Restrictions on finance and overseas travel for bankrupt Australians should be reduced to ease the processes of starting and closing businesses, the Productivity Commission (PC) says.

The PC’s draft report, Business Set-up, Transfer and Closure outlines several ways Australia could remove the barriers to setting up a business.

Currently, bankrupt Australians face three years of restricted access to finance, overseas travel and employment options. The restriction period should be reduced to one year, the report recommends.

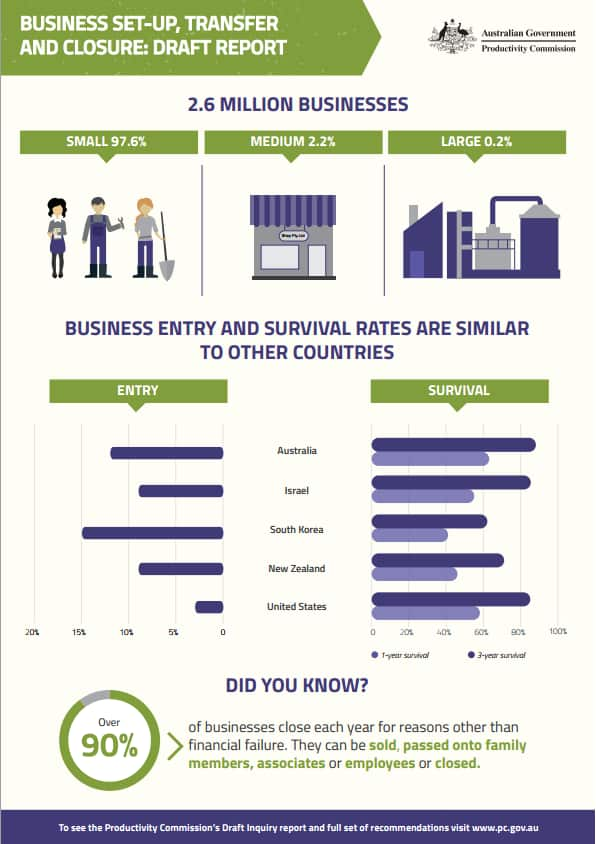

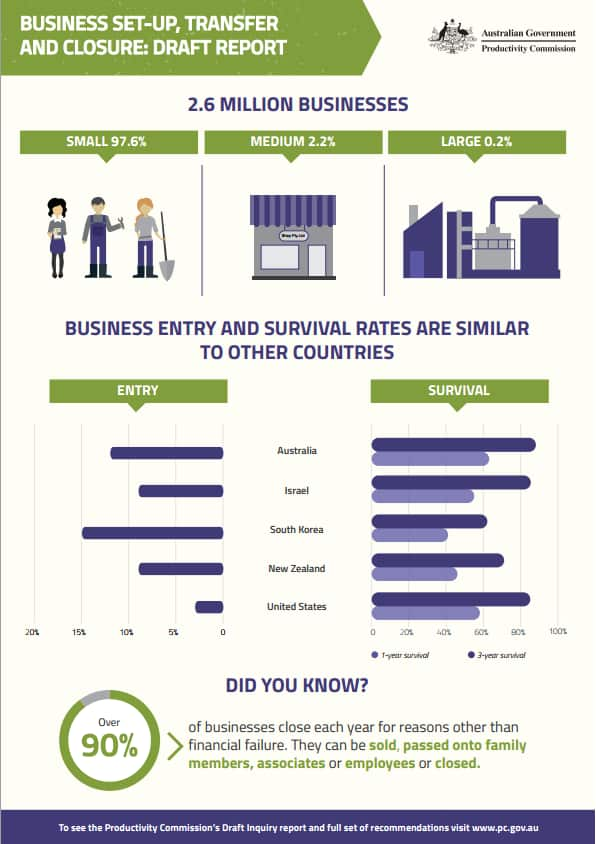

The report notes the business entry and survival rate in Australia is similar to other countries. However, Australia could do more to facilitate businesses starting up and closing, the Commissioner Dr Warren Mundy said.

However, Australia could do more to facilitate businesses starting up and closing, the Commissioner Dr Warren Mundy said.

Source: Productivity Commission

“Whilst the rate of new business establishment in Australia is relatively high, very few businesses can be characterised as innovators,” Dr Mundy said.

“Policy options are available to create a commercial environment more conducive to innovation.”

The report highlights an issue hindering innovation in Australia - a fear of failing, and trying again.

"Societal views towards business failure may limit an entrepreneur from trying to establish a subsequent business or businesses," the report said.

The PC will receive submissions before the final report is published later this year.

The report makes various key points:

- Most businesses are small and a very low proportion are innovative. The tendency to be innovative is highest amongst larger businesses.

- Starting a business in Australia is relatively easy, but a number of regulatory issues remain unaddressed and are making new business entry more complex or costly than needed.

- Some new business models are challenging existing regulatory arrangements or causing others to operate in regulatory grey areas. Regulators should have the capacity to exempt businesses, for a fixed period, from particular regulatory requirements where these deter entry but exemption does not threaten consumer, public health and safety, or environmental outcomes.

- Government assistance to business set-ups should not be directed at particular business models, technologies, sectors or locations. Assistance should focus on areas with economy-wide benefits and on businesses that would require government assistance without assisted business set-ups.

- Access to finance is generally not a significant barrier to setting up a business.

- Most businesses are closed or transferred without financial failure. Governments’ role in those situations should be limited.

- Wholesale reforms to Australia’s corporate insolvency regime is not justified, although some reforms are needed.

- The default exclusion period and restrictions that apply to bankrupt people - access to finance, employment (including being a company director) and overseas travel - should be reduced from 3 years to 1 year, with the trustee and courts retaining the power to extend this period.

Share