The number of new property listings historically peaks in spring, and a combination of rising prices and stagnant interest rates could mean the market continues to "heat up".

Despite an increase in the number of people looking to sell their homes, data shows that low housing stock remains an issue for first home buyers across Australia.

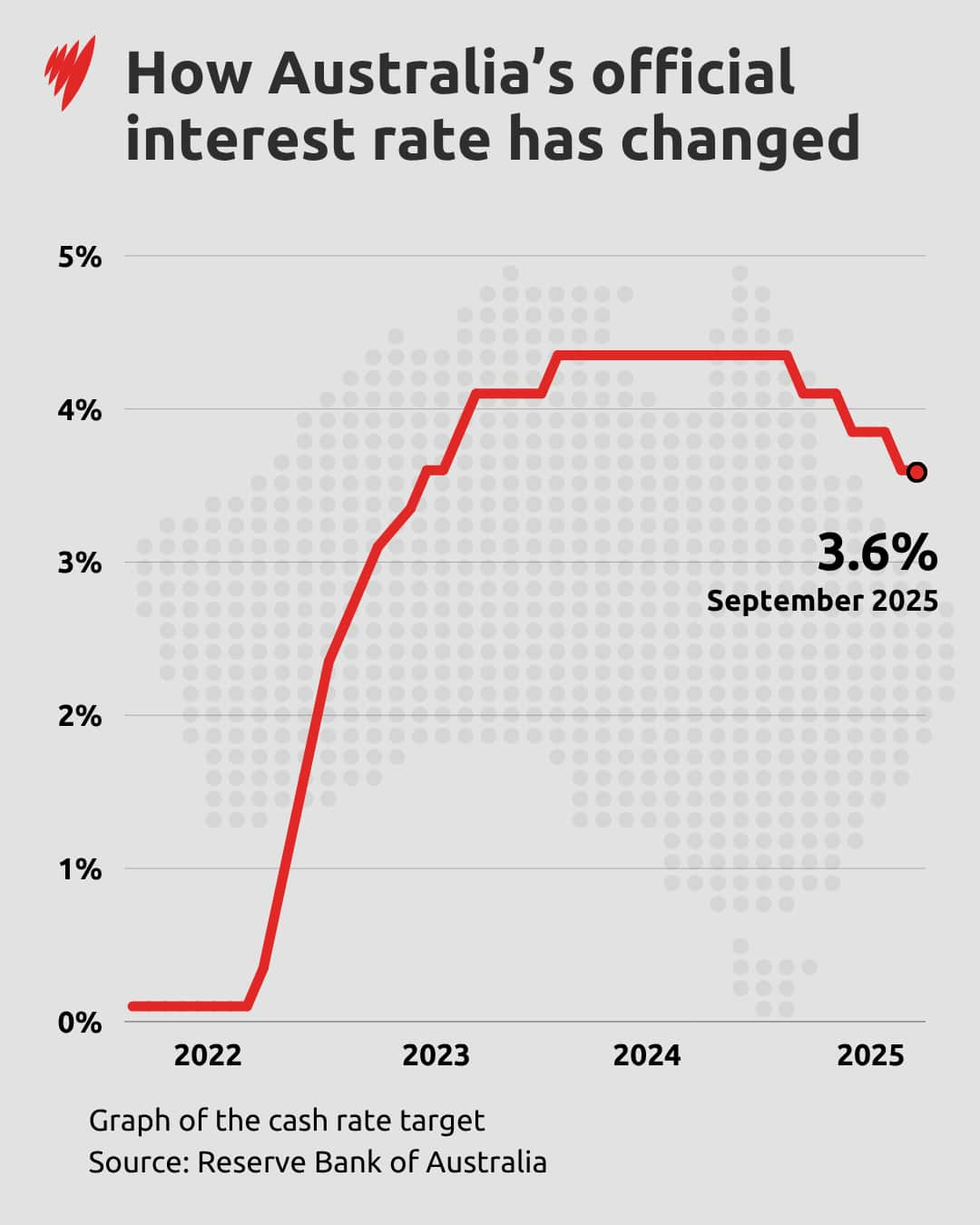

Meanwhile, the Reserve Bank of Australia (RBA) is expected to hold the cash rate target at 3.6 per cent at its Tuesday meeting.

