Solomon Lew has launched a new attack on the board of Myer and called on shareholders to help him oust the department store's directors at next month's annual general meeting.

Citing a falling share price, failing customer service and poor investments, Mr Lew has written to his fellow shareholders urging them to vote against the directors' reappointments.

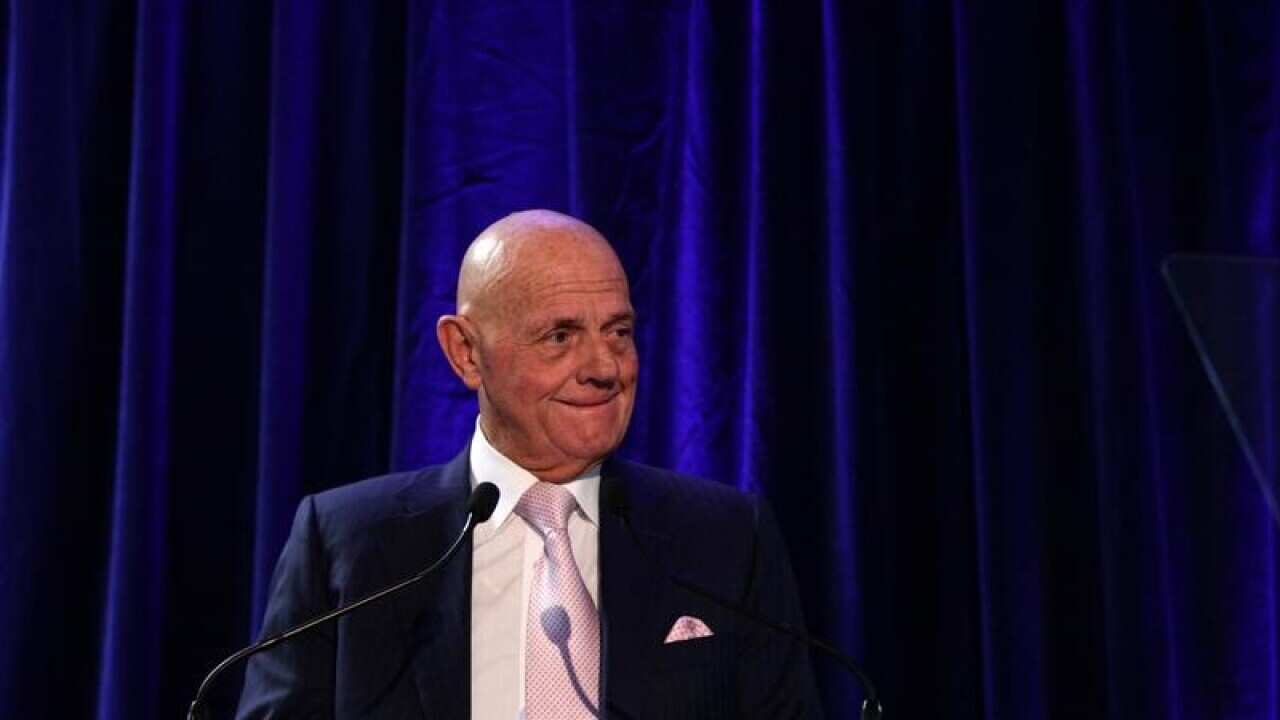

Incoming chairman Garry Hounsell is among those in Mr Lew's crosshairs, with the retail veteran - who is Myer's largest shareholder - insisting that customers and shareholders deserve better.

"We are very saddened to see the state of this once great Australian company," Mr Lew wrote in the letter, which was released on the ASX on Tuesday.

"But we are no longer prepared to put up with being shut out by the board."

Mr Lew claimed he had been trying to speak to Myer about his concerns since May, shortly after his Premier Investments built a 10.8 per cent stake.

But he said Myer told him he would have to wait six months to meet the chairman - a move he described as "simply arrogant".

The company's share price has fallen more than 25 per cent since Premier came on board.

Mr Lew railed against what he said was a lack of retail experience, an unappealing product range, and racks of discounted merchandise he called "a blight on the great Myer name".

"I have been shocked by the 'clearance floors' ... and they are one of the worst experiences I have had in more than 50 years of retail," Mr Lew wrote.

Myer chief executive Richard Umbers has pledged to move away from deep discounting as part of his turnaround strategy.

Mr Lew said he met with Mr Hounsell on October 6 and asked for two Premier directors to be appointed to the Myer board, as well as an independent non-executive director not connected to Premier.

Outgoing chairman Paul McClintock said Myer had been trying to "engage in constructive dialogue" with Premier, which owns Smiggle and Peter Alexander, for months but Myer had good reasons to reject the proposal.

"We had regard to, among other things, the potential for conflicts of interest given Premier and its associates' status as one of our largest suppliers and competitors," he said.

Premier says it has no plans to mount a takeover but reserves its right to call an extraordinary general meeting to vote on Myer board nominees.

Mr Lew's letter highlighted Myer's investments in TopShop and Sass and Bide, which resulted in $45.6 million of writedowns in 2016/17 and contributed to an 80 per cent fall in annual profit.

"Premier bought its stake in Myer in late March after hearing management talk up the business, and we, like many of you, have been bitterly disappointed in the result," Mr Lew's letter said.

"I know that many of you may have invested in the Myer IPO at $4.10 per share and have seen your investments wither away."

Shares in Myer closed up 0.5 cents at 75 cents, while shares in Premier closed one per cent higher at $13.26.

Share