Australia badly needs to reform its tax system and labour laws and cut red tape if it wants to maintain current living standards, the head of one of the country's largest banks has warned.

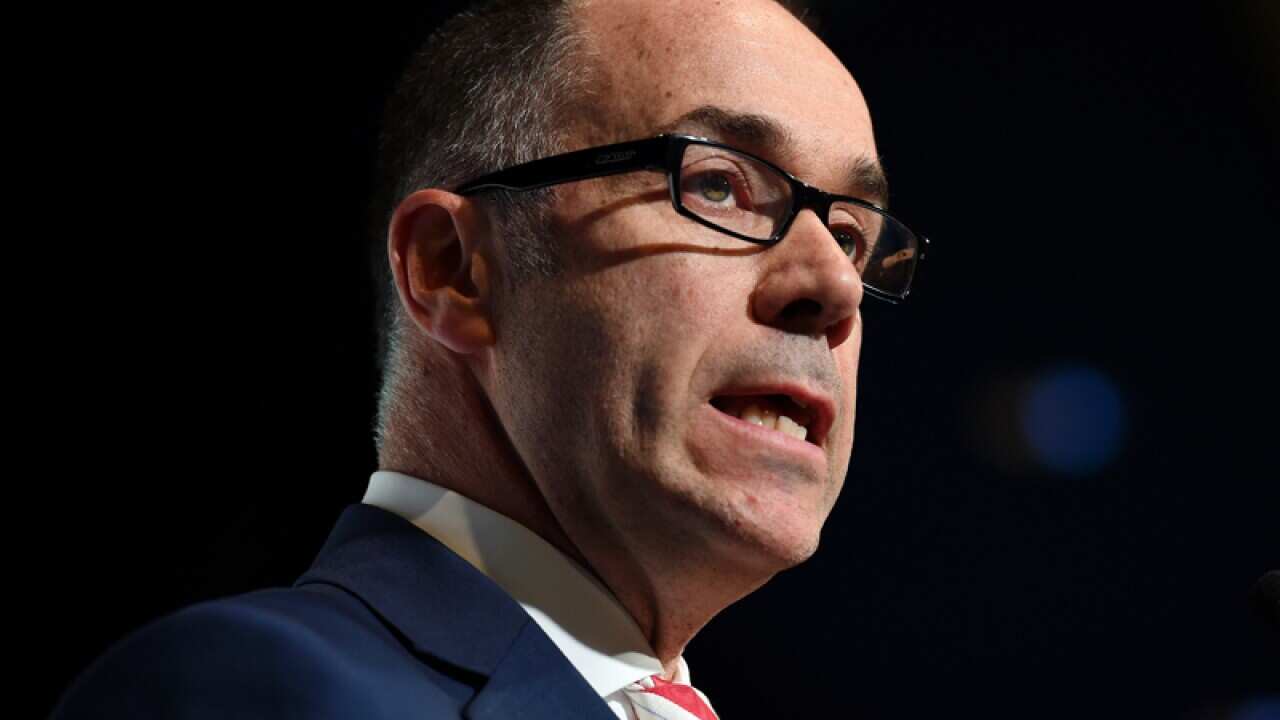

National Australia Bank chief executive Andrew Thorburn laid out the case for urgent major economic reform in a speech in Sydney on Wednesday, saying 24 years of uninterrupted economic growth had bred complacency.

"If we don't change, our living standards will inevitably fall," he told the Trans-Tasman Business Circle lunch in Sydney.

"I think we must be hungrier for change and we must focus on eradicating complacency."

He said Australia had not enacted a significant economic reform since the GST in 2000 and urged the country to look to New Zealand for guidance.

Since his election in 2008, New Zealand Prime Minister John Key has cut tax rates and balanced the country's budget, helping to drive an economic turnaround.

"If you look at the facts of what New Zealand has been able to do since 2008, and actually over a longer period of time, there has been a record of growth and change in that economy," Mr Thorburn said.

He identified tax and workplace laws, regulation for small and medium businesses and the federation as key areas in need of reform.

"We should have no lesser goal than to say that Australia should be the best place in the world to start, to grow and to run a business," he said.

Mr Thorburn also called on businesses to take a more active role in the national debate and suggested they lead by example.

"We must set more ambitious goals for our own companies if we are expecting the nation to do the same."

Mr Thorburn took over as NAB CEO in August last year and has led a major shake-up in the organisation, floating its US subsidiary Great Western Bancorp and announcing plans to spin off its troubled Clydesdale business in the UK.

He said the bank, which has significantly underperformed rivals like Westpac and the Commonwealth Bank, had made mistakes in its investments and project delivery, which needed to be rectified.

"Our goal is to be a top performing company and it's difficult to be a top performing company when you have major assets making a single digit return on equity," he said.

"If you want to be the best, then we must deal with that."

Share