Brokers and analysts often use measurements like price-to-earnings ratios and earnings-per-share to calculate the value of a company. In this case, we take a look at the absolute value of a share price.

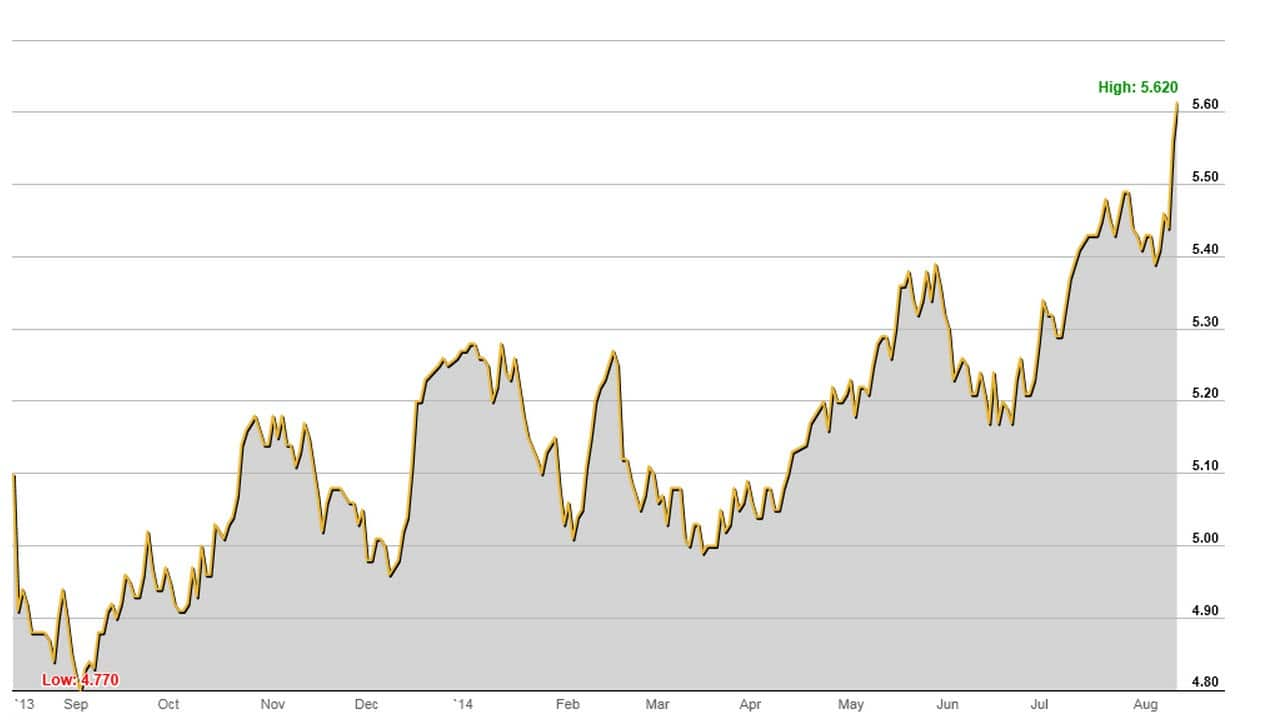

TELSTRA: $5.58 (Friday close)

Telstra is Australia's most widely held stock. Its shares hit at 12 year high after it posted a $4.3 billion profit and bumped up its full year dividend to 29.5 cents fully franked earlier this week. The telco is also buying back $1 billion of its shares.

However it is not Australia's most expensive stock in absolute terms.

COMMONWEALTH BANK: $81.20 (Friday close)

While the Commonwealth Bank has gone through a tumultuous time as it deals with a financial planning scandal, its share price has remained unscathed. The bank is currently trading close to its record high of $83.92. On Wednesday it posted a record profit of $8.7 billion dollars.

CBA is Australia's most expensive stock in absolute terms.

APPLE: US$97.50 (Thursday close)

Apple is the world's biggest company by market capitalisation, having quadrupled its value in the past five years, but is not the world's most expensive stock in absolute terms. Its share price hit a record of around US$700 in September 2012 as the iPhone 5 was released. But earlier this year, the technology giant underwent a 7-for-1 stock split which reduced the absolute value of its shares.

Apple boss, Tim Cook said at the time of the split, it would make the stock "more accessible to a larger number of investors."

BERKSHIRE HATHAWAY: US$202,850.00 (Thursday close)

Warren Buffett's Berkshire Hathaway is the world's most expensive stock in absolute terms, and on Thursday it reached a milestone passing US$200,000 for the first time. The stock is up 13 per cent this year.

The company is an all round investor, with exposure to different sectors of the economy. Two weeks ago it posted a record quarterly profit, up 41 per cent thanks to good performances from its railroad and energy businesses as the US economy improves.

Chris Weston from IG Markets told SBS World News, Mr Buffett isn't keen on a share split similar to Apple because he would want to "hold a certain prestige and keep a much more institutional and high net wealth register."

Warren Buffett is the company's biggest shareholder.

Remember, 'expensive' in this case relates to the absolute value of the relevant share price, and does not consider value measurements like price-to-earnings ratio or earnings-per-share.