A loophole allowing multinational companies to use bad debts to avoid paying taxes will be closed if Labor wins the next federal election.

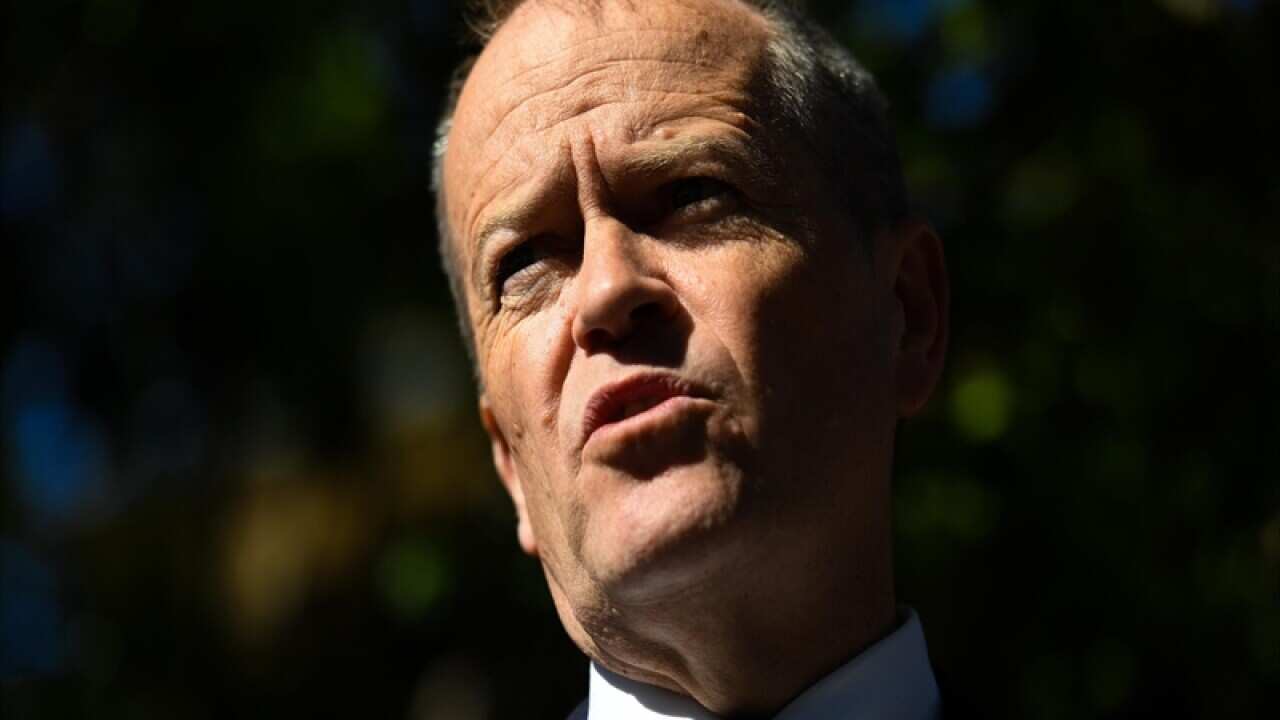

Opposition Leader Bill Shorten says Labor would introduce laws to make those companies "much more transparent in reporting."

"We are going to put forward a series of very specific proposals which international tax experts say are best practice to clamp down on all the money going overseas rather than paying for our schools and roads," he told the Nine Network on Wednesday.

The policy is part of the arms race between the coalition and Labor over who can crack down the hardest on multinational companies avoiding tax.

Labor says tightening debt-deduction loopholes will rake in an extra $3 billion over the next 10 years.

"Australians know that when multinational tax dodgers and the super-rich don't pay their fair share, we can't fund our education and health systems properly," Mr Shorten said.

Businesses will also be banned from claiming illegitimate tax deductions for travel to and from known tax havens.

"Tax havens are used by drug-runners, extortionists and counterfeiters," Mr Shorten says.

"Around four-fifths of the money shifted to tax havens is estimated to be in breach of other countries' tax laws."

The announcement is the latest in Labor's push to claw back money from multinational companies, including a $250,000 bounty for whistleblowers who reveal tax avoidance.

The coalition has already taken steps to get large international companies to pay more tax, reaping an extra $7 billion in revenue so far.

Prime Minister Scott Morrison attended a G20 finance ministers meeting in July, when he was still treasurer, and spoke to his counterparts about the need to do more on tax avoidance.

A parliamentary committee is also examining the digital economy, which is rife with large companies which make money in Australia but pay minimal or no tax here.