The Reserve Bank Board keeps an eye on inflation to help it make its decision on interest rates.

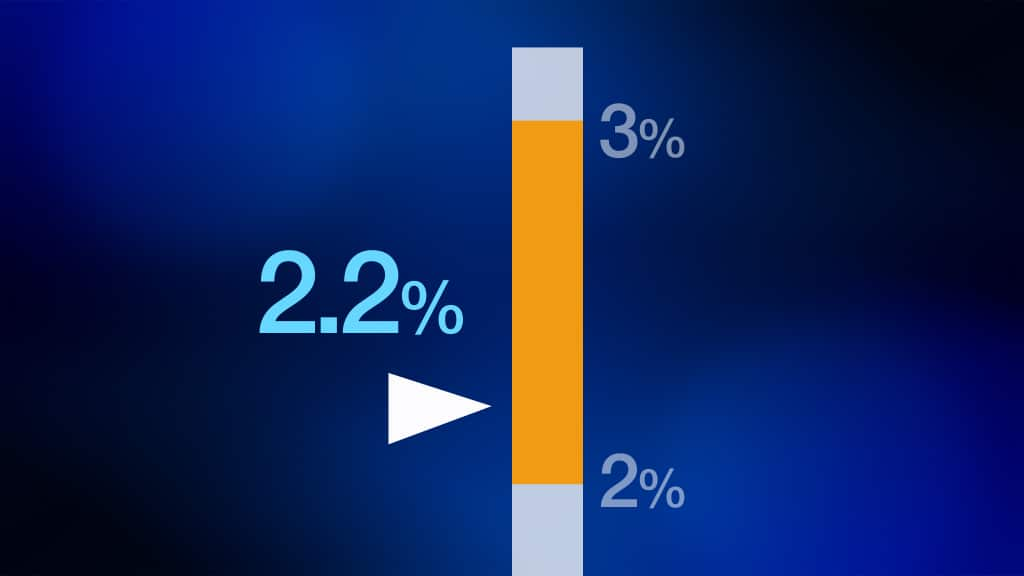

It likes to make sure underlying inflation, which is the measure that strips out volatile one-off moves in the CPI to give a more accurate read on prices, is between its 2 to 3 per cent target band to support economic growth.

In the December quarter, it was at 2.2 per cent, at the botton end of its target band.

Think of it this way, if you're looking to buy a new television but realise that prices are falling, you'd probably wait until prices stabilise to make that purchase. If prices on a whole range of products fall, then you'll keep waiting, and that isn't good for business or the economy.

