More than 1,000 large companies paid no tax last year, but compliance is at an all-time high.

On Thursday, the Australian Taxation Office (ATO) revealed the tax returns for 4,110 corporate entities in 2023-24 with a total income equal to $100 million or more.

The 11th corporate tax transparency report found the number of companies, both foreign and Australian-owned, paying no tax had dropped from 31 to 28 per cent.

ATO assistant commissioner Michelle Sams highlighted that there were "legitimate reasons why a company may pay no income tax".

These reasons include deducting tax offsets, reducing tax because a business may have incurred more expenses than income, as well as carrying losses forward from previous years.

"The Australian community can be assured we pay close attention to those who don’t pay corporate tax and ensure that they are not gaming the system," Sams said.

While almost one in three large companies in the report paid no tax, $95.7 billion in income tax was paid, marking the second-highest total ever recorded.

Sams said the result reflected business conditions but also attributed it to "the continued efforts of the Tax Avoidance Taskforce in holding large corporates to account".

Which companies are paying the least tax?

Brazilian multinational JBS, the largest meat and processing company in Australia, topped the list of companies that paid no tax in 2023-24.

Energy, telecommunications and natural resources companies also made the top 10.

The report notes an uptick from 11 to 16 oil and gas companies paying the petroleum resource rent tax (PRRT), a levy designed for Australians to recuperate profits from the extraction of natural resources.

However, despite the increase in companies paying the PRRT, the overall amount of tax revenue collected declined from $1.86 billion to $1.48 billion.

Domino's Pizza, with a total income of $700 million, demonstrates why some companies don't pay tax.

It has continued to suffer significant losses in Japan and France, forcing it close over 300 stores globally in the last year.

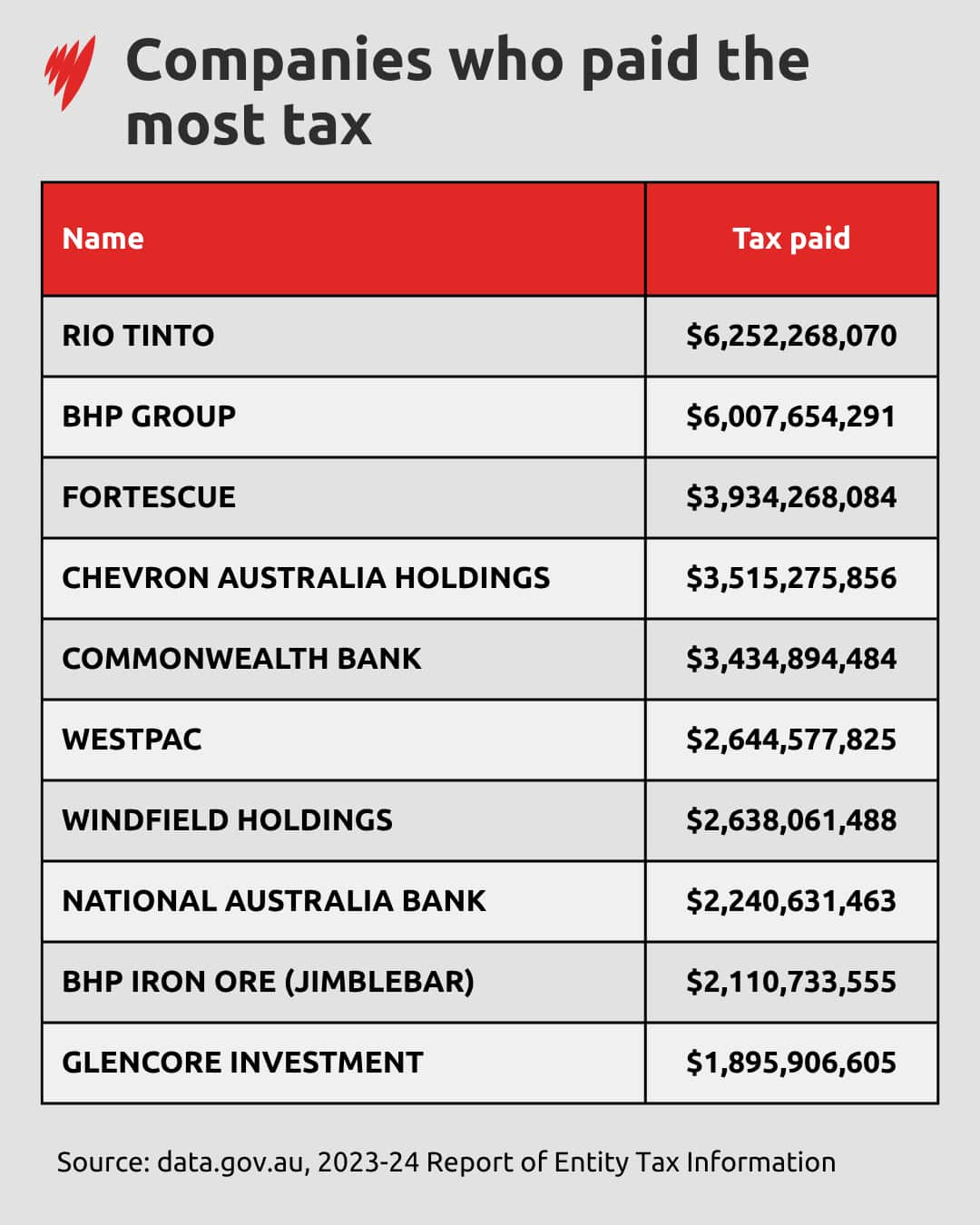

Who's paying the most tax?

The total income of the companies assessed in the report was $3.3 trillion, with $365.5 billion in taxable income.

But more than half the tax paid came from 2.3 per cent of the corporate entities.

Mining companies Rio Tinto, BHP and Chevron paid $15.8 billion in taxes, with BHP's iron ore subsidiary contributing a further $2.1 billion.

Australia's 'big four' banks — Commonwealth, Westpac, NAB and ANZ — were also a significant source of government revenue, paying almost $10 billion in taxes.