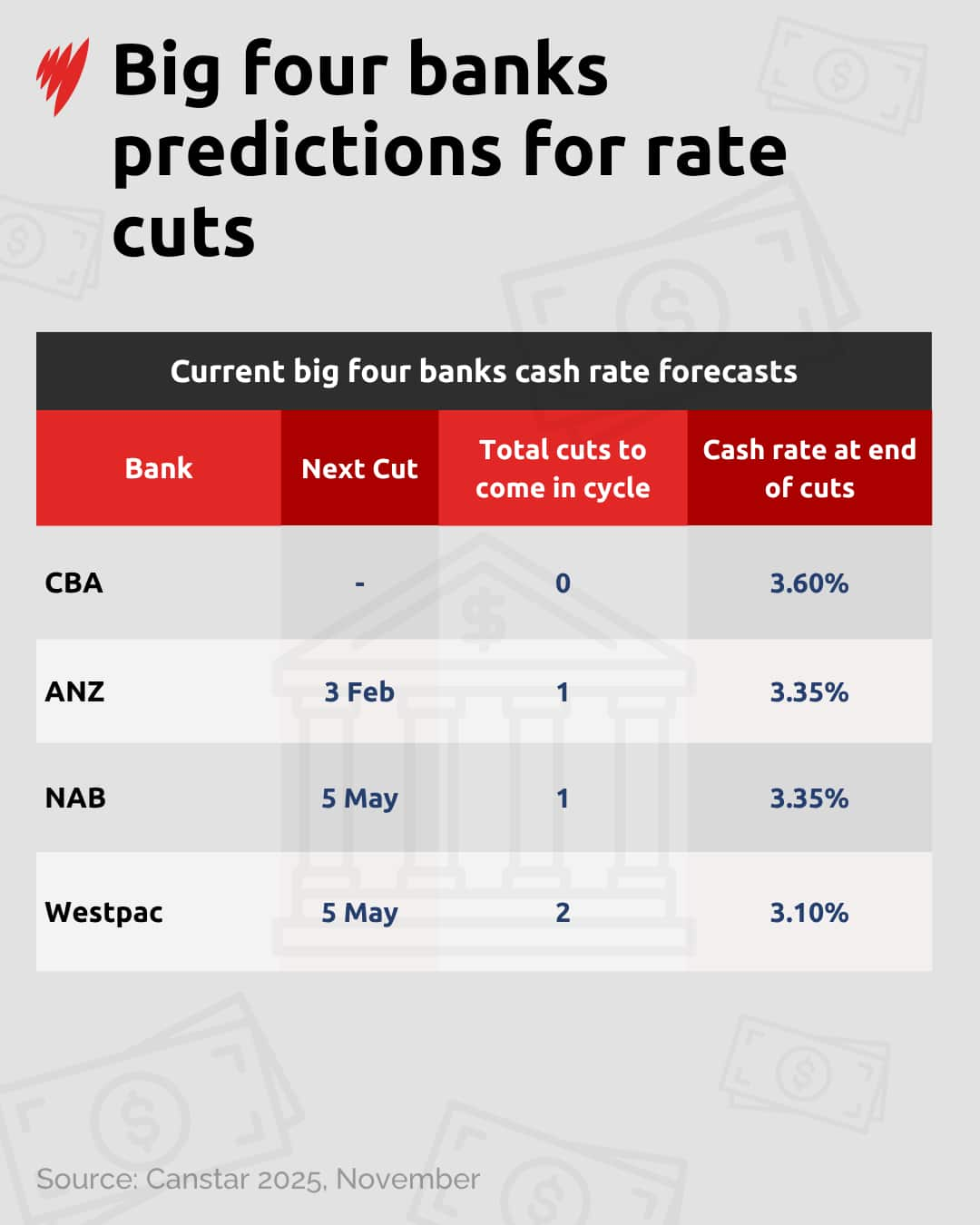

The 'big four' banks are predicting there won't be another rate cut until at least February, after last week's inflation figures were above the RBA's target range.

Why is the Reserve Bank expected to hold rates steady?

David Bassanese, chief economist at Betashares, told SBS News he does not expect a rate cut tomorrow, following "higher than expected inflation".

In its latest quarterly data for September, the Australian Bureau of Statistics measured the consumer price index at 3.2 per cent, above the RBA's inflation target of 2 to 3 per cent.

Annual trimmed mean inflation — a metric that smooths out certain volatile price movements and the RBA's preferred measure — rose to 3 per cent, up from 2.7 per cent in the June quarter.

It’s the first time annual trimmed mean inflation has risen since December 2022.

Bassanese expected this spike to delay a rate cut until next year, as the annual trimmed mean "eases back " to the middle of the RBA's target range.

"I see little risk of a rate hike in the coming year, given rates are still restrictive and inflation should eventually ease," he said.

The big four banks are also predicting the cash rate will remain unchanged for the rest of the year.

ANZ predicts the next cut will be in February, whereas NAB and Westpac expect a reduction in May.

CBA has not predicted any rate cuts in the immediate future.

Eliza Owen, head of research at property data firm Cotality, told SBS News the group has ruled out a rate cut, adding it would only "add fuel to the fire" of ever-increasing property prices.

How has the property market responded to rate cuts?

