Monthly inflation figures rose more than many economists had predicted, leading to mixed predictions over whether the Reserve Bank of Australia (RBA) will continue cutting the official cash rate at its next meeting, or keep it on hold at 3.6 per cent.

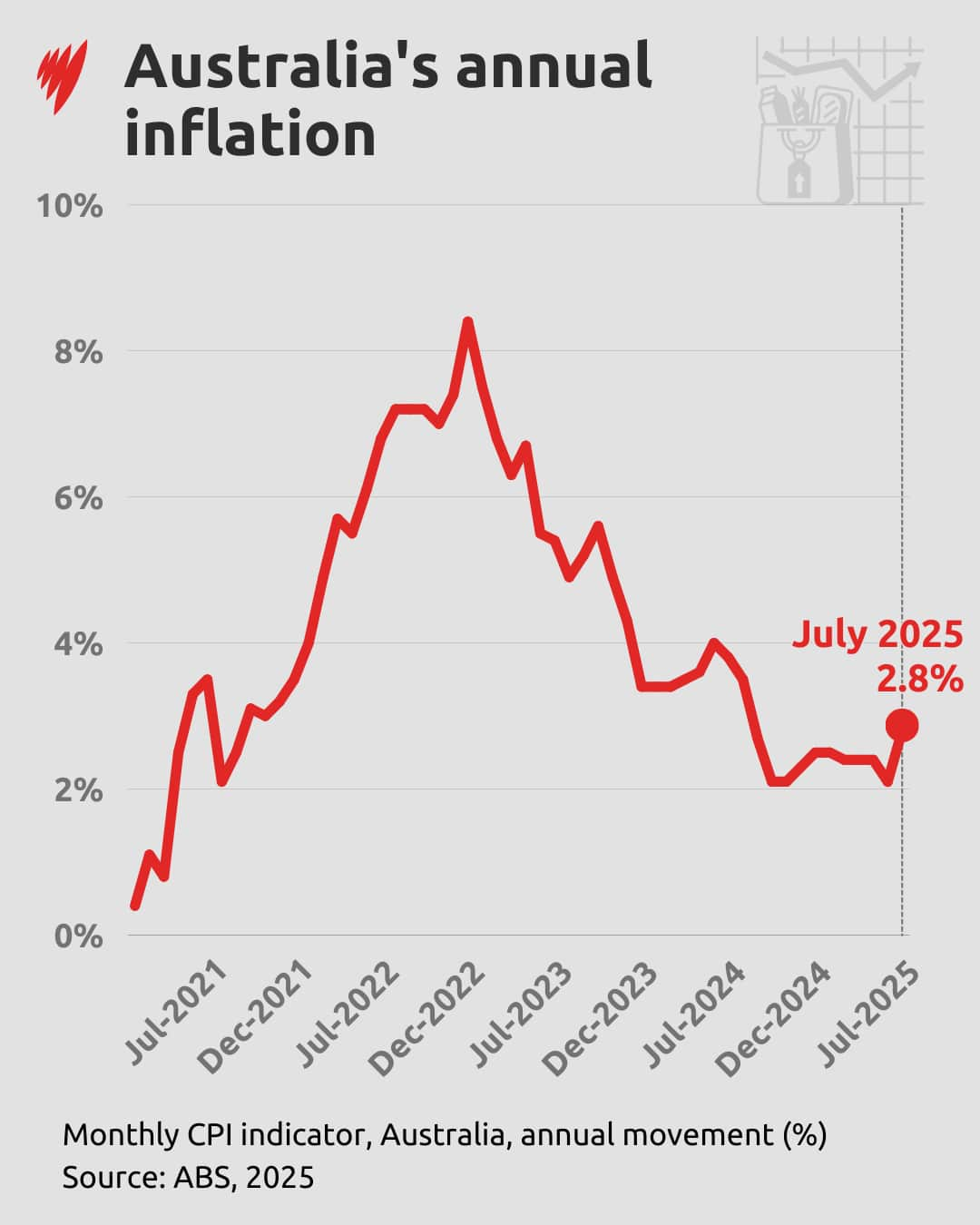

The monthly consumer price index (CPI) rose 2.8 per cent in the 12 months to July, up from 1.9 per cent in the year to June, the Australian Bureau of Statistics (ABS) reported on Wednesday.

It marks the highest annual inflation rate since July 2024, following several months of easing inflation, the ABS said.

A Reuters poll of economists had predicted annualised inflation would only rise to 2.3 per cent.

The ABS attributed much of the jump to surging electricity prices, which rose 13.1 per cent in the 12 months to July, compared to a 6.3 per cent fall in the 12 months to June.

"The large annual rise in electricity costs was due to households using up the state government and Commonwealth energy bill relief fund rebates in some capital cities, as well as price increases following annual electricity price reviews in July," the ABS said in a statement.

In monthly terms, electricity prices rose 13 per cent in July, which the ABS said was down to the timing of when the extended relief fund rebates were applied in some capital cities, as well as price reviews that increased electricity prices across all capital cities.

NAB senior markets economist Taylor Nugent said the inflation release would tell the RBA little about the underlying pulse of inflation.

"The surprise was strength in travel and timing of electricity subsidy payments and so [it] is not as material as it looks at face value," he said.

Even so, it raises the risk that the all-important trimmed mean — a measure of underlying inflation that removes the biggest price swings — for the September quarter comes in above the central bank's forecast, he said.

What do inflation figures mean for borrowers?

BetaShares chief economist David Bassanese said the figures were "an absolute shocker" and likely to "remove any chance" of an interest rate cut at the central bank's next meeting in September.

"The biggest disappointment is the fact that annual trimmed inflation has rebounded from an encouragingly low 2.1 per cent in June to an ugly 2.7 per cent in July," Bassanese wrote.

He also cast doubt on whether the RBA would even cut rates in November, saying it's not a "done deal", because a decline in underlying inflation may not be "as great as we've been led to believe".

IG Market analyst Tony Sycamore told SBS News the inflation figures "came in much hotter than expected", but they are unlikely to change the RBA's long-term forecasts.

"They were looking for core CPI to be at 2.6 per cent for December 2025 and here we are now 2.7 per cent with about five months left to go for the year," he said.

Sycamore said borrowers should be looking at the market's prediction for interest rates.

"Before the inflation figures came out, the market was pricing at about a 40 to 43 per cent chance of a rate cut in September. Most of the economists out there would have been very surprised if the RBA were to cut rates in September, because we know they are cautious rate cutters," he said.

He said it's not surprising that the market is predicting the RBA will keep the cash rate on hold in September, but borrowers should take note that the market is "100 per cent dialled in" for a cut in November.

Sycamore said electricity prices should level out in the next month and inflation could steady. The RBA will be placing more emphasis on quarterly trimmed mean figures due in October.

In its latest meeting minutes released on Tuesday, the central bank's board expected the unwinding of energy rebates would boost the headline inflation rate over 2025 and 2026.

However, it was unclear what could further drive core inflation down, HSBC chief economist Paul Bloxham said.

Unemployment was low and steady, capacity utilisation was above its historical average and the economy was still being hamstrung by weak productivity.

— With additional reporting by the Australian Associated Press

For the latest from SBS News, download our app and subscribe to our newsletter.