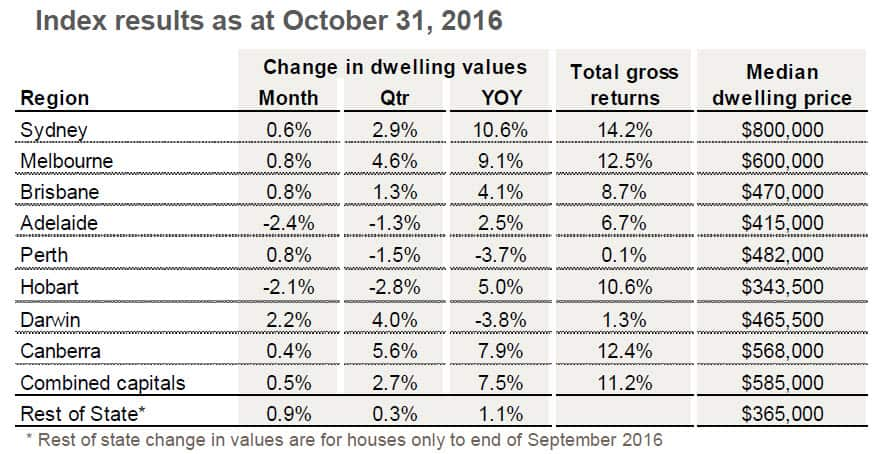

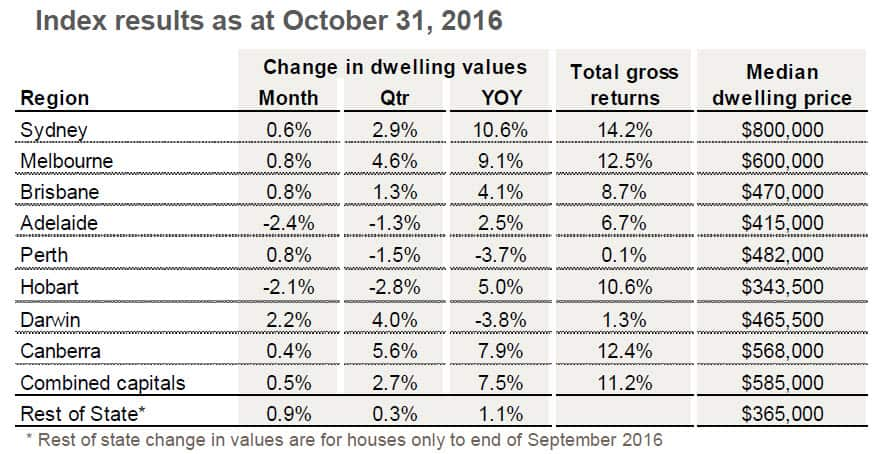

Record low interest rates are continuing to support Australia's property market according to CoreLogic, with prices rising half a per cent across the country last month to a median of $585,000.

Values have increased in all capitals except Hobart and Adelaide.

On a yearly basis Melbourne and Sydney are on top, with the median price in Australia's biggest city hitting a record $800,000. For Sydney, CoreLogic's Head of Research Cameron Kusher says it's about supply and demand.

For Sydney, CoreLogic's Head of Research Cameron Kusher says it's about supply and demand.

Source: CoreLogic

"We're seeing fewer properties going to auction and more demand because migration into Sydney and Melbourne is strong."

He adds that new listings in Sydney are down 16 per cent from a year ago.

"And that's creating a sense of urgency for buyers."

Stephen Walters, Chief Economist at the Australian Institute of Company Directors, says it's something that is concerning the Reserve Bank Board which kept official interest rates at a record low of 1.5 per cent today.

"The governor actually mentioned that house prices in some markets are rising briskly, which they didn't say last time."

In a statement, RBA Governor Philip Lowe also mentioned that growth in rents is the slowest for some decades - amid oversupply concerns.

Cameron Kusher says 49,000 units are set to hit inner Brisbane over the next 24 months, that's a 25 per cent increase.

"At a macro-level you'd say that Brisbane has got some concerns, also the inner city areas of Melbourne."

He also says, some parts of Sydney are on watch.

"We tend to talk down the risks of Sydney because the apartment market is much more established here, but we're seeing a lot of apartments in areas where traditionally you haven't seen apartments being constructed."

Experts say we'll only see a sharp fall in property prices, if we see a sharp increase in the unemployment rate or experience a global economic shock.

Stephen Walters says rates may have bottomed.

"I think interest rates will stay where they are until well into 2017, and I suspect you'd need something badly to go wrong to get them to cut again."

Meaning lower rates for borrowers for longer, unless the big banks spoil the house warming party.

Share