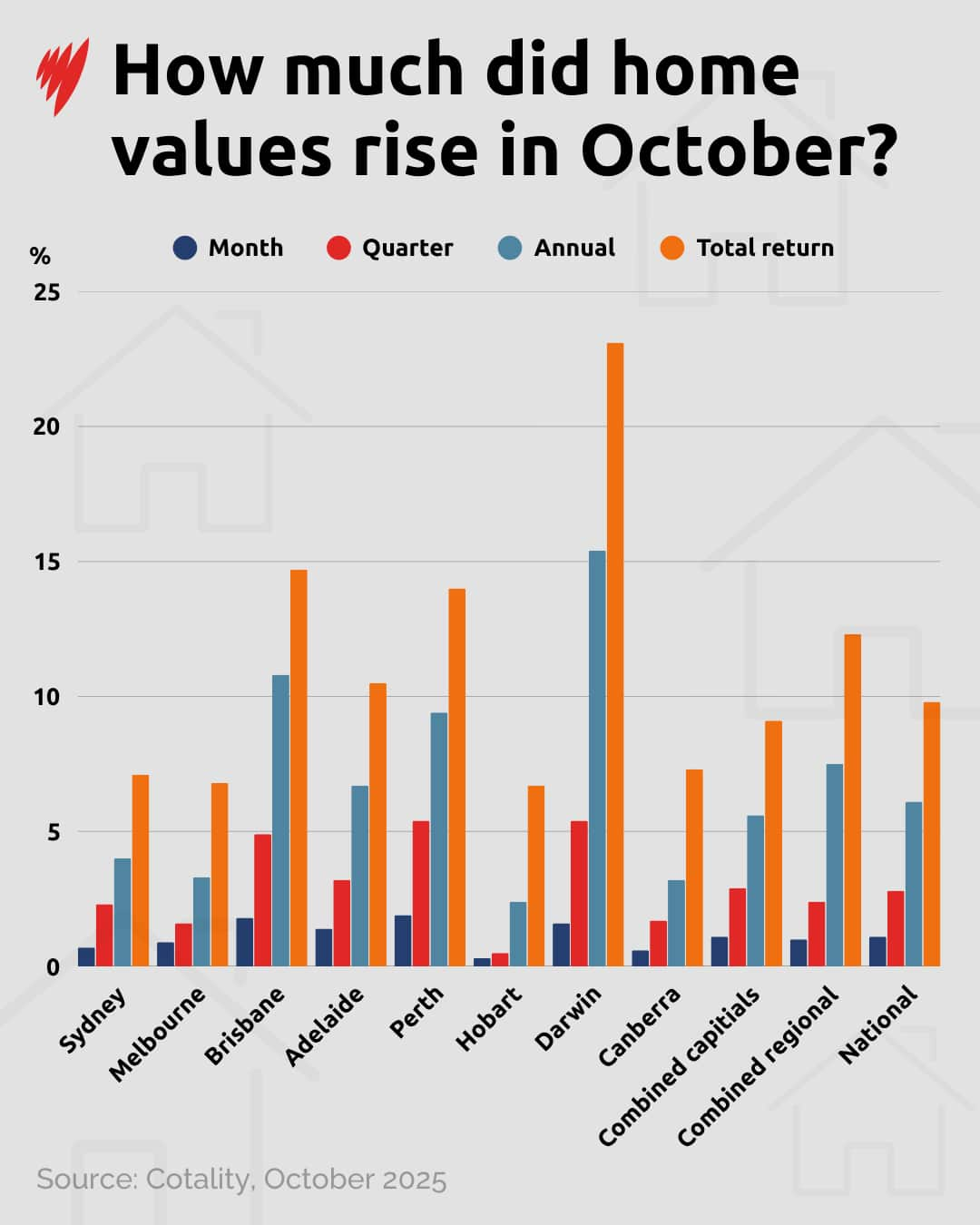

Owen said that the property market has been "very responsive" to the rate reductions so far this year.

"The reason for that essentially is that it's making debt cheaper," she said.

"The cheaper debt is, the more it is demanded and the more that debt is flowing through to property prices.

"So generally lower interest rates lead to a faster increase in property prices."

As the cash rate target is anticipated to remain steady until at least February, this could lead to a slowing down of the market towards the end of the year, Owen added.

Owen predicted the market would also cool off in the summer, following the annual spring "bump" in sales and listings.

A springtime 'sense of urgency'

The highest numbers of new listings in Australia typically come in spring (September to November) as people look to sell their homes when the climate helps their properties look "at their best" as "gardens are in full bloom".

There have been around 43,000 listings added to the market in the last few weeks, Owen said, which is down around 1,000 homes compared to previous years.

While lower than usual, it is still the highest number of listings predicted for the year.

Housing stock is also 18 per cent below the historic average, with around 129,000 properties across Australia currently for sale.

"There are just more buyers than there are people listing their property. And that depletes total stock, creates a sense of urgency and leads to the situation we have now, where property values are rising," Owen said.

A 'tight market' that still holds opportunity

Chris Lewis, director of Lyric Finance, told SBS News the underlying issue with the Australian property market is supply.

"There is not enough stock in the housing market," he said.

"Typically, when there are more buyers than sellers, prices are going to increase."

Lewis described the property market as looking "particularly tight", but said it's "never been a better time for first-time buyers."

He said the newly introduced 5 per cent deposit scheme for first home buyers is a "good opportunity" to get into the market.

"You can save on that large deposit for starters," he said.

For first home buyers looking to access the scheme or make the most of the bump in spring listings, Lewis recommended getting pre-approval from a lender.

"Whenever you're looking to take on a transaction of buying property, the first step is talking to a mortgage broker and understanding what's possible and getting that re-approval in place for the bank, so you can start making offers on property with confidence."

For the latest from SBS News, download our app and subscribe to our newsletter.