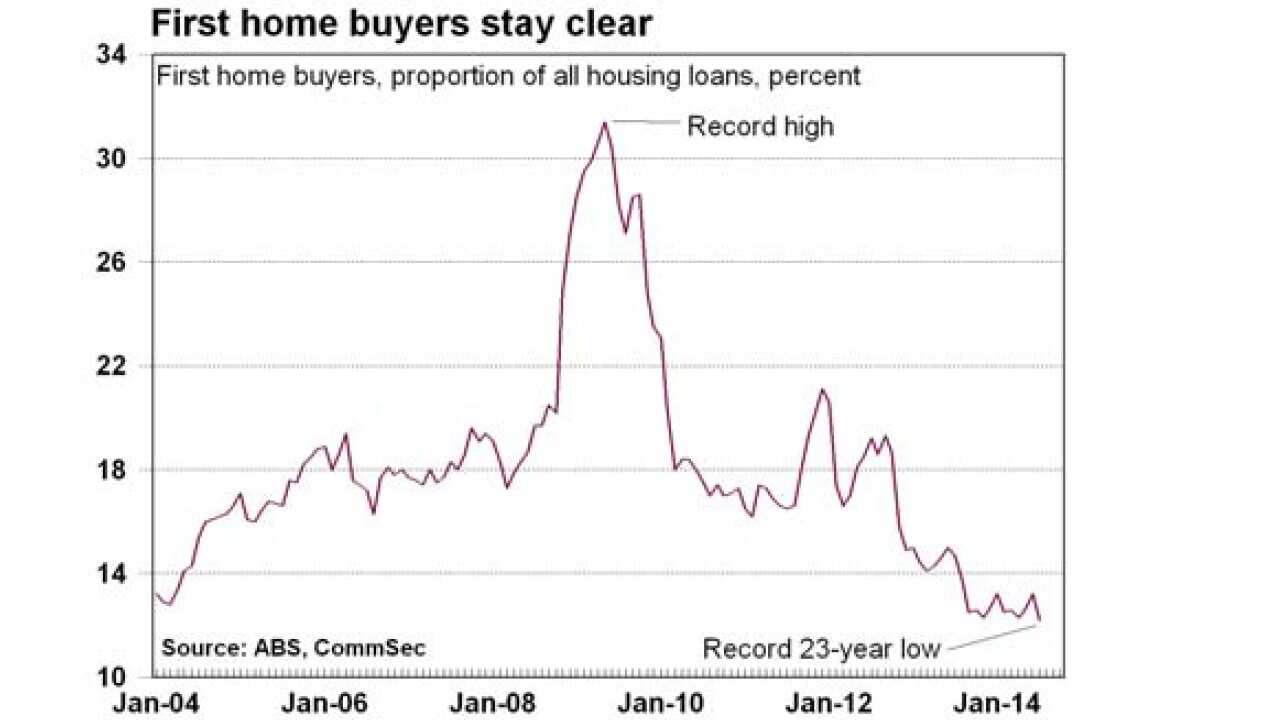

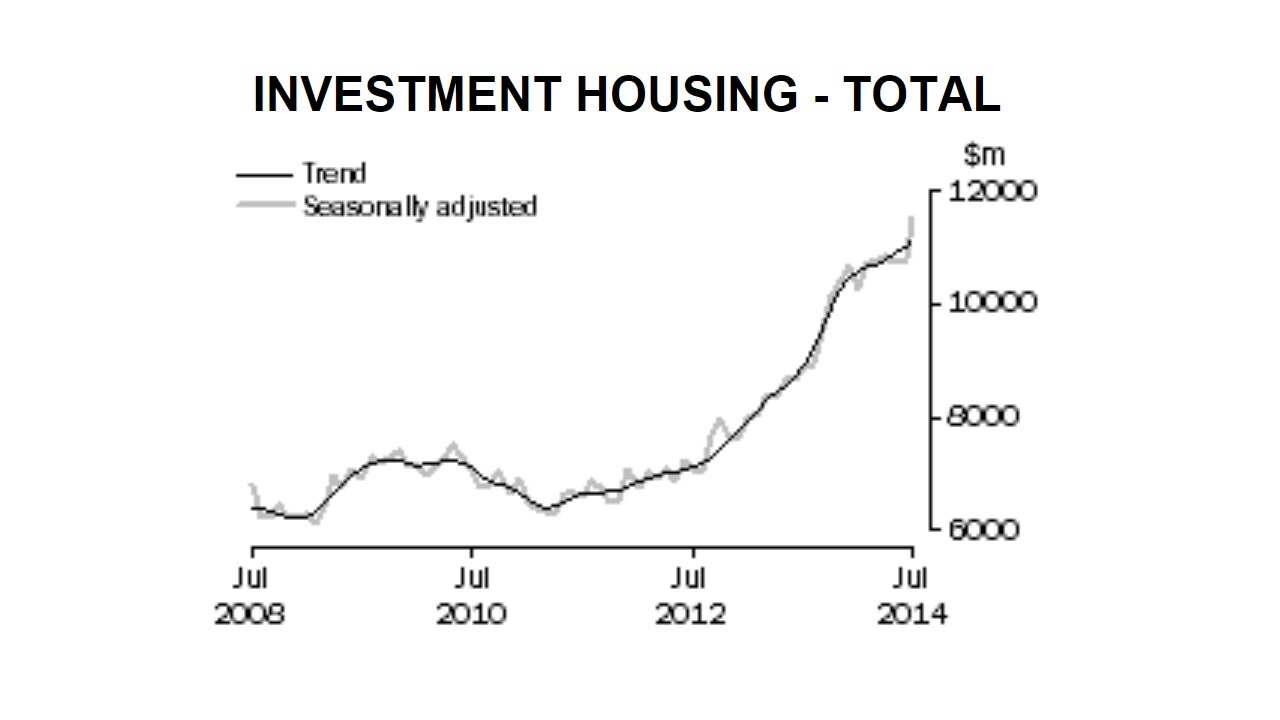

First home buyer activity has also declined to a record low. What is rising though is the value of lending for investment as interest rates remain at record lows and investors look for capital growth.

What is rising though is the value of lending for investment as interest rates remain at record lows and investors look for capital growth. It comes as interest from overseas investors picks up, but Shane Oliver from AMP Capital says while purchases from foreign buyers contribute, they're not the only reason why Australian house prices have risen.

It comes as interest from overseas investors picks up, but Shane Oliver from AMP Capital says while purchases from foreign buyers contribute, they're not the only reason why Australian house prices have risen.

On average, Australia builds around 150,000 homes a year which isn't enough to match supply.

RP Data expects 180,000 homes will be constructed by June next year with the Residential Development Council predicting around 8 per cent of that to be funded or purchased by foreign buyers.

Share