Pre-registration for Medibank Private shares closes tomorrow.

By doing so, Australian residents will receive a preferential allocation of shares if they choose to take up the offer after viewing its prospectus. But many existing Medibank Private members are angry they're not getting free shares.

But many existing Medibank Private members are angry they're not getting free shares.

Medibank Private pre-registration webiste

Michael Forrest, a member of more than 30 years, told SBS World News, "We assumed we were members of an association that we would own. Obviously with this latest information, they're saying we have no rights."

When rival health insurer, NIB floated in 2007, members received free shares in the company.

However, it was a mutual company, owned by members.

In a statement to SBS World News, Minister for Finance, Mathias Cormann said, “The ownership of Medibank Private is very clear. All of the shares in Medibank Private are owned by the Commonwealth. Medibank Private’s policyholders purchase private health cover, they don’t purchase a share in Medibank Private."

"Eligible Medibank Private and ahm policyholders who pre-register and then apply for shares can receive a greater preferential share allocation than non policy holders who pre-register.”

Michael Forrest disagrees and argues the pre-registration offer is ambigious.

Listen to what he has to say:

By pre-registering, existing members will be offered an extra allocation of shares, but Eureka Report Commentator James Kirby says a discount, at the very least, should have been offered.

"Management inside Medibank Private in recent times, a decade ago, were telling people they were building equity in the organisation. Anyone would reasonably assume that someday they would be rewarded for loyalty."

Some analysts, like Peter Esho at investment house 100 Doors says the government may still be open to change.

"The owner of this business is the government, and the government is looking to sell it down, and so how they structure that, what kind of incentives, what kind of bonuses, all of that is on the table, all of that is negotiable because the final pricing mechanism hasn't hit the market yet."

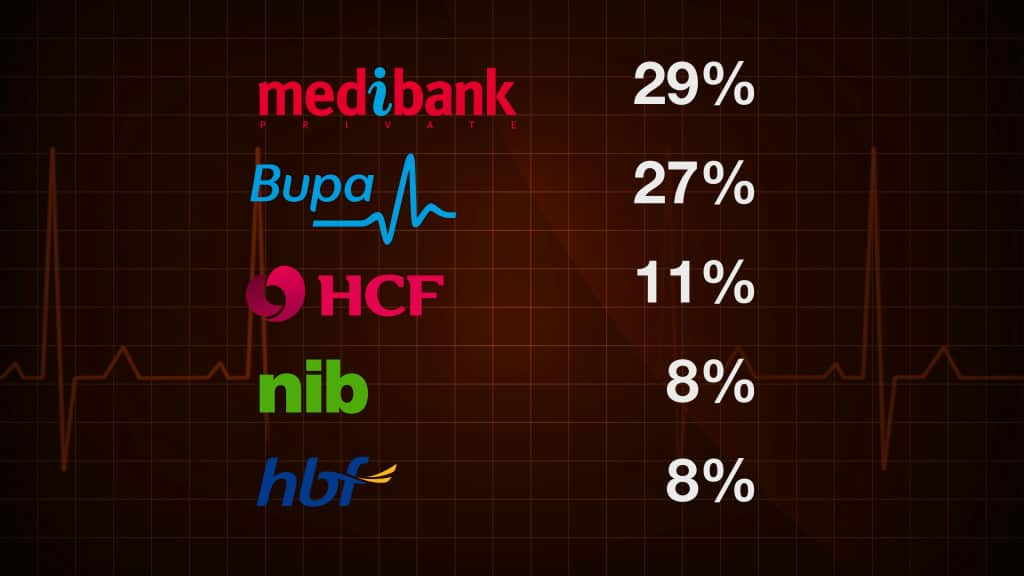

Medibank Private is Australia's largest health insurer, with about 3.8 million members, commanding nearly 30 per cent market share. The government sas is it happy with the strong level of interest in pre-registration to date and will announce the final outcome of the pre-registration process after the closing date of October 15th.

The government sas is it happy with the strong level of interest in pre-registration to date and will announce the final outcome of the pre-registration process after the closing date of October 15th.

Private health insurance market share. (Source: Morningstar)

The market is expecting the sale could earn the government anywhere between $4 billion and $6 billion, which will be used to fund infrastructure projects around the country.

A prospectus is expected in a few weeks, with a sharemarket listing anticipated before Christmas.

Share