Nathan Birch grew up in Sydney's western suburbs and from a young age, worked two jobs to fund his desire to enter the property market.

He arrived at an interview with SBS World News at his latest investment project in north-west Sydney in a blue ute.

"As you can see by my car, my family are blue collar workers from western Sydney."

He bought his first property in Mt Druitt when he was 18 in 2003 for $248,000.

He says he did it on his own.

"There were no handouts from parents."

His strategy is to buy and hold, with property managers helping him to keep on top of his portfolio now worth $37million.

"The bulk of my property investing has been on interest only loans, so for example I've bought property that was below market value with a lot of equity from day one built into them, and then they revert to principle and interest. All of my investing has been in positive cash flow, I don't like negative gearing because it is a loss-making vehicle."

He earns $2million in rent which fall to $500,000 after expenses.

He says he's not worried about his debt which stands at $13million.

RELATED STORY:

Be wary of housing oversupply: HSBC

"From my perspective I treat my debt like a business and I look at debt as part of the game that I'm playing. As far as loan-to-value ratio, I've got a lot of equity in my properties. God forbid...Touch wood, if something goes wrong I've got a lot of equity there."

Nathan Birch certainly isn't the only person borrowing more money to invest in property.

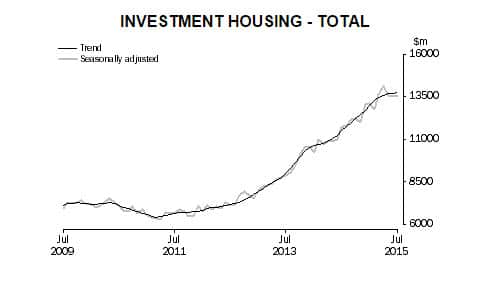

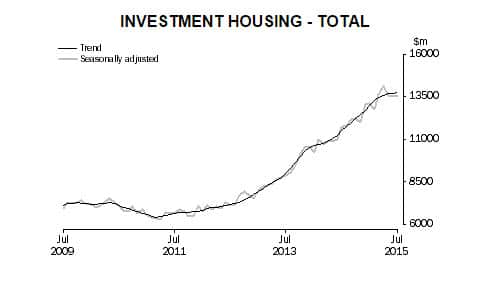

The Bureau of Statistics said today the value of loan approvals to owner-occupiers rose by 2.2 per cent in July to more than $19billion. It said investors borrowed 0.5 per cent more, at $13.6billion. Robert Mellor, Managing Director at property analysis company BIS Shrapnel says that's expected to cool as the bank's recent tougher stance on investor lending takes effect.

Robert Mellor, Managing Director at property analysis company BIS Shrapnel says that's expected to cool as the bank's recent tougher stance on investor lending takes effect.

Source: ABS

"That would flow through over the next three or four months."

But Robert Mellor does have some concerns about certain aspects of the market.

"It's time to be cautious, I mean particularly if you're buying off the plan you're paying fairly top value for property. You're paying a significant premium for new property over established property in many areas."

He adds, some areas are too hot.

"While we think apartment markets are heading into oversupply, particularly in Brisbane and Melbourne, certainly your owner-occupied detached housing market still probably remains undersupplied, certainly significantly in Sydney and Brisbane, and to a lesser degree in Melbourne."

Nathan Birch, who now runs a property investment group, is also cautious.

"The Sydney market is quite hot, there is still opportunity out there but it is minimal. You have to be very creative to create profit in the current market, however there are lots of opportunities outside of Sydney."

Nathan is also using Instagram as a selling tool, and that's also where he revealed why he is driving his blue ute at the moment... His Bentley is up for repair.

Share