Explainer

What the GST reforms mean for your state

The Turnbull government will inject $9 billion over a decade to keep all the states happy in a 'no losers' solution. Is this the GST breakthrough Australia needed?

Published

Updated

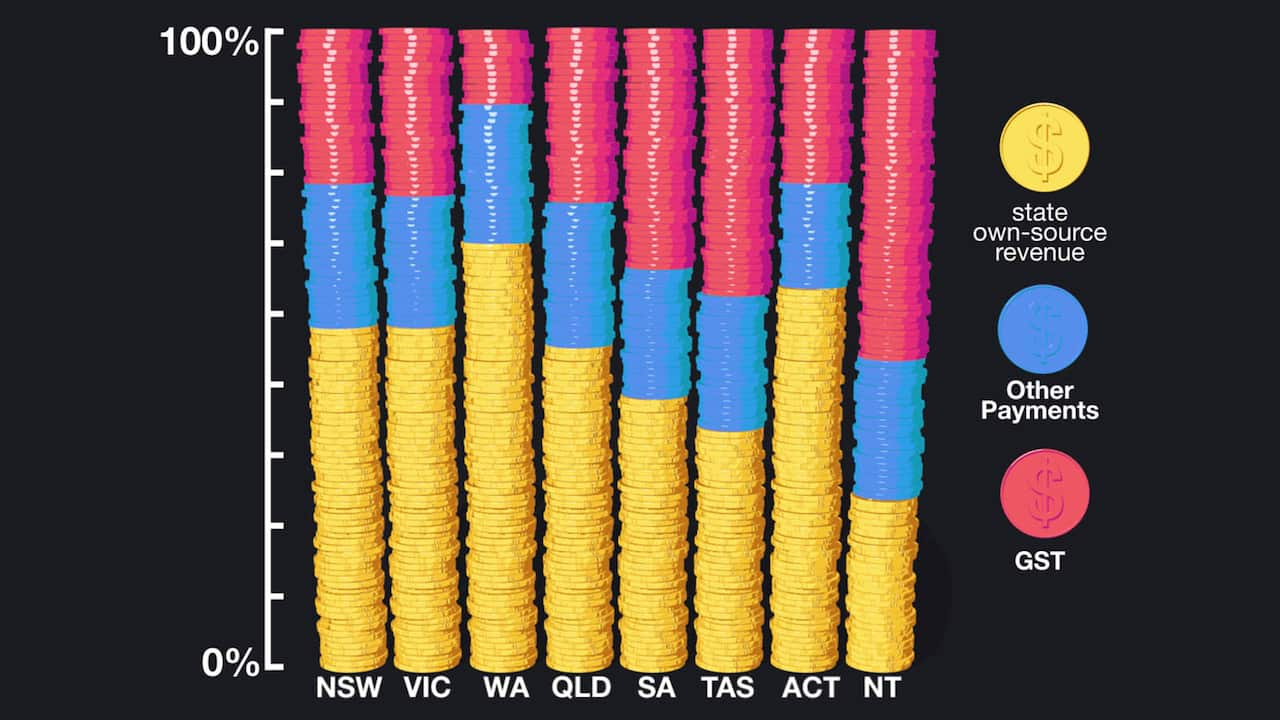

The Turnbull government on Thursday unveiled sweeping changes to the way the pool of GST – worth around $70 billion this year – is divided among the states and territories.

The complicated formula has a huge impact on how much money each state gets from the Commonwealth to run key services like schools and hospitals, and is frequently the subject of political brawls.

What’s the problem?

Right now, all the states tax goods and services at 10 per cent and pay the money into a collective pool.

The money gets divided up among the states based on a “fair go” principle, sometimes given the catchy nickname of horizontal fiscal equalisation.

The idea is Australians shouldn’t get great service at a public hospital in Sydney and less than adequate treatment in Hobart, for example, so the money is distributed in a way that lifts the poorer states to the standard of the wealthiest state.

Traditionally that’s NSW or Victoria. But in the peak of the mining boom in the late 2000s, the system went haywire. All of a sudden Western Australia was earning a massive tax take, but paying the majority to poorer states around the country.

At its most extreme, WA was only keeping about 30 cents per person for each dollar of GST it collected.

WA has long complained that it was being punished for its economic success. The federal treasurer, Scott Morrison, agreed that the system was creating a “disincentive” for states to develop their resources industries.

At the same time, Western Australia became the new “benchmark” state, even though that wasn’t necessarily reflected in the public services on offer.

Hands off my tax

The government will rewrite the formula so states keep more of the GST they collect.

Every state and territory will keep a “floor” minimum of 75 cents in each dollar, per person.

That system should ensure states like WA never lose as much of their GST as they have in recent years, while still giving some flexibility so poorer states can be lifted.

Biggest isn’t always best

The GST rules will also be changed so the “benchmark” services are those in either Victoria or NSW – whichever is performing better at the time.

The old system of matching other states to the “best” performer was too volatile, the government argues, because of anomalies like the WA effect.

NSW and Victoria have strong, diversified economies and should provide a more consistent standard.

No losers, really?

Every time the GST debate rears its head, one state or another complain they are being “robbed”.

That’s the reason the tax formula has barely changed since it was created in 2000. It is politically fraught.

So the Turnbull government has come up with a solution where no state will be worse off – by pumping in a sizeable injection of federal money.

The Commonwealth will pay $9 billion over the next 10 years in “top-ups” to keep every state above the threshold. That money will now be a permanent feature of the system and will continue in the decades to come.

Deloitte economist Chris Richardson says that’s basically a “bribe” – although he describes the reforms as “sensible” overall.

“They've thrown about an extra billion dollars a year into the pot to make sure no one is worse off. Or in other words, this small reform is being accompanied by a solid, billion-dollar-a-year bribe,” Mr Richardson told SBS News.

Getting the states on board

The states and territories will meet to discuss the plan in September. Many are reserving their judgement for now.

"We want to make sure there are no negative implications for Victoria, no way the federal government can give with one hand and take away with the other,” acting Victorian Premier James Merlino said.

It is worth noting Victoria is a Labor state at the moment. Liberal states like South Australia and Tasmania have given the plan a slightly warmer reception.

But Scott Morrison insists that while he would like cooperation, he doesn’t necessarily need it.

“It's not disputed that the Commonwealth can act alone on this,” he said.