The Reserve Bank of Australia (RBA) has kept the interest rate unchanged for a third time at its December meeting, with governor Michele Bullock all but ruling out further mortgage relief in the new year.

Bullock said further cuts to the official cash rate are not part of the bank's thinking, "given what’s happening with underlying momentum in the economy … it does look like additional cuts are not needed".

"I don’t think there are interest rate cuts on the horizon for the foreseeable future."

The RBA board did not consider the case for a rate hike at today’s meeting, she said, but given inflationary pressures there were discussions about the possibility of raising the rate next year.

"We did consider and discuss quite a lot what were the circumstances and what might need to happen if we were to decide that interest rates had to rise at some time next year," she said.

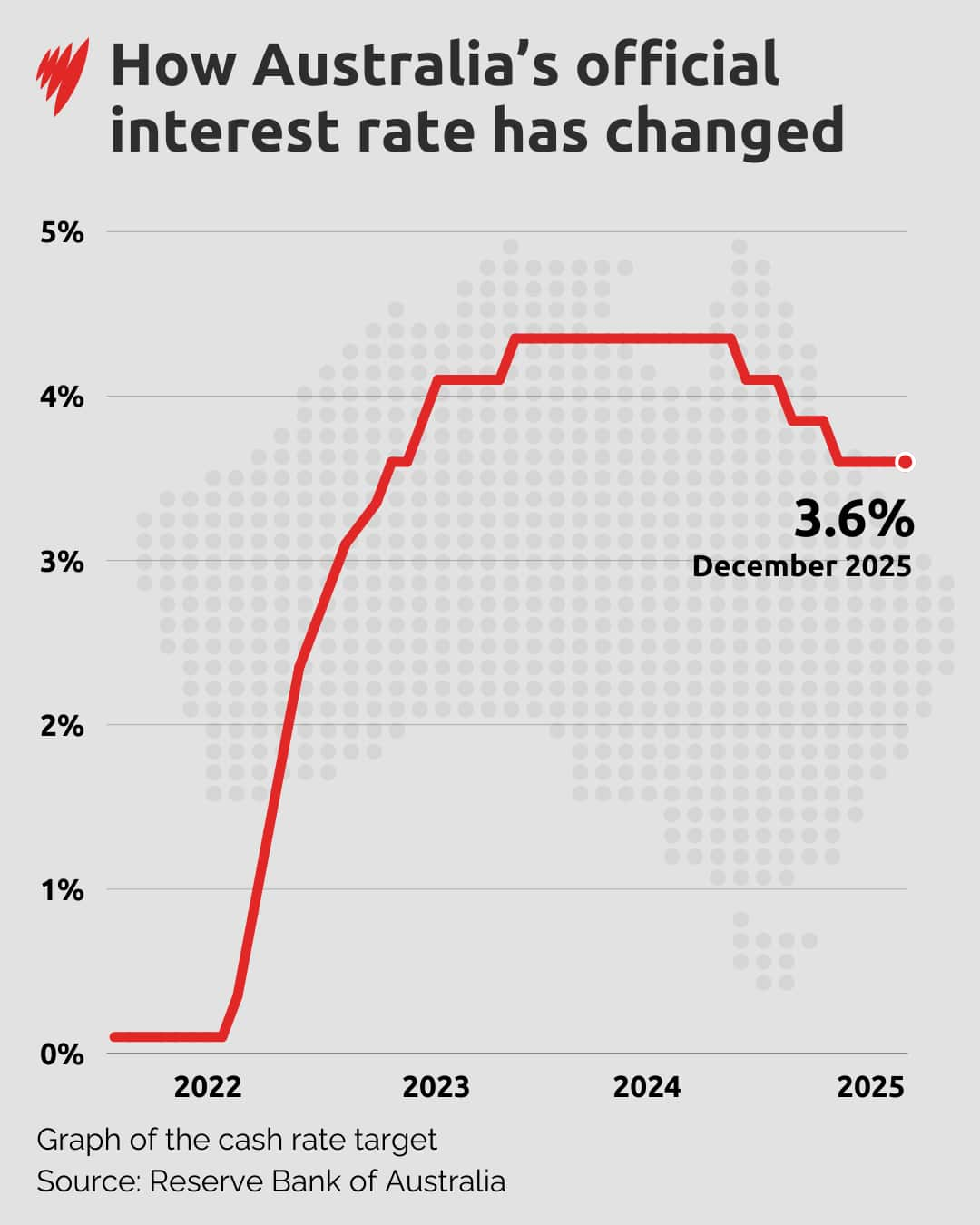

It was widely anticipated by the major banks and economists the cash rate would remain at 3.6 per cent after Tuesday's meeting.

In a statement released by the RBA board, the group said its decision was informed by inflation rates, noting that while inflation is lower than its peak in 2022, "it has picked up more recently".

"The board's judgement is that some of the recent increase in underlying inflation was due to temporary factors and there is uncertainty about how much signal to take from the monthly CPI data, given it is a new data series," it reads.

"Nevertheless, the data do suggest some signs of a more broadly based pick-up in inflation, part of which may be persistent and will bear close monitoring."

In its recent data for the September quarter, the consumer price index was at 3.2 per cent, above the Reserve Bank's inflation target band of 2 to 3 per cent.

Underlying, or trimmed mean inflation, the RBA's preferred measure of price movements, rose 1 per cent over the September quarter — higher than its forecast.

Annual trimmed mean inflation rose to 3 per cent, up from 2.7 per cent in the June quarter, marking the first time annual trimmed mean inflation had risen since December 2022.

The RBA will meet again in February, when it will have its first opportunity to change the cash rate in 2026.

If inflationary pressures continue to build, some analysts say the bank could be forced to hike interest rates as soon as February.

"Should inflation numbers published in January show a continued rise, the possibility of an interest rate hike at the February meeting remains on the table to ensure inflation returns to target in a reasonable time frame," economist at Monash University Isaac Gross said.

Domain chief economist Nicola Powell said the turnaround in rate expectations could help take heat out of the rapid price growth in the housing market during the past year.

"However, it doesn't solve the deeper affordability issues," she said.

"Mortgage holders are still managing repayments that are significantly higher than they were before the tightening cycle began in 2022."

The outlook for households and businesses has soured markedly from a few months ago, when bonds traders were pricing in one or two more cuts.

IG market analyst Tony Sycamore said: "This isn’t the statement of a central bank with one hand hovering over the rate hike button," adding that CPI data points to a broader rise in inflation "part of which could prove persistent."

— With additional reporting by the Australian Associated Press.

For the latest from SBS News, download our app and subscribe to our newsletter.