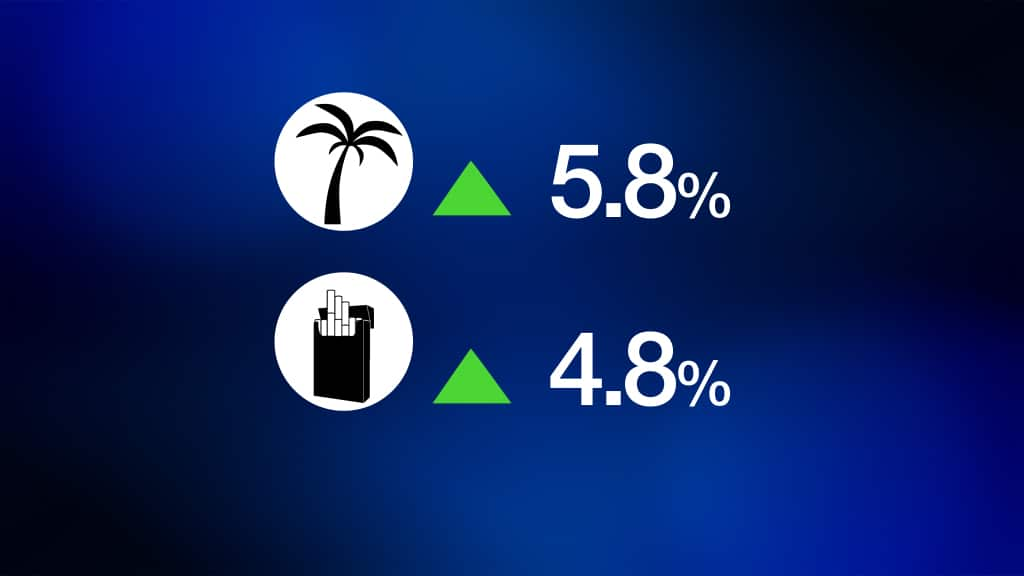

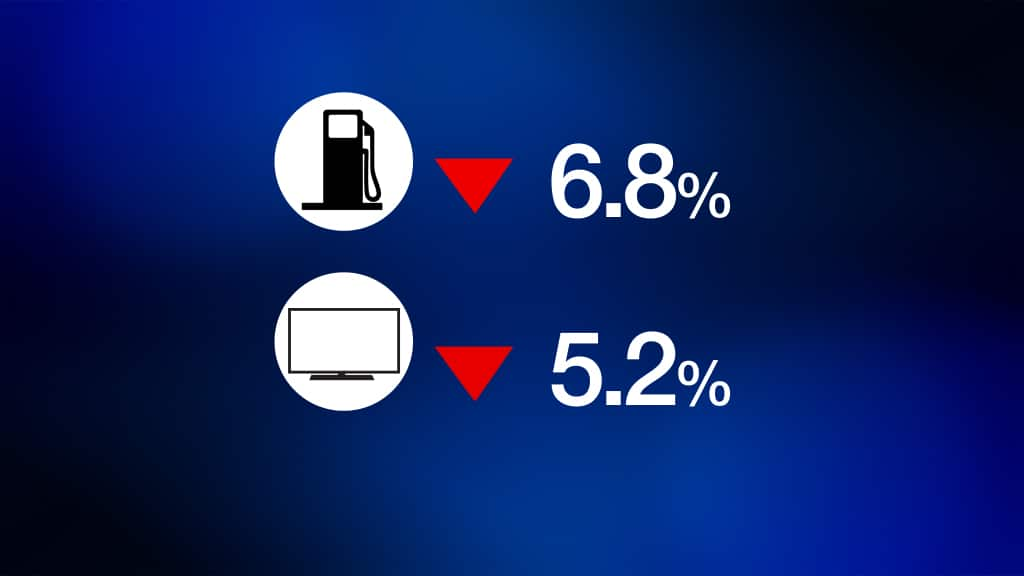

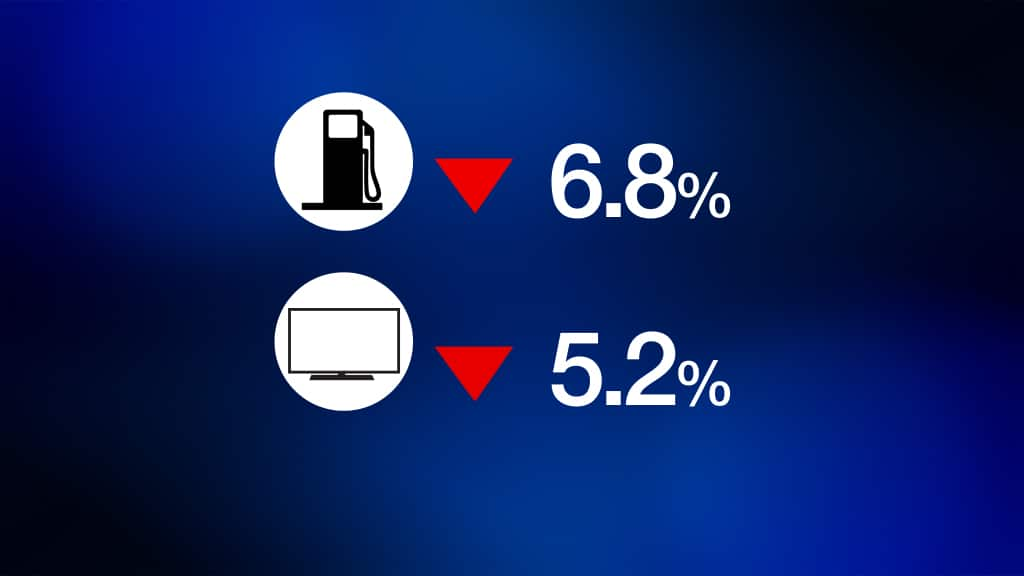

Today's data from the Bureau of Statistics show domestic holiday travel and accomodation prices rose the most in the quarter. Petrol prices and electrical products saw the biggest decline.

Petrol prices and electrical products saw the biggest decline. ANZ Chief Economist Warren Hogan still thinks we'll see a few interest rate cuts. Watch the video below to find out when.

ANZ Chief Economist Warren Hogan still thinks we'll see a few interest rate cuts. Watch the video below to find out when.

Share